Solve Funding Emergencies With a Business Line of Credit

With a business line of credit, you can access capital on demand without having to apply each time you need financing. Spend, pay back and reuse funds as many times as you’d like throughout your term.

At Fast Capital 360, we work with multiple lending partners that offer small business lines of credit. Compare offers to choose the option that’s right for your business.

With one of our online business lines of credit you can handle emergencies or opportunities fast, all with the peace of mind and security you need to manage your business best.

Contents

SECTION 1

What Is a Business Line of Credit?

A business line of credit is “there when you need it” financing. Borrowers are granted a maximum approval amount from which they can borrow at any time (or not borrow from at all). Funds can be withdrawn in part or in whole, with interest accumulating only on the amount used.

Needless to say, this is a popular form of financing for many entrepreneurs. So much so that 35% of employer firms surveyed applied for a business line of credit, according to the Federal Reserve Banks’ State of Small Business Credit report. Of those applicants, 71% were approved.

How Does a Business Line of Credit Work?

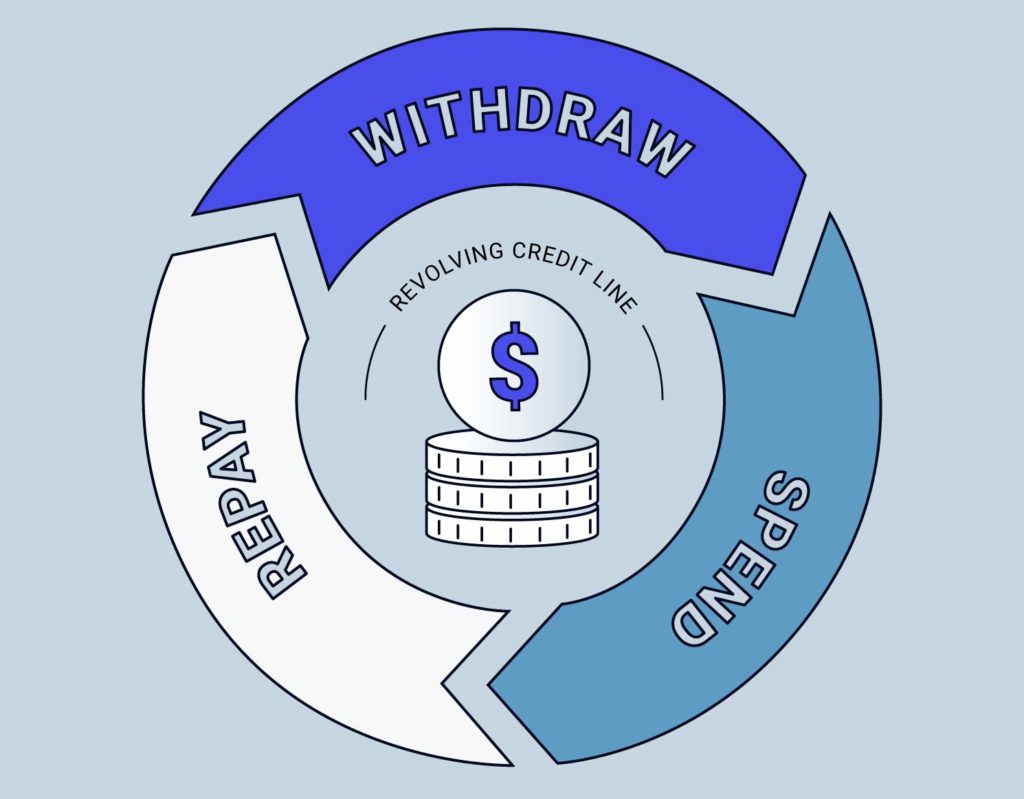

Once approved for a business line of credit, you can access funds whenever you’d like, up to your limit. At Fast Capital 360, our lending partners offer revolving credit lines, meaning as you pay back the funds you borrow, your credit line will be replenished up to your original approval limit.

Depending on your lender, you may be charged a small draw fee on each withdrawal you make. Withdrawal minimums may also apply. Additionally, if you don’t use your credit line for a period of time, you may be responsible for an inactivity or a maintenance fee.

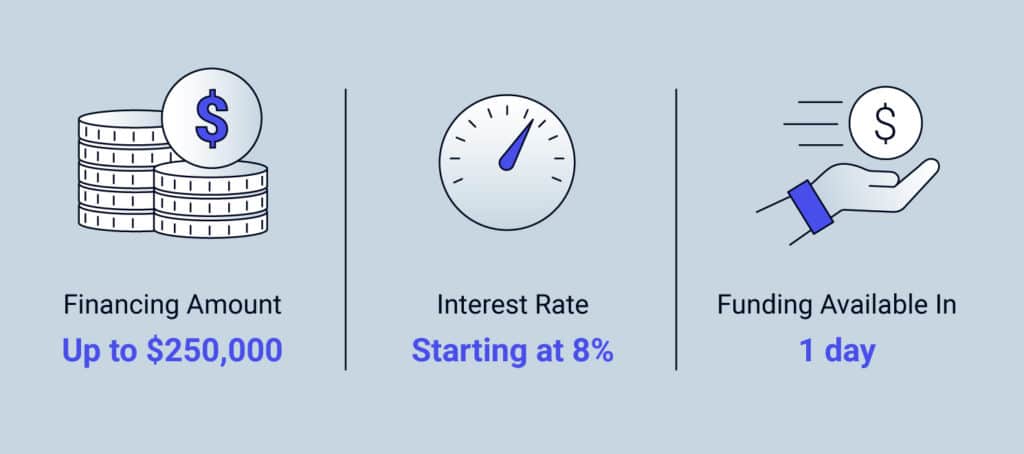

At Fast Capital 360, line of business credit terms range from 6 months to 2 years. Approvals go up to $250,000, and small business lines of credit rates start at 8%. If approved, you could have access to your credit line within a day.

Secured vs. Unsecured Lines of Credit

While business lines of credit can be secured or unsecured, at Fast Capital 360, we offer unsecured credit lines. Here’s what sets each credit line apart.

Secured Business Lines of Credit

Secured business lines of credit require businesses to back the credit line with collateral.

Collateral for a secured business line of credit is an asset that the lender can assume ownership of and liquidate to pay off the remaining balance in the event of default. The most common assets used to secure a business credit line include:

- Real estate

- Personal or company vehicles

- Home equity

- Inventory

- Equipment

- Accounts receivable (e.g., unpaid invoices)

Because collateral offsets the risk for lenders, these lines of credit for business capital may have more competitive interest rates, higher approval amounts and terms when compared to unsecured lines of credit.

Unsecured Business Lines of Credit

Unsecured business lines of credit can be obtained without a borrower pledging specific collateral. This means if a business defaults on its credit line, the lender would have no pledged securities to leverage in order to recoup its losses.

However, lenders providing unsecured business lines of credit protect themselves by other means. This is done mostly by reducing credit limits, charging higher business line of credit rates, shortening terms and requiring a personal guarantee.

Unsecured credit lines have streamlined applications. Indeed, applicants seeking an instant business line of credit often receive a decision within hours. Additionally, access to funds is often available within a day of approval.

SECTION 2

Why Consider a Business Line of Credit?

What They’re Best Used For

Business lines of credit are best for short-term needs and unexpected expenses. Here are a few advantages and disadvantages of a business credit line.

Pros

- Flexible use of funds

- Funds can renew as you pay down your debt

- No collateral required in many cases

- No interest charged until you draw funds

- No restrictions on how funds are used

Cons

- Draw and inactivity fees may apply

- Possible withdrawal minimums

- Limits can be lower than installment loan

- Potential for misuse

SECTION 3

What Does a Business Line of Credit Cost?

Your business line of credit interest rate and subsequent costs will depend on your business qualifications. Some of the factors that affect costs include your credit history, revenue, cash flow, time in business and industry.

How Interest Accumulates on a Business Line of Credit

With a business line of credit, no interest is charged until you draw funds. Each time you draw from your credit line, your outstanding balance will be re-amortized so you’re only paying interest on the funds drawn.

Common Business Line of Credit Fees

Besides a one-time origination fee that might be charged when you proceed with a business line of credit approval, common fees include draw fees, which are typically 1%-3% of the amount used. Some lenders may also charge maintenance fees or inactivity fees if no draw is made.

Business Line of Credit Example

Let’s say you were approved for a $10,000 business line of credit. You don’t need to use all of those funds right away. If you find you need $1,000 to buy inventory one month, you can use $1,000 from your $10,000 credit line.

You’ll likely be charged a draw fee on the $1,000 you borrowed, and you’ll only be charged interest on that $1,000. Your remaining available limit would be the difference until you pay off your existing balance, at which time, you’ll have your full $10,000 limit available again. In the meantime, you can borrow from your remaining credit line if you have other needs arise.

SECTION 4

How to Qualify for a Business Line of Credit

The more established your business and the stronger your credit score, the easier it will be to qualify for a program and the better terms you can expect to see.

What Our Lenders Evaluate

When evaluating borrowers for a line of credit, lenders will review recent bank statements to understand your business cash flow, existing expenses, debt obligations and income. To qualify for an online business line of credit, you must meet certain requirements regarding time in operation, annual revenue and personal credit score.

For example, newer businesses or those with less-than-stellar credit most likely will qualify for short-term business lines of credit with lower approval amounts and less competitive interest rates. Businesses with high revenues, established business histories and good credit scores are likely eligible for long-term lines of credit with higher credit line limits and lower interest rates.

Fast Capital 360 Minimum Qualifications

If you’re looking for a business line of credit for bad credit, our lending partners will consider applicants with the following minimum qualifications:

- Credit score of 560 or better

- 1 year or more in business

- $200,000 or more in annual revenue

SECTION 5

Business Lines of Credit Through Fast Capital 360

What Sets Us Apart

Thousands of small businesses have entrusted us with their financing needs and it shows in our ratings:

- A+ with the Better Business Bureau

- 4.9 stars on Trustpilot

- 4.4 stars on Google

With a single application, see offers from some of the best business lines of credit lenders.

Applying is fast, easy — and most importantly — preapprovals are available without impacting your credit.

How to Apply for a Business Line of Credit

Apply for a business line of credit online in a few simple steps:

- Tell us about yourself and your business

- Attach recent bank statements

- Get multiple loan offers

Once you pick the offer that works for you, your small business line of credit could be funded within a day of approval.

SECTION 6

Business Line of Credit: Frequently Asked Questions

Funds from a business credit line from Fast Capital 360’s lending partners can be used for any legitimate business purpose. Here are a few common reasons people use a line of credit:

- Payroll

- Supplies

- Bill payments

- Inventory purchases

- Emergency expenses

While a small business line of credit and a business credit card may seem similar, there are distinct differences between them:

1. Access to Working Capital

An online business line of credit can provide you with higher limits than you’d get with a business credit card. Additionally, while it’s also possible to receive a cash advance from your business credit card, you’re typically charged a higher interest rate than you’d pay for purchases in addition to a cash advance fee.

2. Repayment Schedules

While a business credit line is quite flexible, business credit cards provide more leeway when it comes to repayment schedules. There is no set repayment term for a credit card.

Small business lines of credit, on the other hand, come with a set end date. With each draw, a borrower is given a repayment term. Borrowers will pay either weekly or monthly installments, often over a few months or years depending on the terms.

3. Fees and Rewards

Business credit cards usually offer attractive rewards programs that lines of credit don’t. These card perks typically come with an annual fee, which recoups the cost of these benefits for the provider.

When it comes to term loans vs. lines of credit, here are the top differences between them:

1. Loan Terms and Fund Availability

With a term loan, you’re approved for a specific loan amount that’s given to you all at once. Unlike a business line of credit, interest on your loan begins accruing immediately. Additionally, your funds do not replenish like they do with a business line of credit.

2. Payment Schedules

Once you’re approved for a term loan, you begin making payments right away. With a business line of credit, you make payments as you use your funds.

3. Repayment Periods

Repayment periods for term loans are often longer than you’d find with business lines of credit. For instance, term loans can have repayment periods from 1 year to 25 years, while business line of credit repayment terms can range from a few months to years.

One application. Multiple loan offers.

Quickly compare loan offers from multiple lenders without impacting your credit score.

GET APPROVED