Building your business takes planning, thought and resources. It also takes capital. If you’re asking yourself, “How will I fund this growth?” The answer may be a secured business loan.

This financing is available to entrepreneurs operating organizations of all shapes and sizes.

So is a secured loan right for your small business?

We’ll explain what you need to know about secured small business loans — and how they can help your company. We’ll cover how secured business loans work, what you can use for collateral, how they differ from an unsecured loan, the different kinds available to small businesses and how to apply for this financing.

What Is a Secured Business Loan?

A secured business loan, also known as a collateralized loan, is a financing product that requires collateral to back the funding. Secured loans can be both short- and long-term.

A conventional business loan is commonly secured with collateral (or pledged assets).

How Do Secured Small Business Loans Work?

Secured business loans are obtained with a borrower’s pledged assets, which the lender can take if the borrower defaults on a loan. Some of these business loans are secured against property or equipment, while others are insured with an amount of money. Once your application is approved, the financing is provided in a lump sum, with the principal of the funding repaid, with interest, in either monthly or weekly increments over an agreed term.

Related: How to Get Startup Business Loans With No Collateral

What Can Be Used as Collateral for a Business Loan?

There are a variety of items that can be used as collateral to secure your business loan. Lenders are most interested in assets that are completely liquid or easily can be liquidated in the event of a default.

Here are the most common forms of collateral you can use for a secured business loan:

Property

Many entrepreneurs obtain business loans secured against property, such as real estate. As this form of collateral has a high worth and retains its value over time, borrowers have the opportunity to secure more funding. However, it’s important to remember not to overextend yourself, especially if the property you’re pledging as collateral is your primary residence. If you default on the loan, you could lose your home.

Savings

A portion of your savings can be used for a secured business loan. When you take out a cash-secured loan, the bank freezes those funds until the loan is paid in full. As with using property as collateral, you don’t want to leave yourself in a situation where you’re hindering your present or future financial safety to secure a loan. However, applicants with significant reserves can leverage their savings to bolster their businesses.

Equipment

Company equipment can be used as collateral for a secured loan for a small business. To obtain a business loan with that type of collateral, the equipment must be in good condition, operational and have a reasonably high market value to other businesses in your industry.

Self-Securing Loans

Another way financing can be secured is through the purchase of new equipment. With a self-securing loan, the lender purchases and owns the asset at the outset of the term and essentially leases it to your business. Note that the borrower owns the equipment once the secured small business loan has been satisfied.

Invoices

Billing your customers represents income for your business. Lenders see these unpaid invoices as an asset—depending on the amount owed, the indebted company’s reputation and the age of the invoices. This type of secured business loan also is known as accounts receivable (AR) financing or invoice financing.

Inventory

As with using invoices or equipment to secure working capital, your business can use inventory (current or prospective) as collateral. Using inventory to secure your loan can allow you to get an advance on any goods you have ready to be sold.

Secured vs. Unsecured Business Loans

Are all business loans secured? No, and the key difference between secured and unsecured loans is that secured business loans require you to put up assets, while unsecured loans don’t.

Keep in mind that most unsecured loans will still require either a personal guarantee or a business lien to protect the lender from defaults.

Often, secured business loan rates are better than unsecured loan rates because the overall risk of the loan is lower.

One of the most important distinctions between secured and unsecured loans is if a borrower goes out of business and needs to liquidate assets to pay off debts, lenders with secured agreements are paid first. Depending on the circumstances, the payment might be repossessed property.

Is a Secured Small Business Loan Right for You?

If you have assets to pledge as collateral to secure business funding, and if you’re willing to post them, the answer is yes.

If the answer is no, an unsecured loan probably is a better fit for you. If you find yourself having difficulty deciding between a secured or an unsecured loan for your business, consider the following:

- Do you own your business assets?

- How much funding do you need?

- What is your credit score?

These 3 factors will play a large role in helping you decide which loan type is right for you, as well as which loan type you have a better chance of qualifying for. (Note that obtaining a secured business loan with bad credit is possible if a business owner has the collateral to back the funding.)

Let’s break down each of these considerations:

Owning Your Assets

If you don’t own your assets, you won’t be able to provide them as collateral. Even if you’re 97% paid through your lease-to-own agreement for an asset, you won’t be eligible to pledge that specific item as collateral until you’re the legal owner.

Desired Funding Amount

For businesses looking to obtain more than $25,000, lenders typically will ask for some form of collateral to secure the funds. While it’s possible to acquire a high-value unsecured business loan, they are often costlier for the borrower, with higher interest rates.

Credit Score

Your credit score indicates to lenders how effective you are at managing your money and repaying debts. In terms of helping you secure a business loan, the higher your credit score, the lower your secured business loan collateral requirements and the better your terms are likely to be. Even if you have a bad credit score, valuable collateral can offset the risk.

How Much Can My Business Qualify For?

Best Secured Business Loans

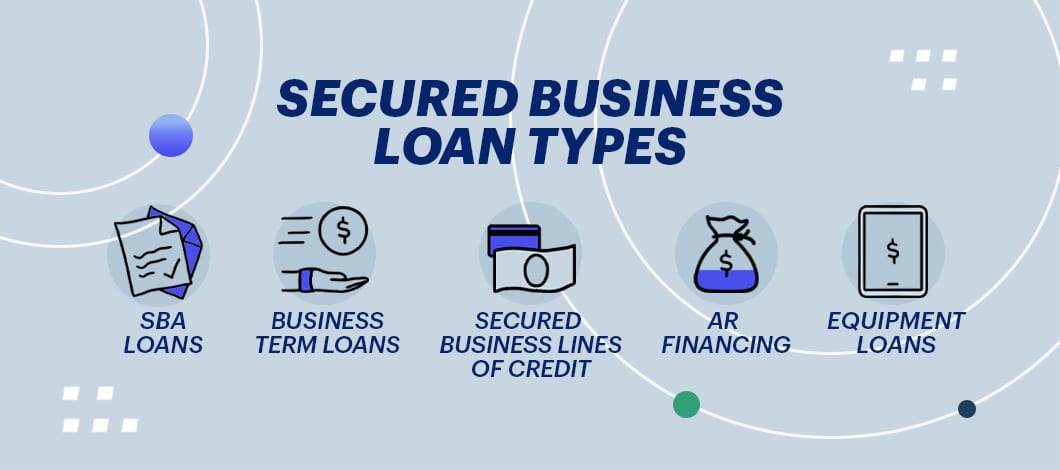

Deciding whether your business is better suited for a secured or unsecured business loan also depends on the type of loan you need.

Each lender will have its own set of standards and preferences.

Equipment Loans

Equipment loans are used to buy equipment that might otherwise be out of your price range. In the majority of cases, the equipment itself is used to secure the loan, meaning that if your business fails to make its payments, your lender has the right to reclaim the equipment to cover its costs.

Using the purchased equipment as collateral, your lender charges your business an interest rate as it pays back its loan. Qualifying for equipment financing, while dependent on the price of the equipment, is pretty straightforward.

SBA Loans

SBA loans are partially secured by the small business administration. This means the SBA will pay a percentage of the lender’s loss if your business defaults on the loan. Because of this guarantee, SBA loans are often given lower interest rates and longer terms than many other forms of small business financing. Depending on the value of the loan, lenders may require borrowers to pledge collateral. For example, lenders don’t require collateral for SBA loans up to $25,000.

Secured Business Lines of Credit

A business line of credit provides access to funds to spend as your company needs. You withdraw only what you need, up to the credit limit, paying interest on the amount you’ve taken. You are never obligated to use the entire amount.

The benefits of a business line of credit make it a preferred funding option for many business owners, offering you the chance to use revolving funds on your own terms and improve your cash flow.

Related: Your Ultimate Guide to Unsecured Business Lines of Credit

Accounts Receivable Financing

If your business manages multiple accounts with payments due, this is the type of financing for you. Lenders provide your business with access to the cash it’s owed.

Accounts receivable (AR) financing is another type of secured business loan. The invoices serve as the security for the financing.

Business Term Loans

With a business term loan, you receive a one-time infusion of capital and pay it back over the term of the financing. They’re used for long-term investments, including equipment purchases, refinancing debt and commercial real estate.

Term loans offer businesses higher limits, longer repayment periods and lower interest rates. The trade-off for these favorable terms is stricter qualifying requirements.

-

Is a Secured Business Loan Easier to Get?

It’s easier for borrowers to qualify for a secured small business loan because the collateral reduces the lender’s risk and makes them more confident in approving your application. This layer of security is especially helpful if you don’t have a lengthy credit history or a strong credit score — both factors can give lenders pause.

How to Get a Secured Business Loan

When you’re ready to apply for a secured business loan, you’ll have to gather relevant documents and business information to provide lenders with a complete picture of your business and any pledged assets.

This can include the following:

- Basic business information, including articles of incorporation, if applicable

- Information about you, business partners or other owners

- Your doing-business-as name (DBA)

- Recent bank statements

- Voided business check

- Tax returns

- Stock ownership documents or certificates

- Proof of assets

Your lender will appraise the value of your collateral and offer financing based on the value of the assets. Note: Secured business loan requirements vary according to the type of financing and the lender.

Which Institutions Are the Best Secured Loan Lenders?

There isn’t a definitive answer. Conventional lenders, such as banks and credit unions, offer higher funding amounts and potentially lower interest rates and longer terms. However, they also have stricter secured business loan requirements, including good and excellent credit scores (670 or higher) and lengthy credit history. An existing relationship with the bank can also increase your chances of approval.

Also, if you’re seeking fast secured business loans, conventional lenders, such as banks and credit unions, use applications that require more paperwork and may take some time to process. Some lenders might require in-person meetings for all or portions of the application. Additionally, when you apply for a secured business loan, your pledged assets will have to be appraised, which could potentially extend the time between submitting your application and learning the lender’s decision.

In contrast, alternative or online lenders will consider businesses that might be newer (operating for only 1 year or 2 years) and are still building a strong credit history. However, because these applicants are considered bigger risks, you might be approved for a business loan with higher rates and more frequent payments or shorter terms.

Applying through an online lender could be a better option for you if you need quick access to funding. Alternative lenders, including Fast Capital 360, have the application process entirely online, and it can be completed within minutes.