A Data Universal Numbering System (DUNS) number is a 9-digit identifier for business. Lenders, vendors and even potential business partners reference your DUNS number to determine your financial stability.

A DUNS number, also called a Dun & Bradstreet number, not only establishes your creditworthiness but it is required for all companies hoping to work with the U.S. government.

What Is a DUNS Number?

Since establishing the DUNS system in 1962, credit-rating firm Dun & Bradstreet (D&B) has issued DUNS numbers for more than 330 million businesses worldwide. Each 9-digit number corresponds to a single physical location of a business.

As indicated by its name, the Data Universal Numbering System, a DUNS number is universal and is recognized around the world.

A DUNS number can be issued to several types of business organizations, including sole proprietorships, corporations, partnerships, nonprofits and government entities. Similar to how an individual’s Social Security number (SSN) stays constant for life, a DUNS number is also a constant throughout the lifecycle of a business. Obtaining a DUNS number is the first step to establish your company’s D&B credit file. Your credit file includes a variety of information, including your business name, addresses and credit inquiries, used to generate your D&B credit rating, one of which is known as a PAYDEX score.

Your DUNS number and D&B ratings are part of what D&B calls its Live Business Identity, which is intended to serve as a single, accurate source of your company information.

DUNS Number vs. EIN

Like a DUNS number, an employer identification number (EIN) is a 9-digit number that identifies a business. While a DUNS number is used for business credit reporting purposes, an EIN is issued by the Internal Revenue Service (IRS) for tax purposes. Businesses around the world can get DUNS numbers, so you don’t necessarily need an EIN to apply for one.

Why Is a DUNS Number Important?

As a small business owner you might be asking yourself, “What is a DUNS number used for?” or “Do I need a DUNS number?” Obtaining a DUNS number is helpful, and may even be required, in several situations.

- Required to receive a PAYDEX score, which is used by lenders, suppliers and vendors to check your company’s creditworthiness

- Helps build business credit

- Keeps business and personal credit separate

- Required to apply for government grants and contracts or Small Business Administration (SBA) loans (starting January 2021, businesses will need a Unique Entity Identifier to apply for government grants or contracts)

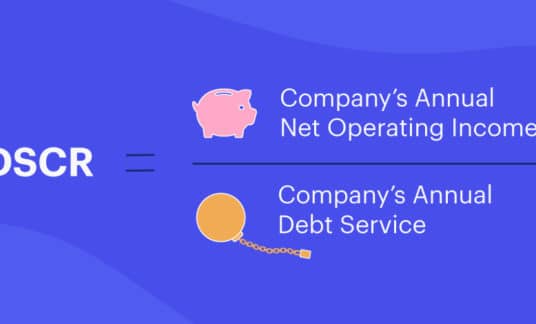

Why Your PAYDEX Score and Creditworthiness Matter

Measured on a scale of 1-100, the higher your PAYDEX score the less at risk your business is of making late payments or defaulting on a loan.

Lenders and vendors may use a PAYDEX score to determine:

- Whether they want to finance or work with a business

- Interest rates for financing

- Payment terms

In short, if you’re using suppliers and vendors, seeking financing or working as a government contractor, you might want or need to obtain a DUNS number.

How To Get a DUNS Number

Before applying for a DUNS number, confirm there isn’t a DUNS number already assigned to your business.

The Dun & Bradstreet number lookup is available online. You can find your company’s or another company’s DUNS number using a business name or phone number. If your DUNS number search is successful, the information will be sent to you via email.

Otherwise, this is how to apply for a DUNS number.

The DUNS number application can be completed online. You will need personal and business information to receive your DUNS number, including:

- Owner name

- Legal business name

- Trade or doing business as (DBA) name

- Mailing and physical address

- Telephone number

- Total number of employees

- Business legal structure

You’ll need to electronically upload documents showing your company’s correct legal business name at the current physical address. Acceptable documents include:

- Secretary of State Articles of Incorporation

- Taxpayer Identification Number (TIN) confirmation letter

- Employer Identification Number (EIN) confirmation letter

- DBA/Assumed name certificate filing

- Lease agreement

- Utility bill

If you need to modify an existing DUNS number, you’ll also need documents supporting the changes but these will vary based on circumstance.

How Long Does It Take to Get a Duns Number?

Registering for a DUNS number is free, but the process can take up to 30 business days. If your business is required to register with the U.S. government for contracts or grants, you may be eligible to receive a DUNS number within 1 business day.

Otherwise, you can opt to pay D&B a $229 fee to expedite the process. This means you’ll receive your DUNS number within 5 business days, along with a basic D&B credit file.

Applying for a DUNS number is a simple process that can benefit your small business by proving your creditworthiness and opening up more opportunities for growth.