Small business loan scams can turn opportunities to find financing into financial catastrophes. Learn how to avoid common scam tactics.

First, we’ll look at some of the most common scams and how they illustrate typical con tactics. Then we’ll share some tips for avoiding loan scams. Finally, we’ll cover what to do if you find yourself the victim of a loan scam.

What Are Some Common Small Business Loan Fraud Scams?

Loan fraud scams come in a number of forms. They fall into a few major categories and they all share some common characteristics.

Some pretend to represent exclusive loan opportunities that are available at exceptionally low rates. Others, often extended after you’ve already applied for a loan, may offer services such as credit repair or debt relief. All seek to gain your confidence to entice you into paying an advance fee or turning over sensitive information that can be used to steal your money.

Here are some of the most common tactics con artists use to achieve this goal.

1. Loan Offers in Return for Advance Application Fees

One basic scam which illustrates the tactics used in other common scams involves extending a low-interest loan offer in return for an upfront application fee. The offer might be sent via email, text message, letter or other means.

It typically consists of inviting you to take advantage of a low-interest financing opportunity, such as a loan for no interest. To secure the loan, the scam artist requests an upfront application fee.

Legitimate lenders may charge genuine processing fees during the closing process. However, a fake loan offer includes a number of distinguishing red flags.

For instance:

- It arrives unsolicited, rather than you coming across the offer while visiting a lender’s website.

- The sender’s information may be difficult to trace to a physical address other than a post office box.

- The offer makes unqualified promises, such as assuring you that your loan will have no interest and is guaranteed no matter what your credit score is.

- The fee is requested before any prequalifying screening or loan approval.

These marks help distinguish advance fee scams from legitimate lenders requesting normal processing fees.

2. Small Business Administration Loan Scams

A related variety of scam involves extending fake offers for Small Business Administration (SBA) fraudulent loans. SBA loan scams may resemble the advance fee scam discussed above, except the fee is being asked in return for a promised SBA loan. Alternately, the offer may claim that your loan has been approved already, but you have to pay a fee to continue processing it.

The SBA provides guidelines for recognizing phony SBA loan offers. Among other tips, they recommend being suspicious of any offer which promises loan approval for an up-front fee.

3. Loan Broker Scams

Loan broker offers resemble advance fee offers, but rather than offering you a loan directly, the perpetrator pretends to be a broker who can connect you with a lender, for an upfront fee. Legitimate loan brokers generally work on commission rather than charging an upfront fee.

4. Fake Investor Offers

In this scam, the thief poses as an investor interested in funding your business. To facilitate their financing, they request sensitive financial data, such as your business tax identification number or your financial statements. Their real purpose is to use this information for identity theft to apply for funding in your company’s name elsewhere.

Legitimate investors won’t approach you this way. You typically need to submit a solid proposal including a business plan to attract investors.

5. Peer Lending Offers

Peer lending scam artists approach you pretending they can facilitate a loan from a peer-to-peer lending network, which is an online platform where borrowers can connect with lenders. The thief may request a fee, financial data or both. They may request you to wire money through a method such as Western Union, which offers less fraud protection.

Avoid this scam by working through legitimate peer-to-peer networks rather than unsolicited offers. Don’t offer payment upfront or use a money wiring service.

6. Credit Repair Scams

Some scams tend to target borrowers who have already applied for loans or are in the market for loans. One such tactic is the credit repair scam. Here the perpetrator extends an offer guaranteeing to increase your credit score by hundreds of points quickly in return for an advance fee.

While there are legitimate credit repair services, they can’t deliver guaranteed results, and they can’t do anything you can’t do on your own. For example, the Federal Trade Commission (FTC) provides instructions for obtaining your credit report free. In addition, credit data analytics provider FICO spells out guidelines on how to increase your credit score.

7. Debt Relief Scams

Another scam targeting previous loan borrowers is fake debt relief offers. This scam targets business owners with existing debt by offering to negotiate lower repayment terms, such as promising to cut your debt in half. To facilitate this, the thief requests a fee and sensitive financial information.

Legitimate debt relief services can’t guarantee to reduce your debt, which is a red flag. Real debt assistance providers may be able to arrange lower monthly payments through techniques such as debt consolidation or refinancing. However, before taking such measures, you may be able to approach your lender directly to negotiate different repayment terms.

8. Debt Collection Scams

An aggressive scam threatens debt collection action or arrest unless a debt is paid immediately. Perpetrators of this type of scam may pose as government or law enforcement agencies.

This scam usually can be detected by checking the perpetrator’s contact information and their knowledge of your loan. Phony government agents won’t check out with their alleged agencies, and fake collectors won’t know loan details.

Even if the collector is real, the tactics used in this scam are illegal. Federal regulations enforced by the FTC prohibit debt collectors from using deceptive, unfair or abusive tactics such as posing as government agents. The FTC recommends reporting violators to their commission, the Consumer Financial Protection Bureau and your state attorney general.

How Can You Avoid Small Business Loan Scams?

While there are many variations on loan scams, they all share some common tactics which enabled them to be countered. The SBA offers some general tips on how to avoid loan scams.

Here are some of the most important things you can do to avoid falling prey to loan scam artists:

1. Don’t Authorize Advance Payments

Ultimately, the goal of all loan scams is to get your money, either directly by tricking you into authorizing a payment such as an advance fee or indirectly by stealing your financial information. Being cautious about authorizing advance payments forms your first line of defense against most common scams.

Legitimate online lenders won’t charge you fees before your loan is approved. While lenders may charge fees for approved loans, these fees should be disclosed upfront. In the case of SBA loans, regulations prohibit brokers from charging more than 3% for loans up to $50,000, more than 2% for loans of $50,000 to $1,000,000 and an additional 1/4% on amounts over $1,000,000, up to a total limit of $30,000.

2. Don’t Share Sensitive Information with Unknown Parties

To protect yourself and your business from identity theft, don’t release information such as Social Security numbers or bank statements to parties who make unsolicited offers to you by email, letter or phone.

Only share this type of information after you’ve verified the identity of the party and the legitimacy of an offer.

3. Question Unsolicited Offers

Legitimate lenders normally wait for you to come to them. They typically don’t make cold calls or send communications to offer you money, unless it’s a financial provider you’re already a customer of.

If someone you don’t know makes you an unsolicited lending offer, exercise due diligence.

4. Don’t Click Links or Call Numbers from Unverified Sources

One way con artists may try to get your personal and financial information is by tricking you into clicking on a link or calling a number, opening the door to identity theft.

Simply put, don’t click on links or call numbers from suspicious parties.

5. Verify Contact Information

Before contacting alleged lenders or accepting offers, verify the party’s contact information. Legitimate lenders use physical addresses which aren’t post office boxes.

Genuine phone calls should trace to the company or government agency purporting to make them. Genuine emails should originate from the domain of the alleged sender.

In the case of government agencies, website addresses and email domains should end with a .gov suffix. For example, a genuine email from the SBA should have an address ending with @sba.gov.

The SBA recommends doing an online reverse phone search on the numbers of suspicious parties. This often turns up previous scam complaints. You also can search using the keyword “scam” and the name of the party on search engines or on sites such as those of the SBA or the Better Business Bureau (BBB). Your state attorney’s general office also maintains data on scam complaints.

6. Question Extravagant Promises

Scam offers are marked by making extravagant promises, such as guaranteed loan approval or no interest.

If an offer promises something which sounds too good to be true, review it critically.

7. Learn How Legitimate Lenders Work

You’ll be in a better position to spot phony offers if you’re familiar with how legitimate lenders work. For example, if you know the steps in the SBA loan process, you’ll be wary of offers promising guaranteed SBA loans regardless of your credit score.

Use online resources such as government websites, websites from legitimate financial providers and the Fast Capital 360 Beyond Capital blog to learn about the lending process. Consult a trusted resource such as your bank’s loan officer or your company’s financial adviser with detailed questions.

What Should You Do If You Get Scammed?

If you do fall prey to a loan scam, you can take several steps to try to minimize the damage to your credit, recover your money and bring the perpetrator to justice:

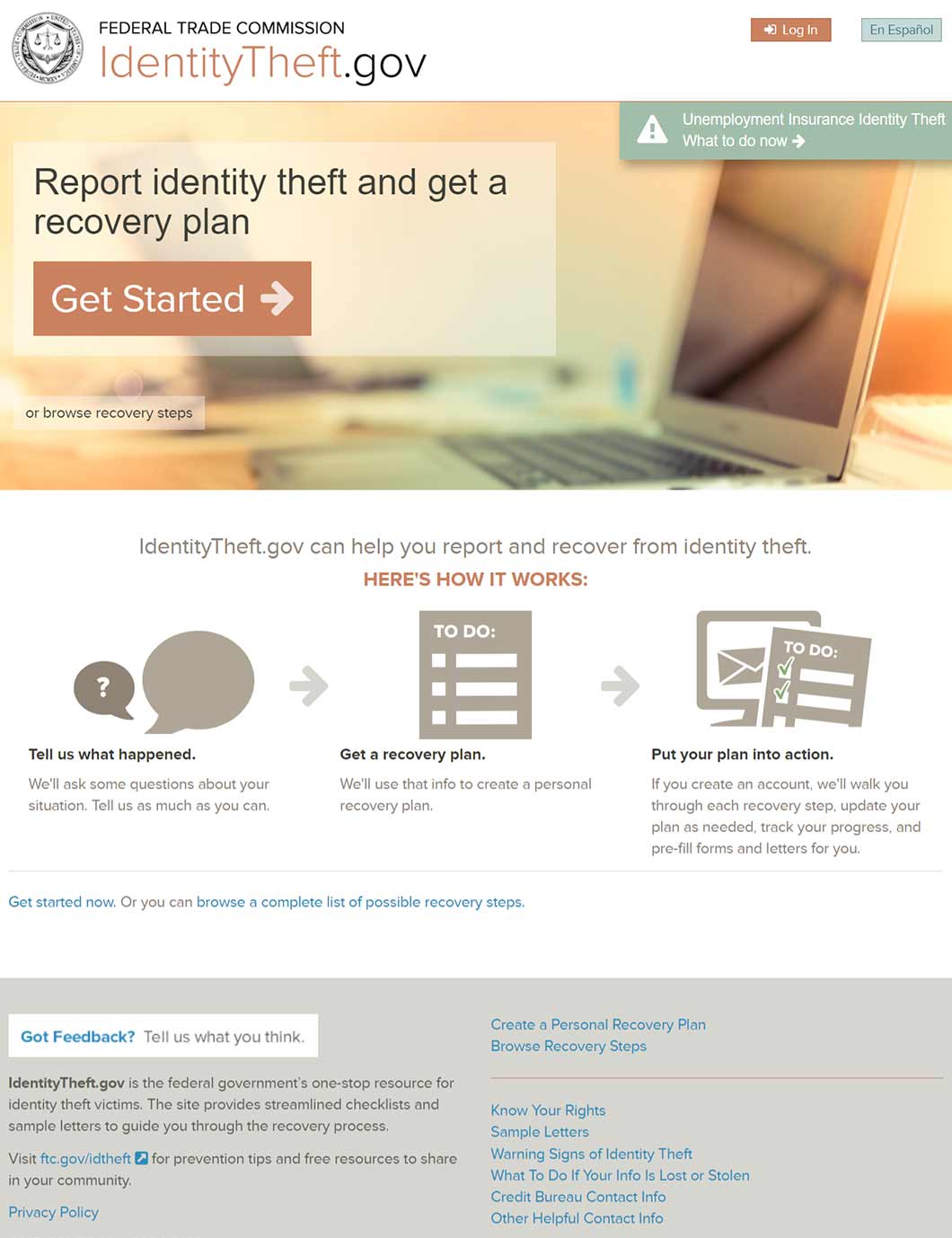

- Place a fraud alert on your credit report by contacting one of the major credit reporting providers (Equifax, Experian and TransUnion) using the contact information provided by the Consumer Financial Protection Bureau (CFPB)

- File an identity theft report with the FTC and your local police

- File a complaint with the CFPB

- Submit a complaint with your state attorney general

- File a complaint with the BBB

- For SBA scams, file a report with the SBA’s Office of Inspector General

Taking these steps can help protect you as well as others targeted by the same perpetrator.

Avoid Business Loan Fraud While Finding the Financing You Need

Business loan scams come in a variety of forms, ranging from fake loan offers to phony credit repair and debt relief claims.

All of these scams have certain telltale traits in common, such as unsolicited requests for up-front fees or information, unverifiable contact information and extravagant promises at odds with how legitimate lenders work. Learning to spot these signs can help you avoid most scams. If you do get scammed, contact credit reporting providers and report the incident to the proper federal and local authorities.

One key to avoiding loan scams is learning how legitimate lenders work. Fast Capital 360 provides information on lending and helps match you with legitimate, screened lenders. Take a few minutes to fill out our free, no-obligation prequalifying form and see your loan options.