Lenders offer 2 types of loans to finance a company’s operations and growth: simple interest vs. amortization.

With both types of loans, you make the same fixed amount of payment on each due date. However, there are significant differences with each loan in the way interest amortization charges are accrued and balances are paid down.

In terms of amortization vs. simple interest loans, amortizing loans have fixed rates that can be compared on an annualized percentage rate (APR) basis. In contrast, simple interest loans often have interest costs quoted as a factor rate. Each one is appropriate in particular circumstances and has its purpose in funding a company’s operation as well as its advantages and disadvantages.

Let’s examine how each method works and find out how to determine which type of loan repayment schedule would work best for your business.

What Is an Amortized Loan?

Amortized loans are usually for longer periods of time, say 3 years or more. Payments are typically made monthly in fixed amounts.

The portion of each payment that goes to interest and principal changes each month. Interest is paid first with the remaining balance applied to the principal. For subsequent months, because the principal has been reduced, the amount of the payment applied to interest goes down and more of the payment goes to principal.

Related: Amortization Schedule: What It Is – and How It Works

Amortized Loan Example

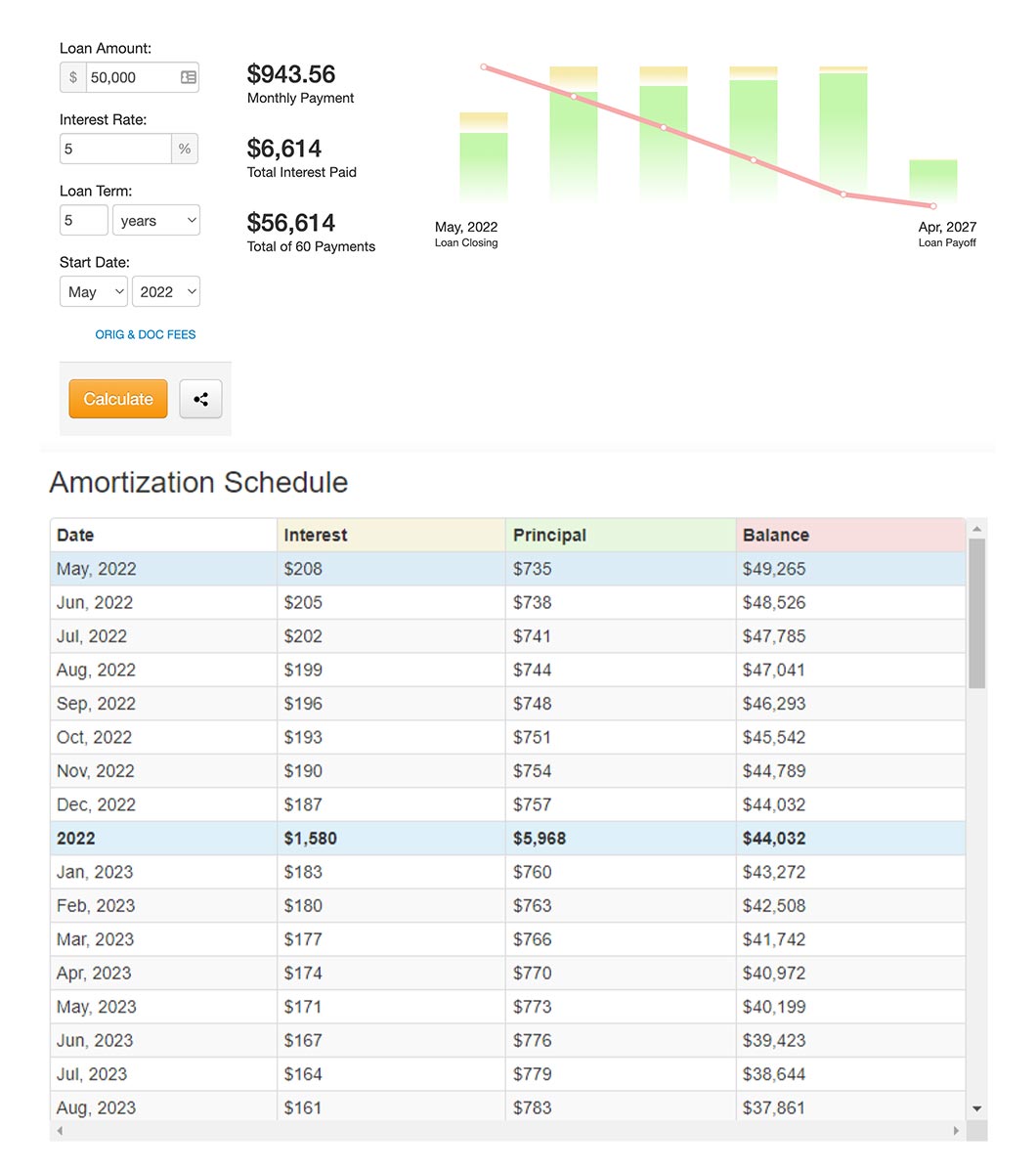

Suppose you borrow $50,000 at a fixed interest rate of 5% to be repaid over 5 years. After entering this data into a loan amortization calculator, you will find that your monthly payment would be fixed at approximately $944, including principal and interest, for the life of the loan, a total of 60 payments.

In the first month’s payment, $209 (rounded) would be paid to interest and $735 applied to principal. The new principal balance after this payment would be $49,265.

For the second month’s payment, $206 would be paid to cover interest, which is lower because the principal balance has been reduced, and $738 applied to reduce the principal balance. The new principal balance would now be $48,527.

Because of the declining loan balance, the portion of each month’s payment used toward interest would go down and the amount applied to principal would go up. This process continues until the loan is paid off and the loan balance is zero.

What Is a Loan With Simple Interest?

Simple interest loans are usually for shorter time periods than amortized loans — say 6 months up to 18 months. A simple interest loan also has a fixed interest rate and fixed payments, but the interest costs and principal repayments are treated differently than amortized loans.

The simple interest loan payment formula requires that the borrower make equal payments of principal and interest over the life of the loan. The amounts applied to principal and interest are the same each month, since interest is not recalculated each period based on a declining principal balance.

Simple Interest Loan Example

Unlike amortized loans, which have interest rates expressed as percentages, the interest on simple interest loans is usually stated as a factor rate, which often ranges from 1.0 to 1.9. Lenders base the factor rate on an analysis of a company’s cash flow as presented on its bank statements, the length of time in business and tax returns that show a stable income.

Suppose you have a $50,000 loan and the lender quotes a factor rate of 1.2 with weekly payments over 6 months. This means you would repay the lender 1.2 times the principal amount of the loan or, in this case, $60,000. Of this amount, $10,000 would be your interest cost (total amount due of $60,000 minus the original advance of $50,000).

Assuming there are 26 weeks in 6 months, your combined fixed interest and principal payment would be approximately $2,307.70 weekly. [This accounts for $1,923.08 ($50,000 / 26 weeks) to pay off the original advance plus $384.62 ($10,000 / 26 weeks) to pay the interest charges.]

With a simple interest loan payment schedule, principal and interest payments do not change over the life of the loan. They are fixed. This is different from amortized loans, for which the distribution to principal and interest cost changes with each payment.

How to Convert a Factor Rate to an Annualized Percentage Rate

Since a factor rate is a decimal number and not a percentage, you may want to convert this rate to an annualized percentage rate to have a common base to compare the cost of simple interest loans with other loans. However, keep in mind APR may not be the best way to compare apples to apples when it comes to short-term financing, as many of these funding programs do not extend beyond a year.

That said, here’s how you’d convert a factor rate to an annual percentage rate:

Using our example of the $50,000 loan above, do the following calculations:

Divide the financing costs by the original advance amount and multiply by 100 to get the percentage:

$10,000 / $50,000 X 100 = 20%

Multiply this percentage by the number of days in a year:

20% X 365 = 73

Divide this figure by the number of days of the loan. In our example, this would be 180 days.

73 / 180 = 40.6%

Therefore, the factor rate of 1.2 used in our example would equate to an annualized percentage rate of 40.6%. By making this calculation, you could compare the potential annualized borrowing costs of a simple interest loan to other alternatives, such as amortizing loans.

Related: Short-Term Loans: Why APR Is the Wrong Metric

Differences Between Simple Interest vs. Amortized Interest Loans

In regards to simple interest vs. amortized loans, here’s a more detailed breakdown of what makes each unique.

Terms and Rates

Amortizing loans are generally for longer terms — over several years — and have lower APRs than simple interest loans. In contrast, simple interest loans are usually just for a few months up to around a year. Additionally, as mentioned, simple interest loans have higher interest costs, often quoted as a rate factor instead of a percentage.

Collateral

Amortizing loans are usually backed with some type of collateral, such as equipment or vehicles, whereas simple interest loans are generally unsecured financing with repayments often based on receipts of future sales. In this sense, amortized loans are less risky for lenders than simple interest loans.

Prepayment

Most amortizing loans allow prepayments of the principal without penalties. This option would let you pay off the loan sooner and reduce your overall interest cost. With amortizing loans, one strategy is to make small additional payments to the principal with each regular payment to get the loan paid sooner.

On the other hand, simple interest loans don’t allow prepayment and may even have prepayment penalties. In our example of the $50,000 simple interest loan, you would be obligated to pay the lender a total of $60,000 whether you paid off the loan in 1 month or 6 months.

Time to Approval

Amortized loans take longer to get lender approval. Lenders will evaluate your financial statements and cash flow to determine the company’s capacity to make the loan payments. Conversely, lenders will often approve a simple interest loan in just a matter of hours or a few days without as much in-depth investigation.

How to Choose Between a Simple Interest vs. Amortization Loan

The choice between a simple interest loan or an amortized loan depends on several factors. One is the purpose of the funds. If you’re looking to purchase a truck, for example, you would prefer to have an amortized loan. Loan balances that are amortized over several years are more likely to match the depreciation rate of the underlying collateral, such as equipment or vehicles.

On the other hand, if you have a cash-flow shortage and need funds immediately for a short period of time, a simple interest loan could be the way to go, even if the interest rate is significantly higher. Approvals for these funding types will be much quicker than applying and getting approval for a long-term amortized loan. A merchant cash advance is an example of simple interest financing.

Your personal and business credit rating will affect the types of loans available to you. Businesses with low credit scores will have difficulty getting approved for long-term amortizing loans. These types of businesses may need to use short-term simple interest loans at higher rates until they can improve their credit standing.

Keep in mind, even companies with good credit scores that are approved for an amortized loan vs. a simple interest loan need to have sufficient cash flow to comfortably handle the debt payments. If you think you’re going to have excess cash flow in the future and may want to prepay your loans, you’ll need to find out if your loans have any prepayment penalties.

Managing Your Company’s Debt

Managing debt is a critical skill that can either form the foundation for your company’s growth and development or weaken its position. It’s important to find a lender willing to understand your business and make recommendations for the right type of financing when it’s needed.

At some point, you might need a simple interest loan to meet short-term cash-flow deficits. Other times, you may need to purchase fixed assets financed with amortizing loans.

Even if your credit score isn’t great in the beginning, a lender interested in your business will work with you to finance your operations and help you build your borrowing history. They’ll be able to look at your cash-flow needs and make recommendations that match your requirements.