Applicants for Small Business Administration (SBA) loans often wait months for approval. Thankfully, the federal agency provides an express loan program to speed up the review process and fund small businesses faster.

If you need funding for your small business and need it quickly, consider an SBA Express loan. Here’s what you need to know before you apply.

What Is an SBA Express Loan?

SBA Express loans are a part of the agency’s 7(a) loan program, the SBA’s primary means for helping small businesses obtain funding.

SBA Express loans help business owners obtain the benefits of other SBA loans in an expedited fashion. Business owners searching for working capital loans, business lines of credit and equipment financing can cut the time they wait for approval. Though the lender, not the SBA, is ultimately responsible for the decision to extend credit, the SBA notes it responds to Express applications within 36 hours and Export Express applications within 24 hours.

The review process of SBA Express loans is sped up because these loans generally involve lower amounts of money and have fewer documentation requirements than other SBA funding programs.

Types of SBA Express Loans

There are a couple different types of these expedited SBA loans: Express and Export Express. (The SBA Express Bridge Loan was another option, but the program expired in March of 2021.)

SBA Express Loans

The flexibility and competitive terms of SBA’s standard Express loans make them a popular funding option for many small business owners. Express loans max out at $500,000 and carry a 50% guaranty backed by the SBA.

SBA Export Express Loans

Express Export loans are for owners who want to begin or enhance their international exporting business. To qualify, you must prove the money will be used to fund your day-to-day operations, inventory orders and to refinance debts related to that part of your business.

Because many conventional lenders associate international business operations with higher risk, the SBA guarantees up to 90% of the funding to help borrowers receive approval. These loans have a maximum amount of $500,000. It’s important to note that the CARES Act changes do not alter the maximum loan amounts for Export Express loans.

-

SBA Express vs. Export Express vs. Standard 7(a) Loans

SBA Express Loans SBA Export Express SBA Standard 7(a) Maximum Loan Amount $500,000* $500,000 $5 Million SBA Percent of Guaranty 50% 90% for loans of $350,000 or less, 75% for loans greater than $350,000 85% for loans of $150,000 or less, 75% for loans greater than $150,000 SBA Turnaround Within 36 hours Within 24 hours 5-10 business days

What Are the Terms of SBA Express Loans?

The rates, fees and other details of SBA loans are designed to make them more accessible to small business owners.

Rates and Fees of SBA Express Loans

The steep interest rates and hidden fees of many funding opportunities can cripple a business owner’s cash flow. You may get the funding you need now, but the premium you pay will make it more difficult to grow in the future.

Knowing this, the SBA and its lending partners aim to lower the financial burden that borrowers face.

Fees

For SBA loans, lenders are prohibited from including specific fees that are usually a part of their loan agreements, including processing, application, origination fees and more. This could mean thousands in savings for your business.

Certain fees are paid on the guaranteed portion of SBA loans, but they’re generally lower than you’d expect with other loans. Depending on the loan amount and term length, your guaranty fees can range from 0.25% for loans of 12 months or less and 2% or 3.5% otherwise (plus 3.75% when the guaranty portion is greater than $1 million). Guaranty fees are waived for veterans. In addition to guaranty fees, there is also an ongoing lender fee of 0.55%.

| Express Loan Amount | Guaranty Fee (Repayment Term < 1 Year) | Guaranty Fee (Repayment Term > 1 Year) |

| SBA Express loans to qualified veterans and spouses, up to $500,000 | 0% | 0% (when program is zero subsidy) |

| Up to $150,000 | 0.25% | 2% |

| $150,000-$500,000 | 0.25% | 3.5% |

Interest Rates

The SBA also regulates interest rates. These rates are capped and tied to the prime rate. As of Dec. 15, 2022, the prime rate is 7.5%.

The maximum rates for SBA Express and Export Express loans are as follows:

| Loan Amount | Interest rate |

| $50,000 or less | Prime rate + 6.5% |

| Over $50,000 | Prime rate + 4.5% |

If you add the current prime rate to 6.5%, the interest rate on a $50,000 loan would not exceed 13.5%. Visit the Federal Reserve website to find updated daily prime rates.

Maturity Terms

SBA Express business funding can be used for revolving lines of credit or term loans. Express and Export Express term lengths will be determined by what you are using the funding for, the expected life of the collateral you offer and your ability to repay the loan.

- Real estate loans: Up to 25 years

- Working capital, machinery and equipment loans: Typically range from 5-10 years, but are not to exceed the useful life of the collateral (usually the equipment that was financed)

- Lines of credit: Up to 7 years (maturity extension available)

Who Is Eligible for an SBA Express Loan?

The SBA is essentially going out on a limb to help business owners get the funding they need to succeed, so the agency understandably has its requirements. Here are factors to consider when you decide to complete an SBA Express loan application form.

Determining Your Eligibility

Here’s an SBA Express loan application checklist of some of the requirements you’ll need to be considered:

- Operate business for profit

- Engage in operations in the U.S. or its territories

- In business for 2 years or more

- Qualify as a small business using SBA size standards

- No delinquencies on any previous government loans

- Owner must have personal equity invested in the business

-

What About My Credit Score?

Typically, for your SBA Express loan application form to be considered, you’ll need a personal credit score of 650 or better. The SBA will also review your FICO SBSS small business credit score during its prescreening process. Reportedly, the SBA requires a minimum SBSS score of 155, with many SBA lenders requiring a minimum of 160-165.

Businesses Ineligible for SBA Loans

As a government agency, the SBA won’t assist certain businesses, including the following:

- Lending companies

- Gambling businesses

- Businesses that promote or partake in illegal activities

- Insurance companies

- Businesses following a pyramid sales structure

- Businesses primarily engaging in the teaching, instruction or promotion of religious practices

If your business doesn’t qualify, there are alternative ways to get funding.

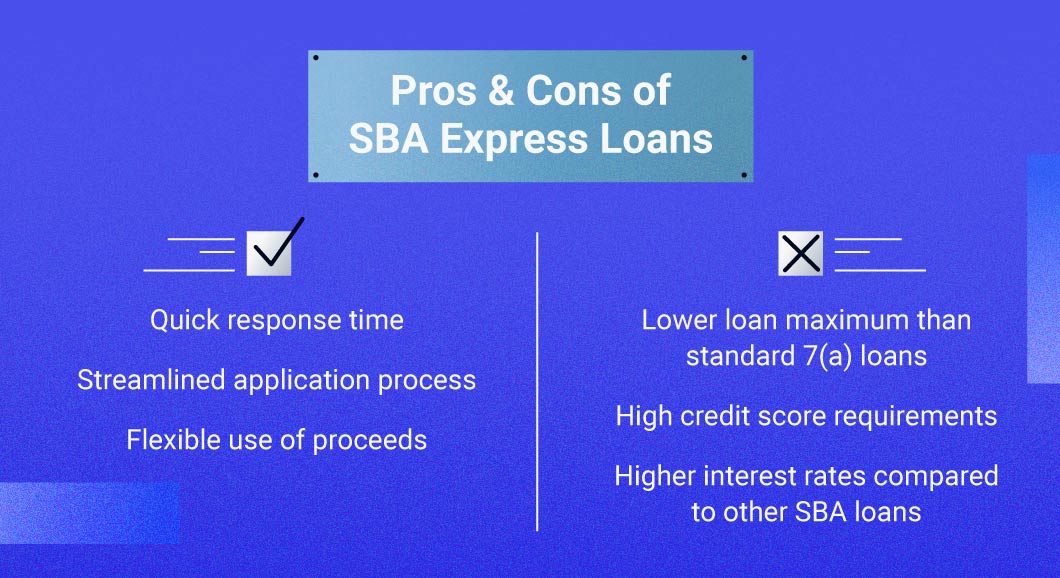

What Are the Pros and Cons of SBA Express Loans?

While the relatively fast process and generous term lengths are attractive, there are some drawbacks to SBA Express loans.

Before deciding whether this is the right funding option for you, weigh the advantages and disadvantages of SBA Express business funding.

How to Apply for SBA Express Loans

The application process for an SBA Express loan doesn’t have to be complicated. The first step is to gather the documents you’ll need to apply with an SBA-approved lender.

You’ll need to fill out the SBA’s borrower information form, also called Form 1919. In the document, you’ll include everything the SBA will need to verify and qualify your application, including information about your business’s structure and operation. The SBA will also require Form 912 (Statement of Personal History) and Form 413 (Personal Financing Statement).

Additionally, you may be required to provide the following paperwork/documents:

- Personal and business tax returns

- Business financial statements (required from each individual owning 20% or more of the company)

- Profit-and-loss statement

- Balance sheet

- Proof of collateral

- Business licenses

- Articles of incorporation

- Commercial leases or franchise agreements

- Ownerships and affiliations

- Business overview and history

- Loan application history

Refer to the SBA’s Express loan application online checklist.

Finalizing Your SBA Express Loan Application

When you have everything together, submit the documents to your lender and the SBA will review your application. Since you’ll be applying for an SBA Express loan, you should receive a decision in a few days. Once approved, funds could be available within 7 days, with the entire process taking 45-60 days.