Payroll factoring, also known as staffing factoring, is a method some businesses and staffing companies use to pay their employees. This financing option helps keep cash flowing when money is tied up in accounts receivable.

Think about it – a small or growing company needs lots of cash to run. However, invoice repayment terms can extend weeks or even months. During that time, expenses may surpass available cash reserves.

To cover payroll, some companies turn to staffing factoring. The company sells its invoices to a factoring payroll services provider for an upfront advance. An advance typically ranges between 80% and 90% of the total accounts receivable value.

-

Payroll Invoice Financing vs. Factoring

While payroll factoring has businesses selling their invoices to the factoring company, payroll invoice financing is a bit different. Though invoice financing is a solution for businesses in need of working capital, with this type of funding, the invoices aren’t sold off. Instead you’re borrowing money against your receivables.

Often, you’re responsible for collecting payment from your clients, not the financing provider. Additionally, you may be responsible for making payment installments to the lender while you’re waiting for your client to pay.

Alternatively, you may be able to repay the provider for the advance once your client pays you, minus any fees and expenses.

Related: Invoice Factoring

How Does Factoring Work When It Comes to Payroll?

Five basic steps go into invoice factoring:

- Send your customer the invoice. You must send your invoice to the customer, even if you plan to factor it. Typically, the repayment period must be 90 days or less to work as a factor.

- Appoint the invoice to the factoring company. You must designate that this is an invoice to factor, a practice known as spot factoring. With this type of arrangement, you select which of your invoices to factor. Alternatively, you can choose a conventional factoring plan, where all of your issued invoices are factored.

- Factoring company provides the advance. The factor will pay you a cash advance for the invoice(s). The percentage of the total invoice you receive will depend upon the terms of your factoring agreement. The remaining balance, known as the reserve, is held by the factor as security until the invoice is paid by your customer.

- Customer pays the factor directly. In most cases, you won’t be the middleman. Your customer will pay the factoring company directly for the outstanding invoice.

- Factoring company gives you the rest of the payment. Once your client has paid in full, you will receive the reserve from the factor — minus their fees. The fees from the factoring company are called a discount and will vary based on the lender and terms of the agreement.

As you can see, staffing factoring is straightforward. While companies pay a fee to receive this service, they secure peace of mind and quick funding.

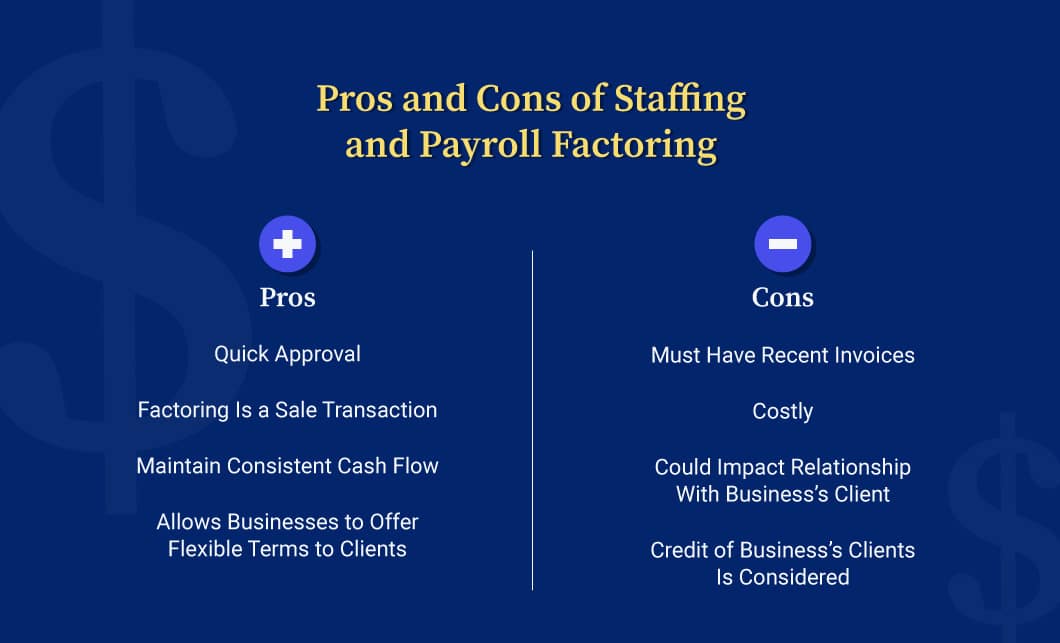

Pros and Cons of Staffing and Payroll Factoring

Here are a few advantages and disadvantages of staffing factoring agreements.

Pros

- Quick Approval: Payroll factoring providers can send funds to an approved applicant within a few days. A standard payroll loan is another option for companies short on cash, but this route could take months to come through.

- Factoring Is a Sale Transaction: Because payroll factoring means a business is selling its receivables to a factoring company, this type of funding isn’t considered debt.

- Maintain Consistent Cash Flow: The funding that payroll factoring companies extend allow many businesses to have the cash on hand they need to not only pay existing employees, but even hire new ones or invest in marketing campaigns to attract new talent.

- Allows Businesses to Offer Flexible Terms to Clients: Business clients are accustomed to having 30-60 days to remit their accounts payable. However, those terms can be a strain for a small business that needs to maintain weekly or biweekly payroll. Payroll factoring lets companies offer flexible payment terms to their clients.

Cons

- Must Have Recent Invoices: If you have invoices due in 30-90 days, consider a factoring system to obtain payroll funding. That said, the most desirable invoices for staffing and payroll factoring providers are newer invoices.

- Costly: The cost and rates associated with payroll invoice factoring are higher than you’d find with conventional loans.

- Could Impact Relationship With Business’s Client: Payroll and staffing factors take over collections. If care and discretion aren’t taken on their end, your clients could be left with a poor impression of your company.

- Credit of Business’s Clients Is Considered: Staffing factoring providers want to make sure they get paid, so your clients’ creditworthiness is an important factor they consider when evaluating your invoices for approval.

Payroll Factoring Companies

The following payroll factoring companies provide great options for companies looking into the service. Each has its unique advantages and disadvantages.

Allegiant Business Finance

Allegiant Business Finance is a payroll factoring company that can factor between $30,000 and $3 million. It provides an advance of up to 95% of the total invoice within 24 hours. This payroll invoice factor provides funds via Electronic Funds Transfer (EFT), so you don’t have to wait for a check.

FundThrough

FundThrough has been in operation since 2014. With FundThrough’s Velocity invoice factoring program, businesses with invoices can access $15,000-$10 million. (Invoice financing is also available from $500-$15,000.)

This provider will offer you the invoice amount less a 2.5% monthly fee for 1-30-day invoice terms. A rate of 3.75% applies for 31-45 days, 5% for 46-60 days and 7.5% for 61 or more days.

ECapital

ECapital offers invoice factoring for staffing solutions. The company provides up to a 90% advance rate, with up to $250,000 in funding available.

Funds are paid in as quick as 24 hours. In addition to staffing agencies, ECapital has a 3.5% fixed fee per invoice with rolling 1-month contracts.

Staffing Factoring as a Financing Option

Now that you’ve read our payroll factoring guide, if your staffing company is struggling to pay its bills even though it’s bringing in plenty of clients, consider staffing factoring as a financing option. A staffing factoring company can help you stay current with payroll and finance your human resource needs.