In most cases, the answer is no. Cash-back rewards from credit card companies typically aren’t taxable.

More often than not, the IRS views them as discounts or rebates. The same usually goes for loyalty points, travel reward miles and business rewards points you earned as a result of purchases you made.

There are just a few small caveats to keep in mind, however.

When Do Credit Card Rewards Count as Taxable Income?

When you haven’t spent a dime to earn a credit card or cash-back reward, you’ll owe taxes on the reward money. For instance, if you receive a $200 bonus simply for opening a new account, you’d be required to report that $200 as income to the IRS. In states where income taxes are filed, you might also need to report it on your state tax return.

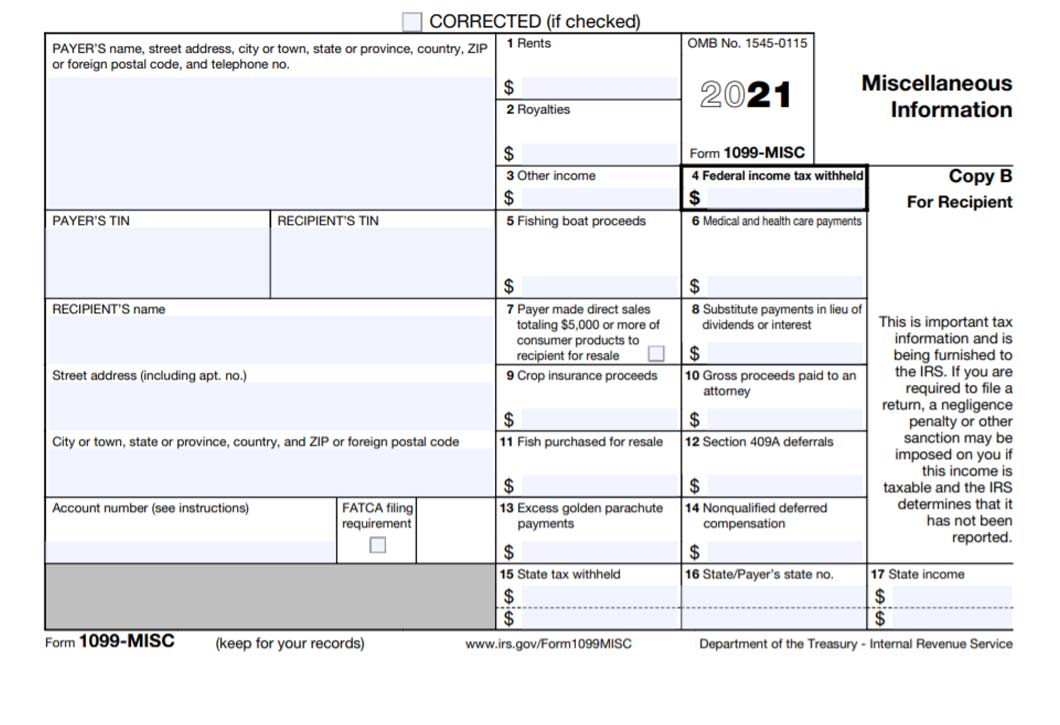

If your credit card company issues you a 1099-MISC (or 1099-INT in some cases) tax form, that’s also an indicator that your rewards were taxable. The Internal Revenue Service (IRS) requires a 1099-MISC to be filed if the income is more than $600. A 1099-INT must be submitted if there’s interest income of more than $10, often the case when you’re given a cash bonus for simply opening a new bank account.

When Are Credit Card Rewards Not Taxable by the IRS?

Now, let’s say you get approved for a credit card and the issuer offers a sign-up bonus: Spend $3,000 in your first 3 months and earn 50,000 miles. If you’re awarded the miles because you met the spending requirement, you’re in the clear.

Additionally, if your credit card offers points based on a percentage of your purchases and you can use those points as statement credits or to buy gift cards or use for travel, you don’t need to pay taxes on those rewards.

There also is no tax on credit card business rewards points you’ve earned with your spending that you decide to redeem for personal use instead.

-

Credit Card Rewards vs. Cash Prizes

While, in most cases, credit card and cash-back rewards aren’t taxable by the IRS, if you were to sign up for a contest and happened to win a cash prize, that would be considered income and would be taxable. You could think of it along the lines of winning the lottery.

Accounting for Credit Card Rewards

When you earn cash-back rewards from a purchase you make for your business and deduct the purchase as a business expense, things get a little tricky. That’s because in the eyes of the IRS, you received a discount on that purchase.

For instance, let’s say you earn 2% cash back on your credit card purchases. You buy a new work desk for $500, which earns you $10 in cash back. You’d only be able to deduct $490, or the $500 cost of the desk minus the $10 cash-back reward.

Along the same lines, if you used travel reward points to buy an airline ticket for a business trip, you’d only be able to deduct the net purchase. In other words, if you earned $200 in airline miles and your ticket cost $400, your allowable business expense deduction would be $200 – the $400 ticket price minus the $200 worth or airline miles.

In some cases, your credit card company will allow you to donate your rewards points to a charity. If that’s the case, you can’t deduct that as a charitable contribution for tax purposes. However, if you earn a cash-back reward and use that cash to contribute to a charity yourself, that could be deductible.

That said, be sure to keep records of credit-card rewards used for business expenses as well as receipts of purchases and charitable contributions.

Getting Started With Cash-Back Rewards

Whether you have a business credit card or a personal one, you’ll probably benefit from a cash-back reward or loyalty program at one time or another. In most cases, as long as you spend money to earn your reward, you won’t have to worry about being taxed for your bonus.

Still have accounting questions when tax season rolls around? Don’t hesitate to consult a tax professional.