If you’re looking for cash for an investment into your business that will span several years, a long-term loan can help you get the funds you need to meet your goals.

Long-term business loans are a type of financing meant to be repaid in years, not months. Terms can extend 5, 10 or 25 years, depending on the loan type and lender, and payments are often monthly.

When Would a Business Need a Long-Term Loan?

Small business long-term loans are meant to support long-term objectives, such as:

- Hiring staff

- Renovations

- Expansion projects

- Business purchases

- Debt refinancing

- Equipment purchases

- Site improvements

- Construction projects

- Real estate purchases

Best Long-Term Business Loans

The best long-term business loan for you will depend on your needs and preferred repayment terms and timeline. Here are several types of long-term loans to consider.

Bank Term Loans

Bank term loans are one of the most competitive long-term loans when it comes to interest rates and repayment terms. However, they’re also one of the most challenging loans to qualify for, with applicants needing a high credit score and significant time in business for approval.

Additionally, the application and funding process can take weeks or months, and collateral is often required to secure the loan.

Nonbank Term Loans

If you don’t qualify for a bank term loan or need money in a pinch, consider long-term loans from nonbank lenders. Nonbank term loans are offered through alternative lenders who are willing to take on more risk. In exchange, they typically offer higher interest rates and more frequent payment installments.

Nonbank term loans are often unsecured, meaning you do not need to provide collateral to secure the loan, though a personal guarantee is usually required.

Need a loan fast? Compare offers today!

SBA Loans

These are loans offered through lenders that partner with the Small Business Administration (SBA), a federal government agency. Depending on the type, repayment terms can range from 5-25 years.

The SBA guarantees a certain percentage of each approved loan — up to 90% in some cases. With the SBA’s assurance, these long-term business loans present less risk to lenders. As a result, borrowers who’ve been denied conventional bank loans may qualify for SBA loans.

The following are a couple of the SBA’s most popular loan programs.

SBA Standard 7(a) Loans

One of the best loans for a long term is the SBA 7(a) program. It has repayment terms ranging from 7-25 years, with loan amounts of up to $5 million. The SBA guarantees up to 85% of these loans up to $150,000 and 75% for loans greater than $150,000.

The time to funding for this type of long-term business loan can range from 60-90 days.

SBA Express Loans

If you’re looking for a long-term loan that can be fast-tracked, consider an SBA Express loan. Repayment terms range from 5-10 years, and approval and funding for these loan types can be as quick as 7 days post-approval.

The trade-off is usually a higher interest rate than you’d find with a 7(a) loan and lower loan limits, with a maximum loan amount of $500,000. The SBA guarantees 50% of these loans.

Equipment Financing

If your needs are specific to equipment, consider equipment financing. With equipment financing, the length of your repayment term generally doesn’t exceed the useful life of the equipment you’re acquiring.

Business Lines of Credit

When you’re approved for a business line of credit, a lender grants you a specific credit limit that you can tap into as needed.

Like a credit card, you don’t have to use the line right away. You can wait until you need funds, and even then, you don’t need to use your entire credit limit. Lines of credit can remain open for several years.

Most business credit lines are revolving, meaning as you pay down your debt, your credit line increases accordingly, up to your original credit limit.

Long-Term Business Loan Interest Rates

Long-term business loan interest rates vary depending on different factors, such as lender, loan type, loan amount and borrower credit history.

Term loans serviced by banks are often the most competitive, with interest rates ranging from 2%-13%, according to Forbes.

The maximum variable interest rate that lenders can charge for SBA 7(a) loans ranges based on the loan amount and repayment term, from the prime rate (7.5% as of Dec. 15, 2022) plus 2.25% on the low end to prime plus 4.75% on the high end. The former rate is for loans of $50,000 or more that mature in less than 7 years. The latter is for loans of $25,000 or less with a maximum maturity of more than 7 years.

Term loans serviced by alternative lenders tend to have higher interest rates. Long-term loan interest rates offered through our lending partners at Fast Capital 360, for example, start at 7% and go into the double digits.

Business line of credit interest rates can be found as low as 5%-8%, though it’s not uncommon to see significantly higher rates too, depending on the lender, loan amount and creditworthiness. You can find many equipment loans with interest rates starting in the single digits, at 8% in some cases.

Estimate your payments on a long-term business loan using our financing calculator.

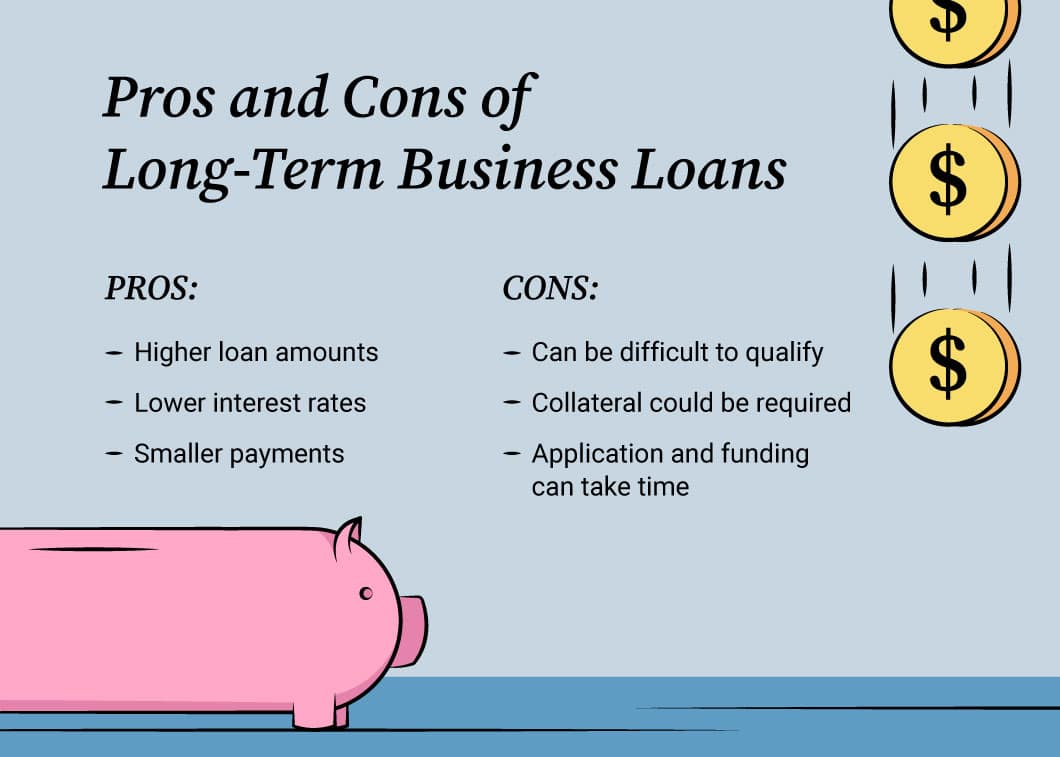

Advantages of Long-Term Loans for Businesses

Whether you’re seeking small long-term loans or large ones, the main advantage is that your payments are spread out over a longer period of time.

Additionally, long-term business loans usually have lower interest rates. This typically equates to smaller, more manageable payments than you’ll likely find with a shorter term loan.

Often, long-term loans also have higher approval amounts than short-term loans.

Disadvantages of Long-Term Business Loans

While long-term loans for small businesses have their benefits, they also have drawbacks.

For instance, these loans can be difficult to qualify for, with applicants often needing a couple of years in operation to be considered.

Also, the application process can be lengthy, and, once approved, funding disbursements can take some time. As such, they’re not the best options for business owners in a rush for capital.

Additionally, some lenders may require collateral. For example, a borrower may have to pledge real estate, vehicles or inventory to secure the loan.

Where to Find Long-Term Business Loans

When you’re looking for a long-term small business loan, you have options. You can walk into your local brick-and-mortar bank or credit union. Or you can search online for lenders offering financing that matches your needs.

To obtain a long-term small business loan through conventional banks and credit unions, you’ll undergo a lengthy application and approval process. You’ll be required to submit a slew of documents, including a business plan.

With alternative, nonbank lenders, you can usually apply for financing by simply providing several months of bank statements. The trade-off for simplicity and speed is usually a higher interest rate and condensed repayment terms.

Additionally, banks, credit unions and alternative lenders will require you to meet specific requirements, including minimum time in business, annual revenue and credit score, which will vary by lender and loan type.

For example, at Fast Capital 360, term loan requirements include at least 1 year in business, annual revenue of $200,000 or more and a credit score of at least 600.

Other lenders offering long-term business loans include:

- Credibly: SBA loans with a minimum of 2 years in business, $100,000 in annual revenue and 620 or higher credit score; non-SBA loans up to $250,000 with 2 years repayment terms are also available

- SmartBiz: SBA loans as well as term loans up to $500,000 with terms up to 5 years for businesses with 2 or more years in business and a credit score above 660

- Bank of America: Secured business loans from $25,000 up to 4 years when secured by business assets; requirements include at least 2 years in business and $250,000 in annual revenue

Keep in mind SBA loans are provided by approved lenders that partner with the SBA. Find a participating provider near you.

Find a loan that’s right for you.

Business Long-Term Loans vs. Short-Term Loans

Besides the apparent difference in term length, what other factors differentiate long- and short-term business loans? Here’s a brief overview:

| Long-Term Business Loan | Short-Term Business Loan | |

| Best Loan Uses |

|

|

| Term Length | Can range from a few years to 5, 10 or 25 years in some cases | Often 3-18 months |

| Repayment Schedule | Often monthly | Often daily or weekly |

| Ease of Approval | Harder to qualify | Easier to qualify |

| Speed to Fund | Bank and SBA long-term business loans can take weeks to months to fund; online lenders can fund within days | Can be available within a day of approval with online lenders |

Questions to Ask Before Getting a Long-Term Business Loan

Before you get a long-term business loan, ask yourself a few questions:

- How much funding do I need?

- How fast do I need funding?

- How much of an installment payment can I afford?

- What will the loan repayment terms look like?

- What is the lender’s rating on popular rating platforms, such as the Better Business Bureau, Google and Trustpilot?

Use this information to help you decide which long-term business loan and lender is right for you, and consider these closing words from Warren Buffett, who made his fortune by wisely investing his time, money and efforts. “We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.”