Your business credit score can make or break your ability to secure financing. Find out how to check your business credit and learn about the following:

- What a business credit report is

- What makes up your business credit score

- How to use premium and free resources to check your business credit

What’s Your Business Credit Score All About?

Similar to a personal credit score, a business credit score is a number that measures your company’s creditworthiness. It lets lenders know how much of a credit risk you represent and gives them insight into the following:

- How long you’ve been in business

- What your company earns

- How much you owe

- How well you repay what you owe

- Whether you have any bankruptcies, liens or lawsuits against your business

This information helps lenders evaluate how much you can afford to borrow and how likely you are to pay it back, helping them decide whether you’re a good credit risk.

How to Check Business Credit Scores

To check your business credit, there are 2 main resources you can use:

- Major credit reporting bureaus, which may charge a fee

- Secondhand business credit reporting resources, which compile information from the major credit reporting bureaus and offer it for a fee or for free as part of a purchased package

Where to Find the Best Business Credit Reports

When you’re looking to check your business credit score, it’s best to go straight to the source. Here are the 3 main credit reporting services:

- Dun & Bradstreet’s PAYDEX

- Experian Intelliscore Plus

- Equifax Business Payment Index

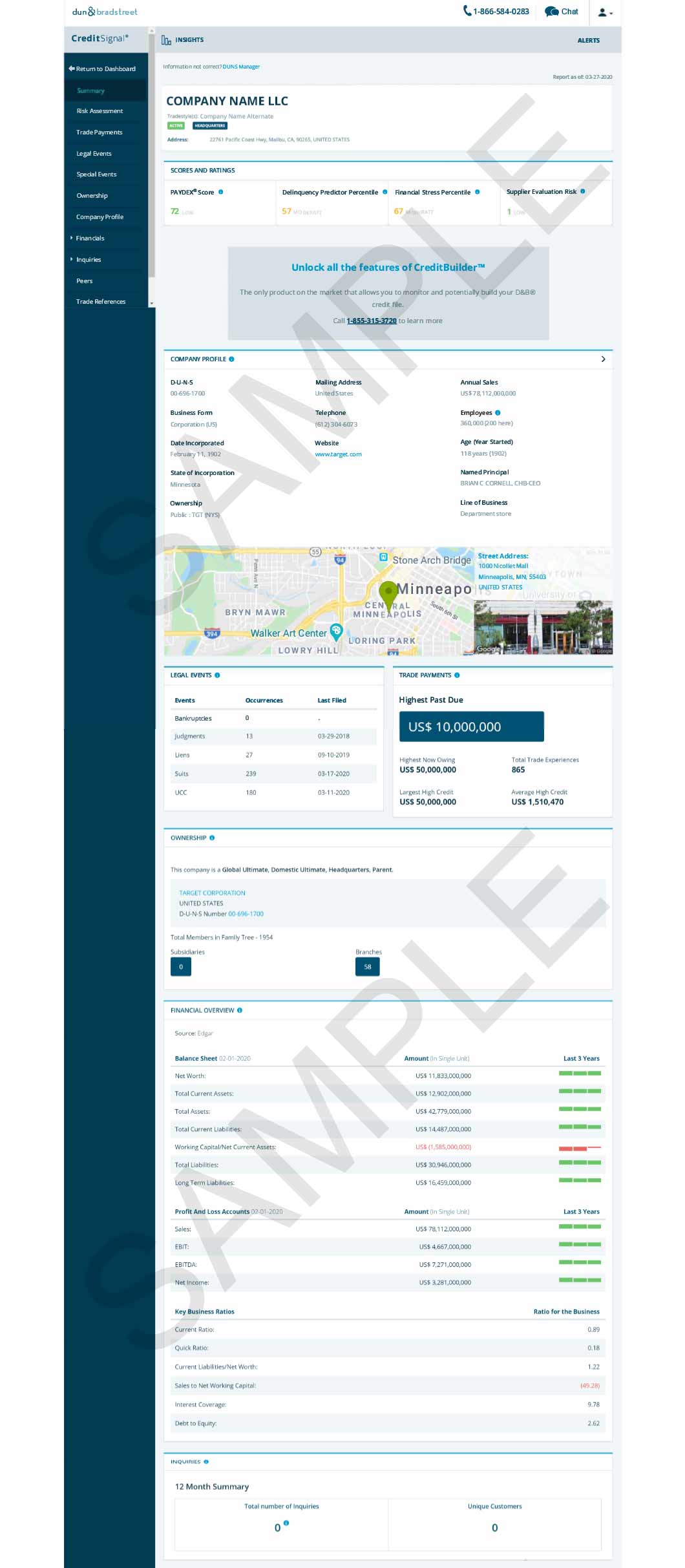

Dun & Bradstreet PAYDEX

Dun & Bradstreet’s PAYDEX scoring service offers one of the best business credit reports. It measures a company’s past payment performance on a scale of 0 to 100, and scores are indexed using an identifying system known as D-U-N-S Numbers.

The score indicates how often a company pays its suppliers and vendors on time. A higher number indicates a likelihood of paying bills on time.

A good PAYDEX score, one that is considered the lowest risk, falls between the 80-100 range. You can see your PAYDEX score by accessing a business credit report from Dun & Bradstreet.

The company offers a free credit reporting service called CreditSignal as well as several other credit reporting products you can purchase.

To register for your report, provide your name, business name, location and email address. You’ll also need to agree to the company’s privacy policy and product license agreement.

Use any of the following to check your business credit score:

- Credit Signal: View 4 of your business credit scores, including PAYDEX, free for 14 days

- CreditSignal Plus: Get alerts of business credit score and rating changes for $15 a month

- CreditMonitor: Real-time monitoring of your Dun & Bradstreet scores and ratings for $39 a month

- CreditBuilder Plus: Unlimited access to your credit score along with detailed reporting information for $149 a month

- CreditBuilder Premium: For $199 a month, get the same features as the Plus plan in addition to information reports for up to 10 businesses.

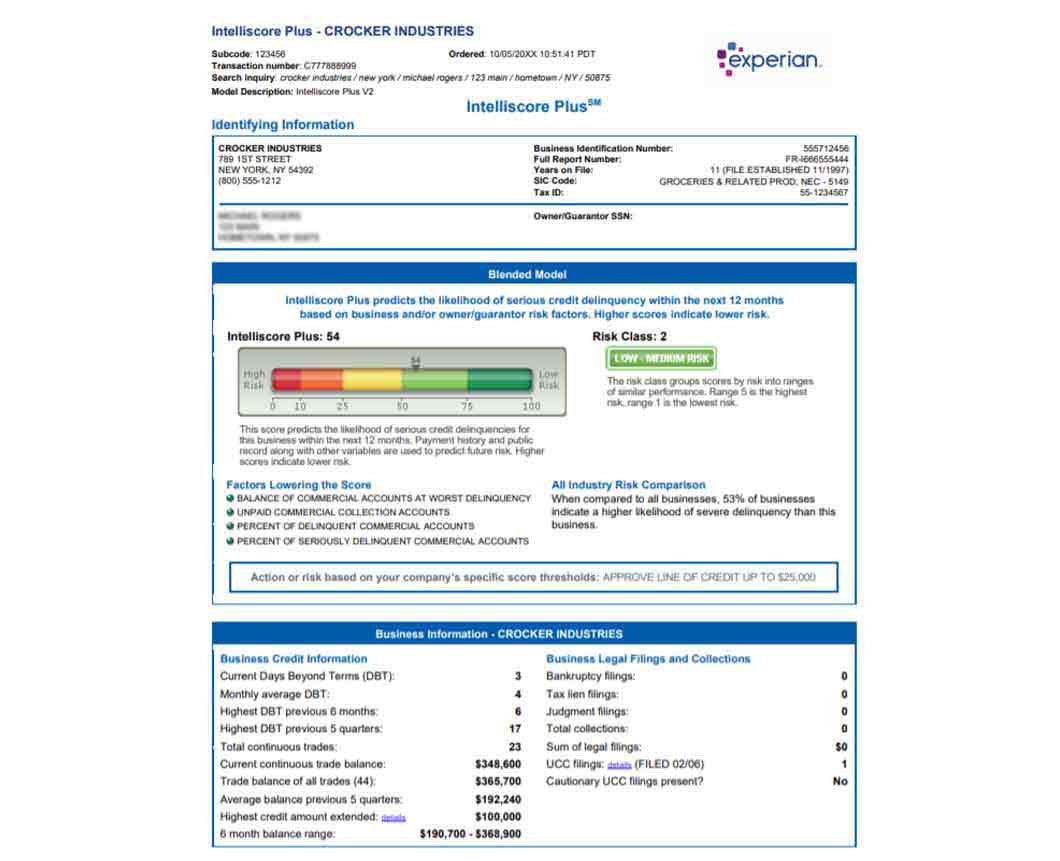

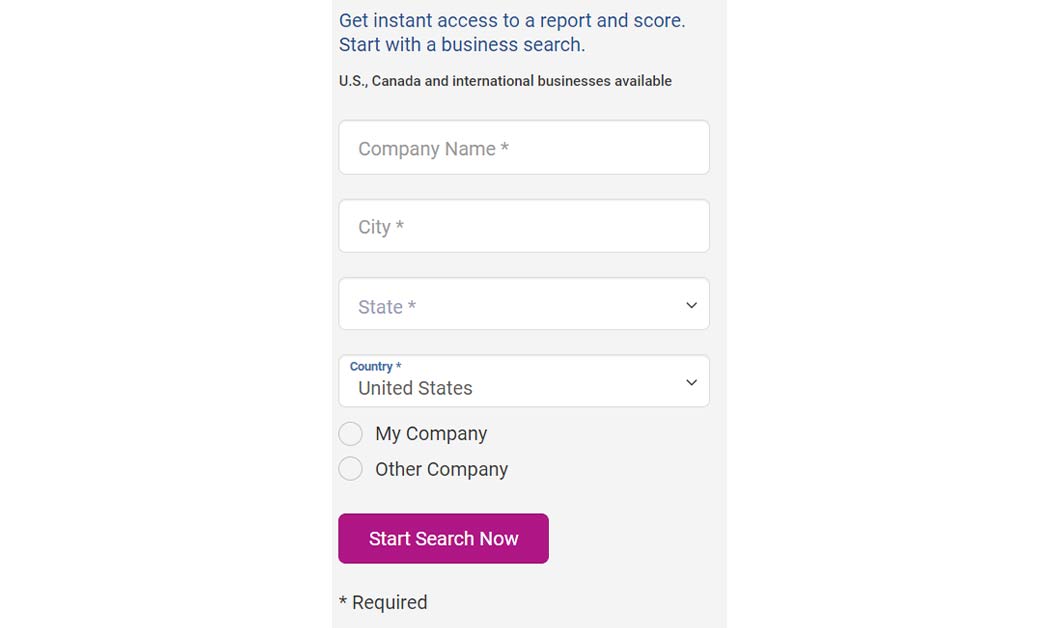

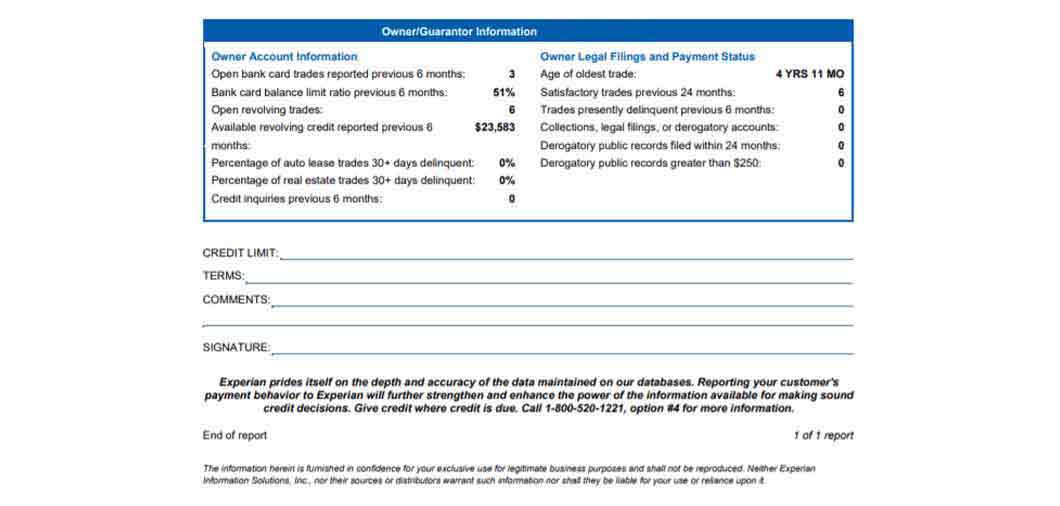

Experian Intelliscore Plus

To access a business credit report on Experian, you’ll need basic information, including the company name, city and state. Once you confirm your business and location, you’ll need to register for your report by creating an account. At that time, you’ll be required to create a password and provide billing information for your credit report purchase.

The credit-reporting firm’s business scoring service is called Intelliscore Plus. It uses a scale of 1 to 100 to assess a company’s risk of becoming delinquent on its payments in the next 12 months. If you have an Intelliscore in the 76-100 range, you’re considered low risk.

Intelliscore Plus users can choose from a couple of risk assessment options when checking their business credit score:

- Data based on a company’s commercial information, including payment trends, public record filings, collections and business background

- Blended data combining company information with the business owner’s personal information, which offers a more complete risk assessment

To analyze this data, Intelliscore Plus uses more than 800 variables. You can purchase Intelliscore Plus data in a number of formats:

- Summary report on a single company for $39.95

- Detailed profile on a single company for $49.95

- Subscription to ongoing updates and score improvement recommendations for a single company for $189 a year

- Subscription to data on up to 30 reports a month for $249 a month or $1,495 annually

Equifax Business Payment Index

Equifax uses the following business credit scoring systems. You may order a single Equifax business credit report for $99.95 or 5 for $399.95.

Payment Index

This is a dollar-weighted evaluation on a scale of 0 to 100 of a company’s payment performance.

If you are consistent with your bill payments, you’ll likely have a score between 90-100, by which you demonstrate your stellar credit history to lenders.

Though it’s not the end of the world, you could fall into the 80-89 score range with 1 payment made 30 days after the due date.

Business Credit Risk Score

This score predicts the likelihood of a business becoming delinquent on payments during the next 12 months on a scale from 101 to 992.

Typically, a score above 566 is considered acceptable, with lower risk as the score increases. A business credit risk score of 0 means the business experienced a bankruptcy.

Business Failure Risk Score

This score evaluates the likelihood of a business facing bankruptcy in the next 12 months on a scale from 1,000 to 1,880.

The higher the score, the lower the risk, and up to 4 reason codes to support the score are provided. A score of 0 indicates a bankruptcy on file.

Secondhand Business Credit Reporting Resources

You can also obtain business credit reporting data from secondhand sources. Some provide the data for free or as part of a premium package. Others may charge a fee.

FICO’s Small Business Credit Score System

One way to obtain your FICO Small Business Credit Score System (SBSS) score is to apply for a business loan.

Lenders often use SBSS scores when considering SBA loan applicants. They may request a customized SBSS report and include your FICO small business credit score with your loan documents. You can also obtain your SBSS score from third-party sources.

FICO’s SBSS score pools data from the business credit bureaus, including Dun & Bradstreet, Experian and Equifax, as well as data associated with your personal credit score. Credit scores range from 0 to 300, with 300 being the best score.

An SBSS score of at least 180 is ideal. That said, it has been reported that the SBA requires a minimum of 155, with many SBA lenders requiring applicants to have a minimum of 160-165.

Other Free Business Credit Check Resources

A number of providers offer secondhand access to some of your business credit data as a free service, as a benefit for a premium service or on a free-trial basis.

With some providers, you’re able to access scores and reports. With others, you’re only privy to overviews and alerts to credit report updates.

Some providers of business credit data include:

- Creditsafe, which provides free access to your score and report

- Credit.net, which offers free access to your report on a trial basis

- Nav.com also offers free access to business credit scores

What’s in a Business Credit Report?

Different business credit reports include varying details. In general, though, you can expect to find the following information.

- Basic details about your business:

- Company name

- Contact information

- Names of any parents or subsidiaries

- Names of key personnel

- Type of company

- Year the company was founded

- Years in business

- Number of employees

- Annual revenue

- Financial information about your interactions with banks, creditors and suppliers, such as the following:

- Account balances

- How long you’ve held accounts

- Payment history and terms

- Past due accounts

- Legal information about actions:

- Bankruptcies

- Liens

- Judgments

- Collections

When to Check Your Business Credit Score

Several occasions call for checking your own company’s business credit score:

- When you want to see if you meet a lender’s minimum credit score requirements

- When you’re trying to attract investors

- When you’re negotiating with a potential supplier

- When you’re preparing to sell your business

It’s prudent to anticipate these types of occasions by proactively checking your business credit score and taking steps to improve it.

Additionally, some occasions may call for checking another company’s business credit score:

- If you’re extending credit to a business-to-business (B2B) customer and evaluating creditworthiness

- If you’re considering an acquisition of another company

How to Improve Your Business Credit Score

After checking your credit score you realize you don’t have the best business credit report. What can you do?

The good thing is, you can take a number of proactive steps that can improve your business credit score.

- Schedule automatic bill payments to ensure you pay debts on time.

- Lower your credit utilization ratio by keeping your spending at 25% or less of your credit limit.

- Use a business credit card or business loan that gets reported to the bureaus and make payments on time.

- Review your business credit report for errors and contact credit bureaus to remove any inaccurate or outdated items.

- Contact Dun & Bradstreet to make sure they’ve assigned you a D-U-N-S Number to index your business in their tracking system.

Manage Your Business Credit Score to Help Your Company’s Financing

By checking your business credit score and taking steps to improve it, you increase your company’s odds of securing a loan, line of credit or other form of business financing.

If you’re looking to acquire capital for your business or trying to diversify your credit mix, be sure to check out Fast Capital 360’s line of business financing options.