Bookkeeping is an essential activity for every business. The practice keeps you organized while providing a direct look into the health of your cash flow.

There are plenty of professional bookkeeping systems available, though some businesses may not need the advanced features. If you run a small business with a low volume of transactions, the free accounting software in Excel may be all you need to keep your books in order.

What Are Excel’s Bookkeeping Abilities?

Although spreadsheets appear to be rigid, Excel provides a great deal of flexibility. Through its combination of pre-populated formulas and custom calculations, Excel is an excellent bookkeeping spreadsheet tool.

Here are some of the software’s best features:

- Templates: Excel comes pre-populated with templates, offering your business bookkeeping essentials including sheets to keep your invoices straight, budgets in order, receipts organized and business statements up to date. The templates themselves can be customized to fit your business’s unique needs.

- Macros and Formulas: No matter how on point your math skills, you run the risk of error if you’re handling calculations manually. You can take advantage of Excel’s built-in calculations and macros to do the math for you. From simple summations to complex tax calculations, the possibilities are near limitless. You can also create and save your own formulas.

- Data Visualization: There’s more to Excel than entering numbers and transactions into columns and rows. The software helps you bring bookkeeping data to life through bar graphs, pie charts and pivot tables. Visualizing your data makes it easier to digest how your business is performing and simpler for others to understand.

- Integration: Excel is compatible with many accounting software packages. With just one click, you can import and export your data to get a better grasp of your finances.

Single Entry Bookkeeping

Excel’s free accounting software is best for owners who run smaller, more straightforward businesses. The program’s simple accounting spreadsheets produce basic income statements by factoring income and losses.

What Is the Single Entry Bookkeeping Method?

The definition of single entry bookkeeping is a transaction that is entered once and either categorized as an expense/loss (money leaving your business) or as profit/income (money coming in).

This style of bookkeeping is designed to produce an income statement for a certain amount of time, recapping your income and expenses. In short, it helps you see whether your business is earning or losing money.

Conversely, double-entry bookkeeping is meant for larger, more intricate businesses, recording both the debit and credit side of each transaction.

How to Make a Single Entry Bookkeeping Excel Template

Learning how to make a ledger in Excel is simple.

- Create a new Excel document.

- Beginning with the second row, merge columns A through F. Don’t merge any cells in the third row. In row four, merge columns B through D; drag or copy this combined group of cells through row 40.

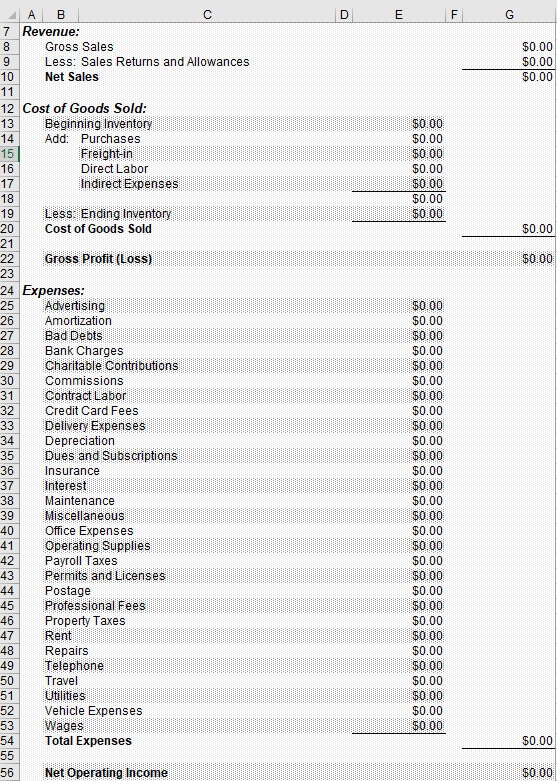

- Next, we’ll be adding the different elements of the income statement framework. In bold, include Date Range, Revenues, Total Revenues, Cost of Sales, Total Cost of Sales, Gross Profit, Expenses, Total Expenses and Net Profit.

- Now you’ll need to create the formulas that reside in column F. To the right of Total Revenue, Total Cost of Sales, Gross Profit, Total Expenses and Net Expense, insert the following formula: =SUM(EXX:EXX)*

Some of these formulas will tally up single categories like Total Revenue and Expenses, while Gross and Net Profit will be dependent on each of the other elements having already been completed.

The XX’s in the formula above are representative of the numerals you’ll need to add in to find the total of each section.

After following these instructions, you should end up with an income statement template that looks like this.

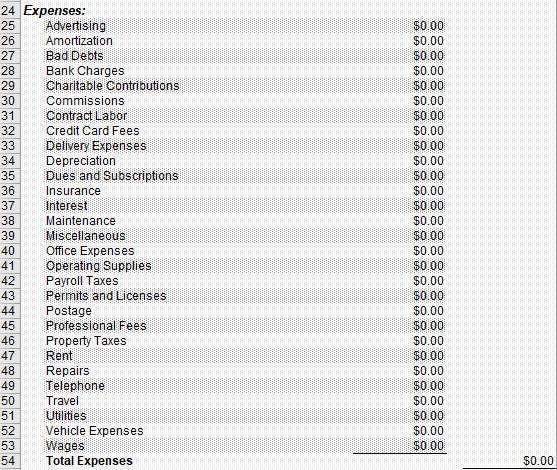

Your bookkeeping template should also include a list of every category that could be associated and applied to your business. Business meals, for example, would be its own category, defined as a type of expense with a brief description of “meals with clients.”

The third and final sheet of any single entry bookkeeping template is the Transactions tab. Here, you’ll input the Date, Description of the Transaction, Amount and Category. By downloading a free accounting template in Excel format, many of these categories will be pre-populated in a convenient dropdown menu.

These single entry templates contain everything necessary to enter and categorize transactions and generate income statements. Each of your transactions is recorded onto a single sheet, accounting for all income and expenses. A summary is then generated using the information from the income statement.

-

Small Business Tip: What Are the Parts of an Income Statement?

Your income statement profiles your net income, minus any expenses. Of course, there are a few elements that dictate how this is determined. To help you see through the fog, we put together this quick guide to mastering the income statement.

How to Update Your Simple Bookkeeping Template

Updating your books is an essential part of keeping your finances in order. To do this, you need to understand how to log everything into Excel.

How to Keep Track of Business Expenses and Income in Excel

After you’ve arranged your business’s income statement template to fit your needs, you’ll need to both input and categorize your financial activity in the Transactions tab.

Whenever a transaction takes place, simply record it in its own row within the Transaction sheet and match it with its corresponding category. Here’s how an item would be entered.

- Produce a saved record or receipt of the transaction. This record could be a credit or bank card statement, cash receipt or other proof of an online transaction.

- Using DD/YY/MM format, record the date the transaction occurred in the Date column.

- In the Category column, organize the transaction according to your business’s Income Statement standards.

- In the Description/Transaction column, add any notes that will help you contextualize the transaction.

Your income sheet should have all the data required to encapsulate your bookkeeping for a given time frame at the end of every month. Make sure to keep the Income Sheets separated and organized by month. It’s recommended that you make a copy of each income sheet at the end of the month. Your accountant will need to review your income sheets for the year; they’ll also be useful for future projections.

Free Bookkeeping Template

The simple bookkeeping template we’ve created and used throughout this piece is available for download. We hope it’s both useful and convenient for your business’s accounting needs and becomes a significant small business resource. If you ever find that your bookkeeping needs have evolved beyond the single entry method, Microsoft offers many Excel templates for small business that could solve whatever challenges you’re faced with.