Are you looking to set up a recurring payment system for your business?

We’ll explain what recurring payments are, how they can help your business and how to set them up. We’ll also go over what to keep in mind when using a recurring payment system.

What Are Recurring Payments?

Recurring payments are automatic deductions a business makes from a customer’s banking or credit card account based on an agreed-upon schedule.

Why Should a Business Set Up Automatic Payments?

Automatic customer billing is more convenient for both customers and business owners. Your customers won’t have to bother making payments every month and will enjoy an uninterrupted supply of goods or services. For you, the business owner, accepting recurring payments saves time and helps guard against cash flow interruptions. In addition, with automatic payments, you don’t have to create new invoices every month and spend time pursuing late payments.

How Do Recurring Payments Work?

First, you’ll have to find a payment service provider that has a recurring payment feature and set up an account with them.

After it’s been integrated into your system, customers will be able to enter their banking information on your site. The account they entered will be used to deduct charges every time they reach the cut-off period.

-

About the Cut-Off Period

The cut-off period can be set by the business owner or left up to the customer. For example, some businesses bill their customers on an annual basis. But sometimes, they let their customers decide if they want to pay on a monthly, a 6-month or a 12-month basis.

All transactions happen electronically. There’s no need for the customer to pay with cash.

The payment service provider will handle the back end of the operation, meaning they will process and deposit payments to your account. Keep in mind that payment service providers typically take a processing fee off the transaction. This is how they usually earn a profit.

The recurring payments will continue until the customer decides to discontinue them.

What Kinds of Businesses Use Recurring Payments?

Businesses that regularly supply products or services usually accept recurring payments. Some of these businesses include the following:

- Subscription-Based Businesses: You’ll need recurring payments if you have products that you need to deliver regularly. Businesses that fall under this category include magazine subscriptions, web hosting, subscription boxes (such as Birchbox or Blue Apron), entertainment services (such as Netflix or Hulu) and online tools (such as Ahrefs or Grammarly).

- Service Providers: You can use recurring payments if you offer routine services to customers at regular intervals. For example, if you provide the same lawn mowing, housekeeping or day-care service from month to month, recurring payments can take some of the hassles out of payment collection.

- Gyms, spas, clubs, etc.: If you own or operate an organization that requires members to pay monthly dues, you can set up a recurring payment scheme so your guests can come in and out without having to wonder if they’ve paid their fees or not.

- Financial Institutions: If you are in the business of loaning money, you can let your customers pay their fees automatically so they won’t have to worry about late payment penalties.

How to Set Up Automatic Payments

The process to set up recurring payments will be slightly different according to your service provider. However, most business owners complete the following general steps:

- Create an account with a service provider

- Select the action you want to take (e.g., “Create an invoice” or “recurring payments”)

- Enter your customer’s information

- Select the customer’s payment method and payment date

Here are some of the top service providers for recurring payment processing. Let’s go through how to set up automatic payments for each provider.

PayPal

According to its website, a PayPal business account allows small businesses to set up automatic payments and manage them, while PayPal handles customer communications and billing. If you use PayPal to accept recurring payments, you’ll pay about $40 per month for recurring billing and a recurring payment tool. You’ll also have to pay a 2.9% plus 30 cents fee per credit card transaction.

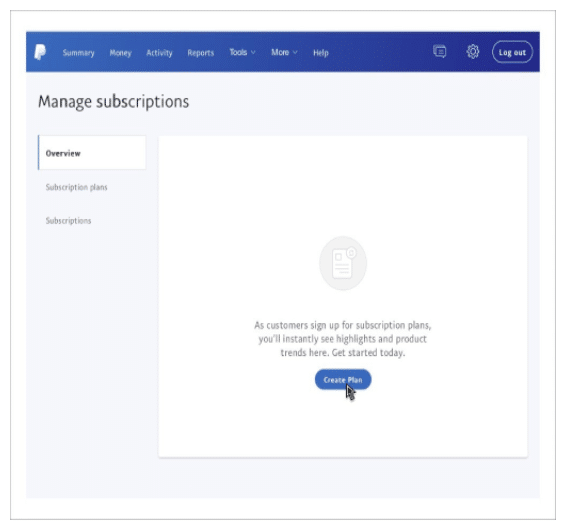

1. Log in to your account. Then go to the “Manage Subscriptions” page and select “Create Plan.”

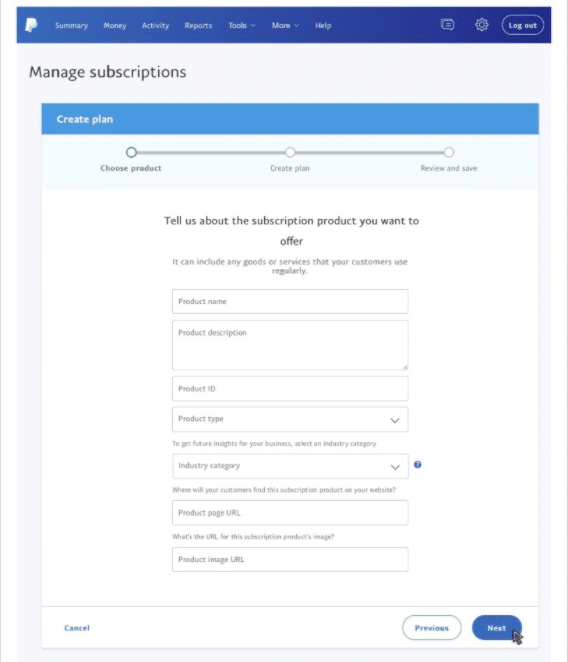

2. Enter the information about the product or service the subscriptions cover.

3. Choose a “fixed pricing” or “quantity pricing” plan.

4. Create the customer-facing subscription plan name (e.g., piano lessons) and a plan description, which is only internally visible.

5. Set the pricing and tax rate for your automatic customer billing.

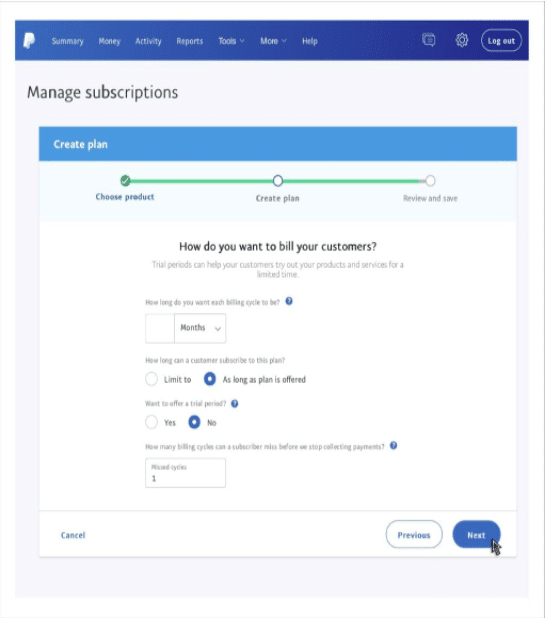

6. Set up the recurring payments’ frequency and how many billing cycles are in a subscription period. You can also choose to include a trial period for customer subscriptions.

7. Review your plan’s details and confirm everything’s accurate.

8. Click “Turn on Plan” to activate automatic customer billing.

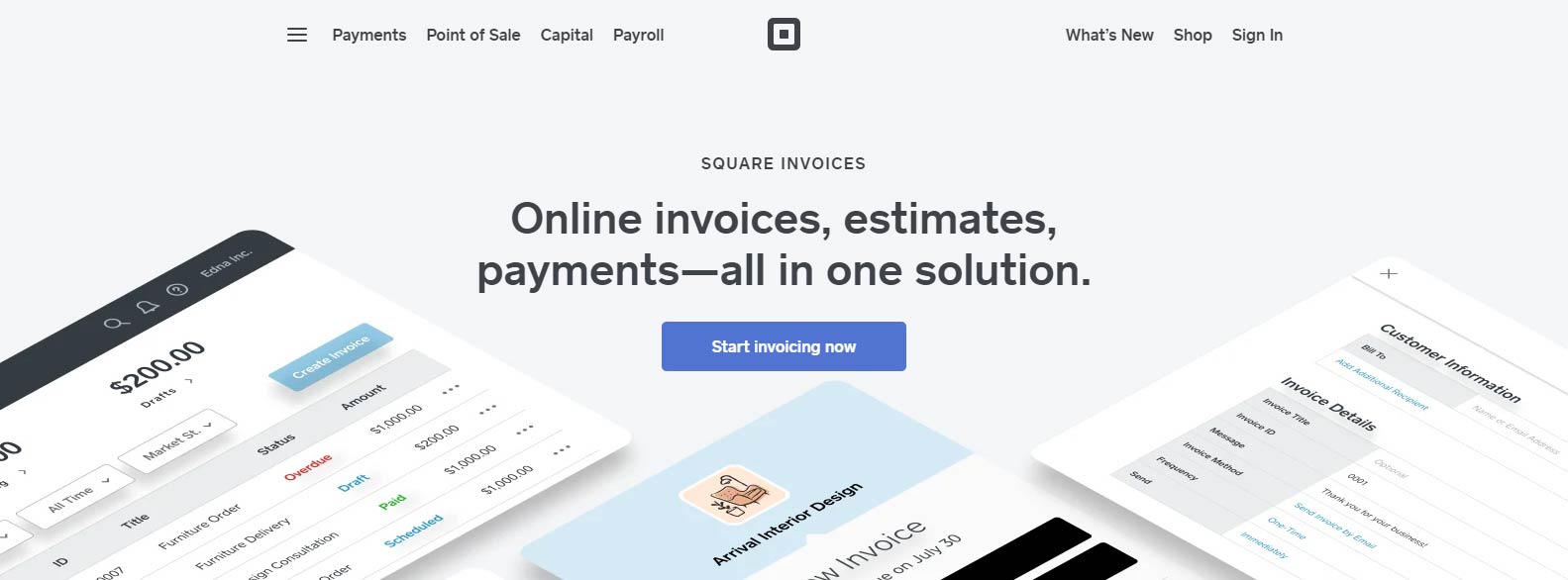

Square

Square is among the best recurring payment processing providers. Square Invoice is free, but you’ll have to pay 3.5% per transaction along with a 15-cent transaction fee.

You can also access additional services, including discount codes in an invoice and a tipping feature.

Here’s how you set up recurring payments using Square:

1. Go to your main dashboard, click “Invoices” in the sidebar. This will direct you to the Invoices page.

2. Under the “Invoices” tab, select “Create Invoice.”You’ll be redirected to the Customer Information page. Here you can select the customer and add additional details.

3. Enter the customer’s name and email. If the customer is already in your directory, simply select their name. If your customer has already saved their payment details, you can choose which card to use for recurring credit card (or debit card) payments under “Invoice Method.”

You can also send the invoice by email.

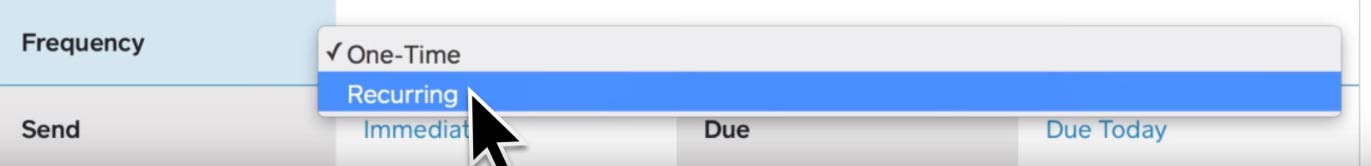

4. Select whether the payment is a 1-time transaction or recurring under “Frequency.”

5. Fill out all the details and click “Schedule” to finish.

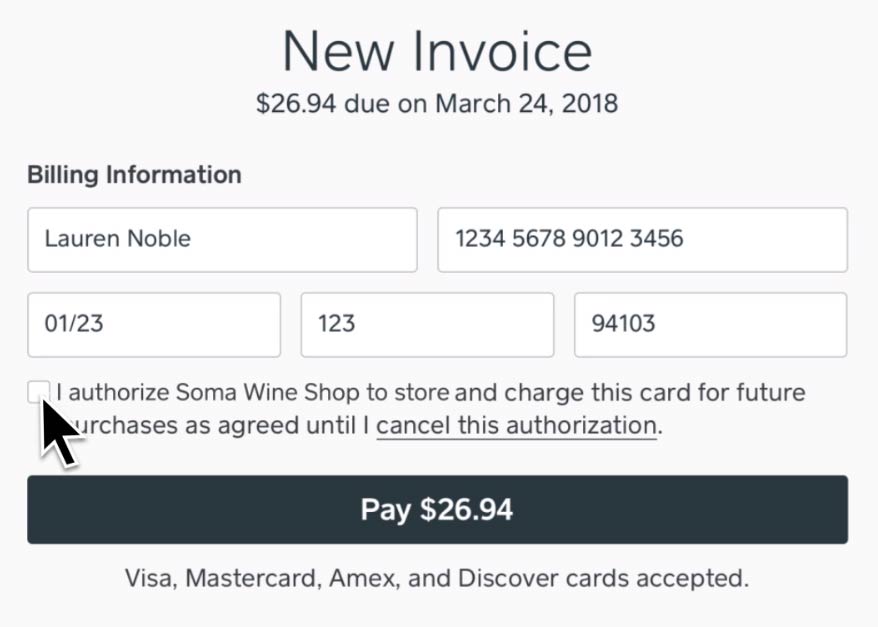

Note: How do you get a client to save their information for recurring credit card payments? The first time you send your customer an invoice using Square, you can add an option for customers to save their cards on file. When that customer processes the payment, they can click the box that authorizes future automatic payments.

Stripe

Stripe, a competitor of Square, offers a recurring billing feature for businesses. Like Square, Stripe doesn’t have a monthly fee, but it does charge 2.9% plus 30 cents per transaction, as well as an additional 0.5% fee for recurring payments.

The Stripe recurring payment app easily integrates with your business’s software. Here’s how to set up recurring payments for Stripe.

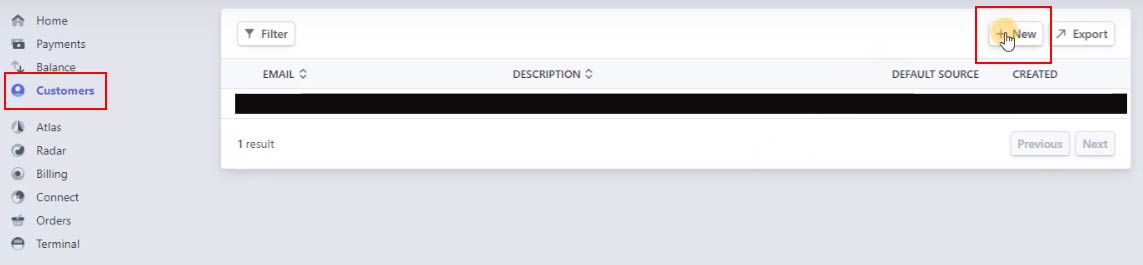

1. Create a customer file if you don’t have a customer in your directory yet. In the main dashboard, click “Customers” in the sidebar.

2. Enter your customer’s information in a pop-up window.

3. Once you’re finished, click “Create Customer.”

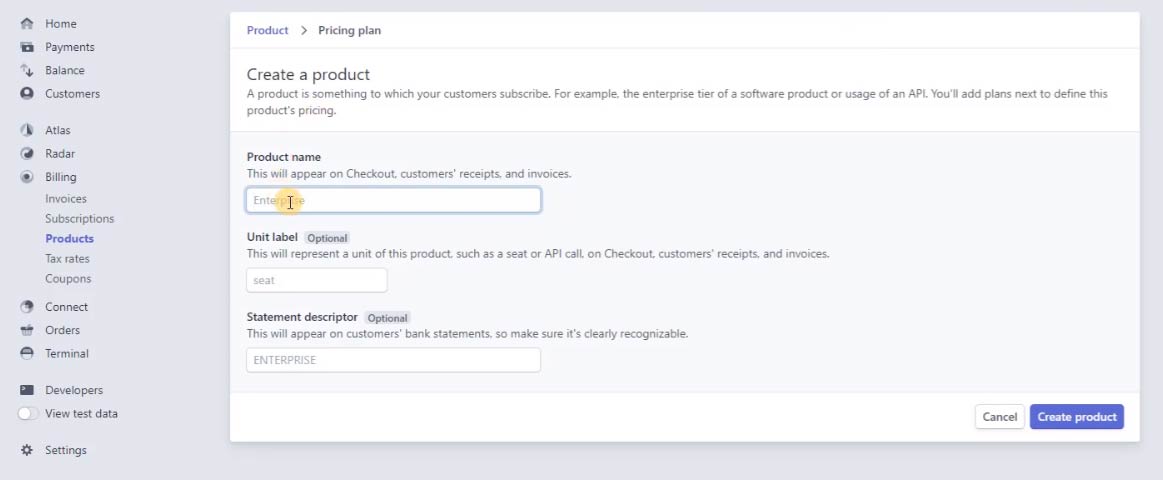

4. Then go to “Billing” and “Product,” then “New.” Here you can add a product, if necessary.

5. Add all the necessary details and click “Create Product” when you’re finished.

6. Next, enter the pricing information for the product or service. You can also specify if the payment is a recurring quantity or metered and set the frequency of which the customer is billed.

7. Click “Add Pricing Plan.”

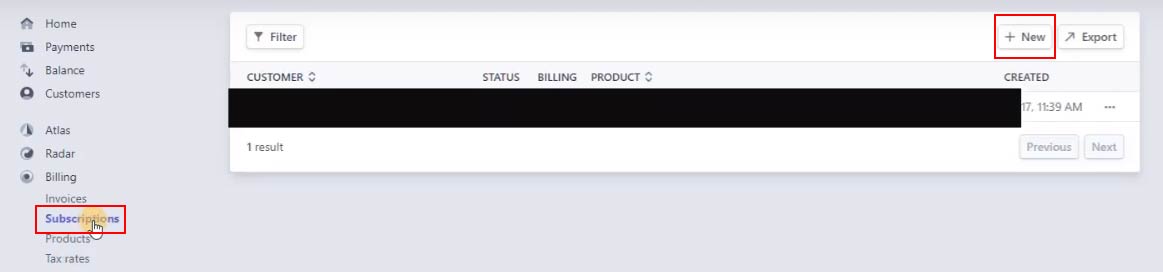

8. Then go to “Billing,” “Subscriptions” and then “New.”

9. Under “Select a Customer,” click on the customer you added. Fill in all the fields under customer information.

10. Click “Add a Product” and select the product that the customer ordered.

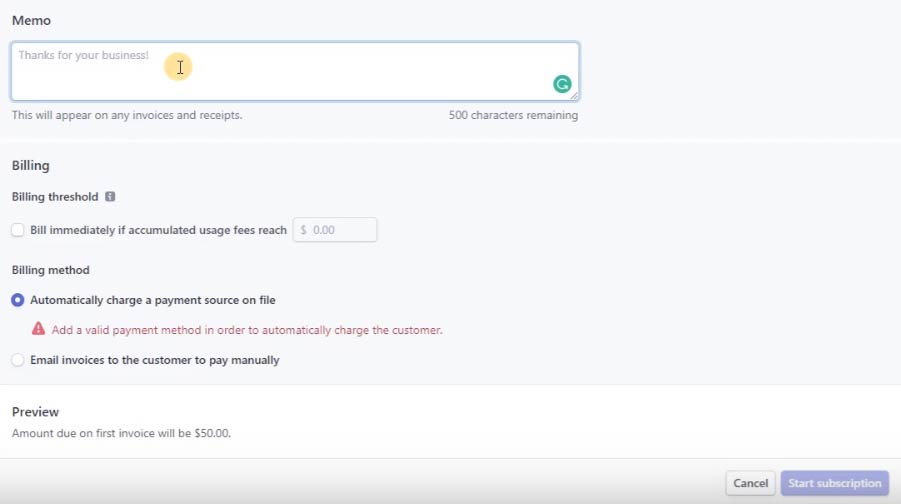

11. Once you add a product, new fields will appear, including “billing” and “billing method.”

12. Fill out the remaining fields. You can add notes under Memo. This is useful if you want to clarify your services’ rules and conditions. You can also add important product information here if you wish.

13. Once you’re finished, click “Start Subscription.”.

Finding a Provider for Recurring Payment Processing

Do your research to select which recurring payment app best fits your business’s and customers’ needs. No matter which provider you choose, make sure they comply with Payment Card Industry (PCI) standards to secure transactions.

In your search:

- Look for payment providers that accept all major credit cards. If you have international customers, ensure your provider can process foreign currencies. The more options you provide your customers, the more seamless their transactions.

- Look for a reporting feature. You’ll want to download reports to keep up with all the transactions.