Financial expert Suze Orman has said, “the question you should be asking yourself right now is not ‘if’ a recession is likely, but how prepared are you for when a recession hits.” And while it’s one thing to prepare as an individual, how do you prepare as a small business owner? That’s what we’ll cover in this article as well as what factors categorize a recession in the first place.

What Is a Recession?

Recessions are marked by significant reductions in gross domestic product, which is the total market value of the finished goods and services a country produces. During a recession, employment, income, industrial production and retail sales also decline. Two back-to-back quarters of such negative economic growth is what’s often thought of as a recession.

Factors that can lead to a recession include:

- High inflation

- Changes in technology

- Unexpected economic crisis (e.g., COVID pandemic)

- Too much consumer and business debt

That said, in the U.S., the private, nonpartisan organization known as the National Bureau of Economic Research’s Business Cycle Dating Committee, which is made up of a group of economists, actually determines when the country is in a recession based on a variety of factors. Indeed, their say is accepted by the U.S. government, businesses, investors and journalists. The committee has not declared a recession to date, even though the U.S. has experienced two consecutive quarters of economic decline.

How Consumer Behaviors Change During a Recession

Some business categories historically perform better than others during a recession, such as healthcare, groceries, alcohol, repair work (e.g., plumbing, roofing, auto mechanics) and freight operations. For others, it’s a matter of the discretionary income consumers feel they have and what they value most.

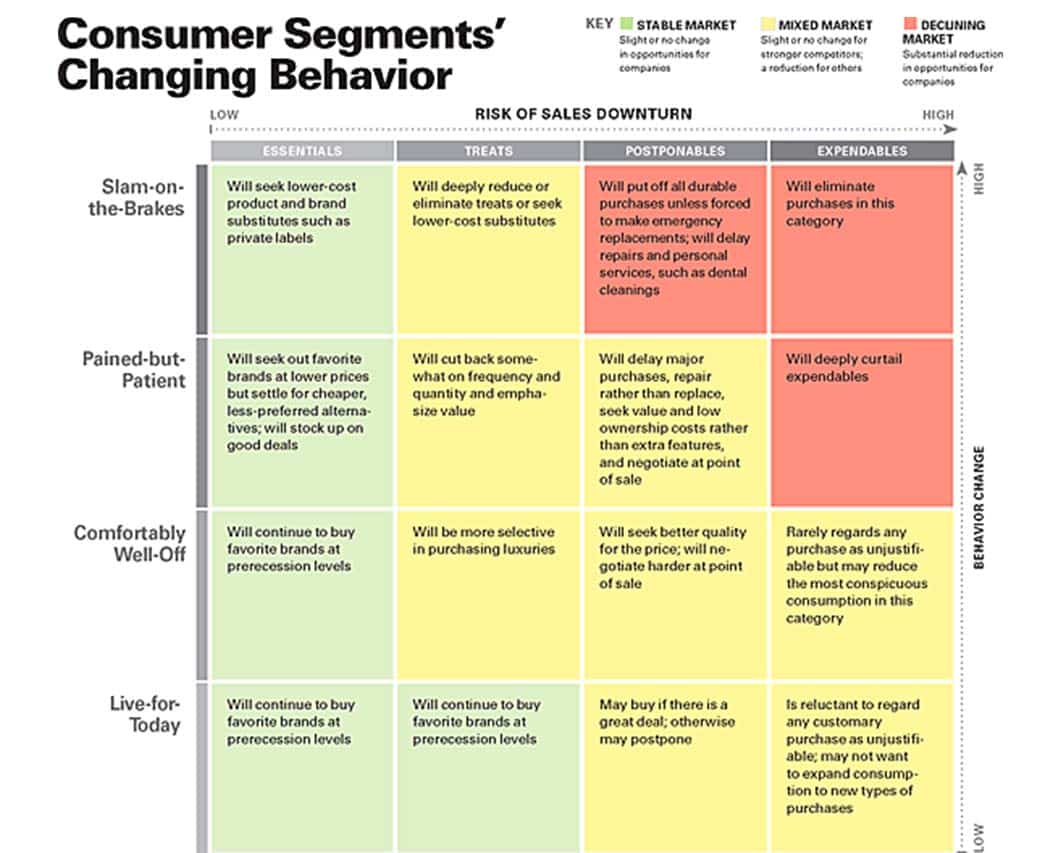

Not surprisingly, when a recession hits, the public often segments into a few key categories in terms of how they spend and what they buy. They often group spending based on priorities, including essential items, indulgences, items that can be postponed and items that they can’t justify spending on anymore.

Additionally, some consumers will continue to spend at the same level they always have, some will be more selective and others may just stop spending on nonessentials all together.

12 Ways to Manage Your Business Through a Recession

A recent Kabbage by American Express survey indicates 83% of small business owners believe a recession is coming, but 80% are confident they’ll be able to get through it. So how exactly would they go about it?

Here are a few strategies to consider to help weather a prolonged economic downturn:

1. Get a Grasp on Business Finances

It’s always important to know where you stand with your finances, even more so during a recession. Take a long, hard look at your business finances and expenses and review your current projections. Be realistic in terms of business expectations during a recession.

2. Focus on Products With the Highest ROI

During a recession, focus on your core products and services that will generate the greatest return on investment (ROI). Think of ways to improve those items and encourage more purchases of them.

In the same vein, pinpoint which products and services are underperforming and consider phasing them out. Working capital is crucial during a recession, and you don’t want to tie it up in stock that isn’t moving.

3. Engage Loyal Customers

It’s always easier to maintain your existing customer base than acquire new customers, so work to keep your current customers happy and coming back. Also, keep in mind, 57% of consumers spend more money on brands to which they’re loyal. Additionally, loyal customers are 71% more likely to spread the word about your brand.

4. Invest in Marketing

Be wise about your marketing expenditures. Strategize what type of ad spend will bring in the most bang for your buck. Then adjust your budget as needed to maintain a balanced marketing plan that is affordable but will continue to reinforce your brand and drive traffic.

You might, for instance, consider diversifying marketing channels and finding ways you can expand your reach. The goal? Gain new customers while continuing to engage existing ones.

Additionally, consider investing in market research to find out what’s important to your target market and understand how they’re allocating their budget amid challenging economic times.

5. Manage Invoices Better

If your clients were slow-paying before a recession, they surely won’t change their ways when a recession hits, and likely will pay even later (or underpay) when times get tough. Do your best to prevent this by invoicing clients quickly and regularly following up with them to collect payment.

Another way you can minimize slow payments or underpayments is to require payment in advance.

For new clients, you can run a credit report to check their creditworthiness. Depending on their history, you can require payment in advance or at delivery instead of offering credit terms.

6. Get Credit from Suppliers

As you give your customers time to pay their invoices, you can request the same from your vendors if you haven’t already. Being able to spread out your payments can help your cash flow, which is critical during a recession.

7. Work to Improve Your Credit

In addition to remaining creditworthy in the eyes of your vendors, you’ll want to maximize your creditworthiness in the eyes of lenders too. After all, you never know if and when you’ll need to access business financing. You might even consider opening a business line of credit now to keep on hand for when you need it.

8. Increase Cash Reserves

Consider stashing cash away for an emergency while you can. This will take dedication and will also affect cash flow temporarily, but having a backup fund for when times get tough can be crucial for a business’s survival. Look into high-yield business savings accounts, such as those offered by many online and alternative banking institutions.

9. Take Advantage of Credit Card Offers

Also think about getting a business credit card with rewards, such as cashback, travel incentives and other points-based programs. These could be valuable if the incentives are items you would be spending money on anyway.

10. Pay Down Debt

Paying down debt could be another good way to prepare for a recession (and improve your credit). You may even think about selling noncritical assets and use the money from the sale to reduce debt.

A low debt load could make you look better to lenders and help you avoid cutbacks in vital operational activities. However, consider how your debt reduction plan will affect your cash flow and weigh the pros and cons.

11. Pursue Alternatives to Layoffs

While it can seem like laying off workers makes sense for a business during a recession, that’s not always the case. Consider that layoffs can be costly over the long term, as you’ll need to invest in hiring and training new personnel post-recession. Additionally, layoffs can impact morale and negatively impact the productivity of remaining employees.

Instead of layoffs, consider:

- Reducing hours

- Furloughing workers

- Implementing performance pay

12. Leverage Technology to Cut Costs

While technology can often be considered a costly investment and one prime for cutting during a recession, it can improve a company’s efficiency, which can help reduce costs.

Additionally, insightful, data-driven analytics can make it easier to understand where it makes the most sense to focus efforts and see where opportunities lie. This can be extremely important in a challenging economy where time is money and money can be hard to come by.