An amortization schedule breaks down the amount of principal and the amount of interest that comprise each payment until a loan is paid off at the end of its term.

When you take out a loan, your lender will likely provide a breakdown of the payments you’ll need to make throughout your loan term. An amortization schedule provides additional details about your loan, including the amount of each payment that goes toward interest as well as principal.

Let’s go through what an amortization schedule is in more detail. We’ll review amortization schedule examples and show you how to make an amortization schedule of your own.

Amortization Schedule Meaning

The definition of “amortize” is to pay off debt through periodic principal and interest payments.

With amortized loans, your loan payment amount typically remains the same throughout the course of your term. However, the amount of each payment installment that’s applied toward principal and interest adjusts throughout the course of your overall repayment period.

This means, in general, you’ll pay more toward interest at the beginning of your loan. As you pay down your principal, you’ll have less interest to pay in each installment. As a result, more of your payment will be applied to your principal and you’ll build equity.

SBA loans are an example of amortized small business loans, as is a mortgage for your business property and auto loans for your company car. Your payments for your business credit card, however, are nonamortized.

-

What Is the Purpose of an Amortization Schedule?

Having an amortization schedule can help you stay on top of your finances. You’ll understand how many loan payments you have left, how much you’re still paying in interest and when you can expect to have the loan entirely paid off.

In terms of business loan amortization schedules, you’ll be better prepared to run your company finances more efficiently. Additionally, knowing where you stand in terms of your loan repayment requirements can help you assess your future working capital needs.

How to Use an Amortization Table

An amortization loan schedule is a great tool for borrowers who like to see the progress of their repayment, step by step. An amortization table provides more detail than a loan payment schedule, which simply indicates when you’ll need to make repayments and the amount due. A payment schedule also doesn’t show you how your payment is broken out between principal and interest.

You can use a loan amortization chart with extra payments to see how additional payments shorten your repayment term. Paying off your loan ahead of schedule saves money on interest, but check with your lender to determine if any prepayment fees apply.

Can You Change the Amortization Schedule for Your Loan?

You can change your business loan amortization schedule by refinancing. You can opt for a longer or condensed amortization schedule — whichever is better for your financial circumstances.

However, note that extending your repayment term — for example, turning a 15-year mortgage into a 30-year mortgage — means you could end up paying more in interest.

Also, remember that refinancing means you essentially apply for and receive a new loan. If you want to shorten your loan payment schedule without going through the refinancing process, you can pay more than the minimum amount to quickly diminish your balance.

How to Calculate an Amortization Payment Schedule

Before you sign for your loan, you might want to create a sample amortization schedule to get a better idea of your financial commitment over the next several months or years. Knowing how to calculate amortization is key to that understanding.

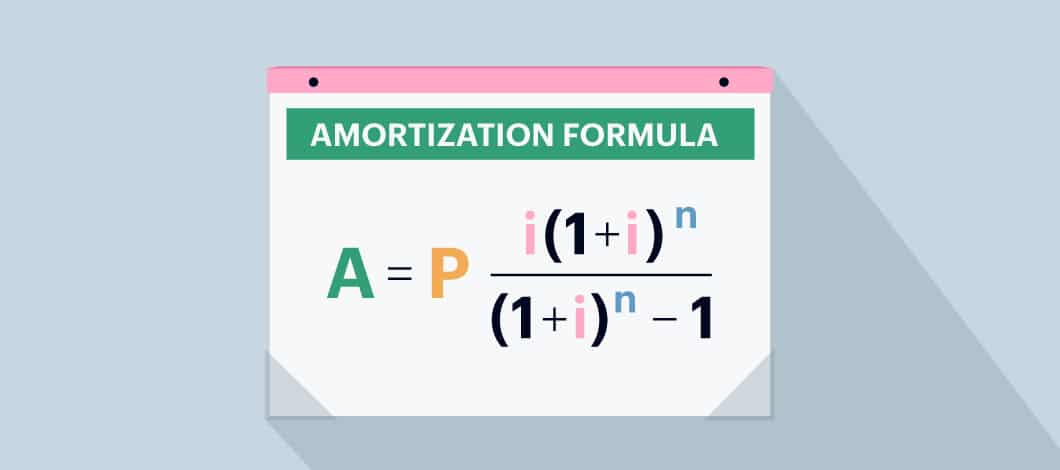

Use the following formula to calculate your payment amount each period.

A = Period payment amount

P = Amount borrowed

i = Interest rate each period

n = Total amount of payments

Amortization Calculators

You can use the amortization formula on a regular calculator to create a loan amortization chart. You also could use an amortization calculator to help create an amortization schedule for yourself or track your loan payment schedule.

Here are a few online resources for debt amortization schedule calculators:

What Does a Monthly Amortization Schedule Look Like?

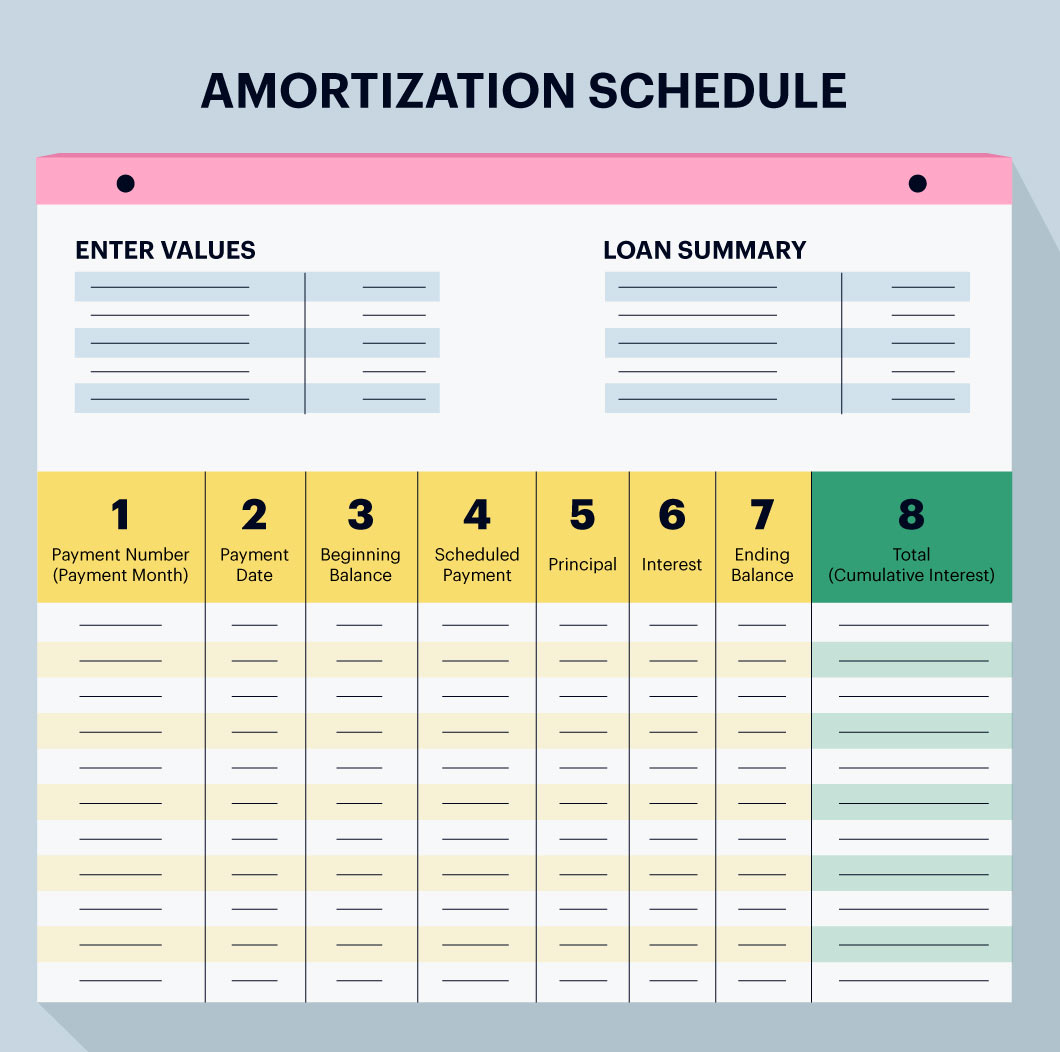

Monthly amortization schedules may vary slightly, but they often include the following information.

1. Payment Number (or Payment Month)

In our sample amortization schedule template above, the payment number column indicates the installment you’re on. Payment 10, for example, would refer to your 10th installment payment due on the loan. Additionally, all of the data in that row of the amortization table would be specific to that payment installment.

2. Payment Date

An amortization schedule with dates will indicate when each payment is due. With a monthly amortization schedule, the due date is typically the same each month. For instance, if your first payment began on Feb. 17, your remaining payments would likely fall on the 17th of each month after.

3. Beginning Balance

The beginning balance column, shown on some amortization schedules, refers to the total amount of principal and interest you owe at the time that payment number becomes due.

4. Scheduled Payment

The scheduled payment column refers to the portion of your amortization schedule with fixed monthly payments. This column lists the total loan payment installment amount.

5. Principal

The principal column records how much of the payment goes toward the actual amount being borrowed. This figure will generally increase as payments continue.

6. Interest

The interest column records how much of the payment goes toward the interest that is being charged on the loan.

7. Ending Balance

The ending balance column keeps track of the total amount of interest and principal that remains left for you to pay as it corresponds to each payment installment. Your amortization table will have a $0 ending balance in the last row to show you have completed your repayment process.

8. Total (or Cumulative Interest)

The total interest on a debt amortization schedule shows the total interest you’ve paid (or will have paid) at the completion of each installment payment.

In addition to a monthly amortization schedule, if you have a daily or weekly repayment structure, you can make an amortization table to correspond with your specific loan details. If you prefer, you can also create an amortization schedule with extra payments.

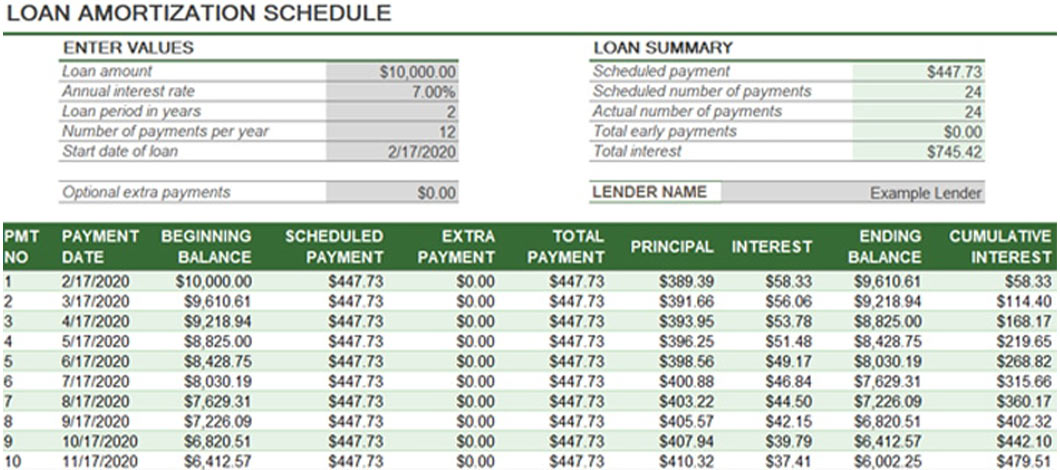

Amortization Schedule Example

Amortization schedules with start dates will appear as shown in the example below. The table features a start date of 2/17/2020 and shows subsequent monthly payments as well as the interest and principal breakdown per installment. You also can calculate amortization schedule annual payments.

Amortization Schedule with Balloon Payment

In addition to calculating your monthly, weekly or daily amortization schedule, you can calculate an amortization schedule with balloon payment loan terms. With a balloon payment loan, only part of the loan is amortized.

To repay your loan in full, the remaining amount is due as one large sum required at the end of your term. This amount is much larger than the periodic loan installments you make throughout your term. You can find an online amortization calculator, for example at Bankrate.com, that provides an amortization schedule with balloon payment terms.

How to Build Your Own Amortization Schedule

If you don’t already have one, consider creating your own amortization schedule with a start date. Look online for an amortization schedule calculator or amortization schedule creator to see how additional payments can impact your total repayment.

Microsoft Excel, for example, offers a loan amortization schedule template that calculates your specific data based on the following inputs:

- Starting date

- Loan amount

- Interest rate

- Repayment period

- Number of payments per year

The more you know about what an amortization table is and how loan payment schedules work, the greater understanding you’ll have of your financial situation and how to take control of it.