FreshBooks vs. QuickBooks: How do the two accounting software platforms compare?

No doubt, both FreshBooks and QuickBooks bring some spreadsheet mojo to the table. That said, we’re reviewing the cost, user-friendliness and functionality of each program, so you can find out which one’s better for your business.

Freshbooks vs. QuickBooks Online: Overview of Basic Features

| FreshBooks | QuickBooks |

| Categorize expenses | Turn estimates into invoices or create invoices from scratch |

| Unlimited time tracking | Track income and expenses |

| Easily add billable hours to invoices | Review profit and loss and balance sheets |

| Customized invoices (unlimited for up to 5 clients) | Photo capture receipts to maximize tax deductions |

| Track inventory | Track mileage |

| Track mileage via mobile | Share your books with your tax professional or export important documents for tax season |

| Track sales and see reports | Customize estimates and see estimate statuses |

| Assign roles and permissions to staff | Accept mobile signatures |

| Easily collaborate between employees, clients and contractors | Accept payments |

| Accept credit card payments and ACH transfers | Automatically calculate sales tax |

| Add images and text content to proposals and estimates | Forecast cash flow |

| FreshBooks for payroll option available by connecting FreshBooks to the Gusto app | Assign vendor payments to 1099 categories, see payment history and prepare and file 1099s |

All features noted above are included in the basic plan within each respective platform. Additional features and users are available at higher plan tiers.

Advanced Features of FreshBooks and QuickBooks

FreshBooks

Here are a few of the features for plan tiers above Lite, FreshBooks’ most basic option.

| FreshBooks Plus | FreshBooks Premium | FreshBooks Select | |

| Expenses tracked automatically | X | X | X |

| Unlimited estimates, proposals and client retainers | X | X | X |

| Automated recurring invoices | X | X | X |

| Double-entry account reporting | X | X | X |

| Bank reconciliation | X | X | X |

| Accountant access | X | X | X |

| Accounts payable | X | X | |

| Customized email templates, signatures and automated client emails | X | X | |

| Project profitability | X | X |

FreshBooks charges a base monthly rate that varies by plan, plus $10 per month, per person, regardless of the plan.

QuickBooks

While all QuickBook plans offer users all of the features previously noted, here are additional features for plans higher than base subscription (i.e., QuickBooks Simple Start).

| QuickBooks Essentials (access for 3 users) |

QuickBooks Plus (access for 5 users) |

QuickBooks Advanced (access for 25 users) |

|

| Pay bills | X | X | X |

| Track time for employees or clients | X | X | X |

| Generate sales, accounts receivable and accounts payable reports | X | X | X |

| Manage inventory and bills | X | X | |

| Monitor project profitability | X | X | |

| Generate enhanced sales, profitability, template-based reports | X | X | |

| Get business insights and analytics | X | ||

| Create batch expenses and invoices | X | ||

| Get custom dashboards and reporting | X | ||

| Restore lost data | X | ||

| Benefit from on-demand training and dedicated support team | X |

Freshbooks vs. QuickBooks Online: Pros and Cons

Ease of Use

| FreshBooks | QuickBooks |

| Easy-to-navigate menu | Menu bar offers quick access to all system functions |

| Clean, eye-catching dashboard | Multiple navigation subtabs could be overwhelming |

| Data displayed simply | Better for individuals with some accounting experience |

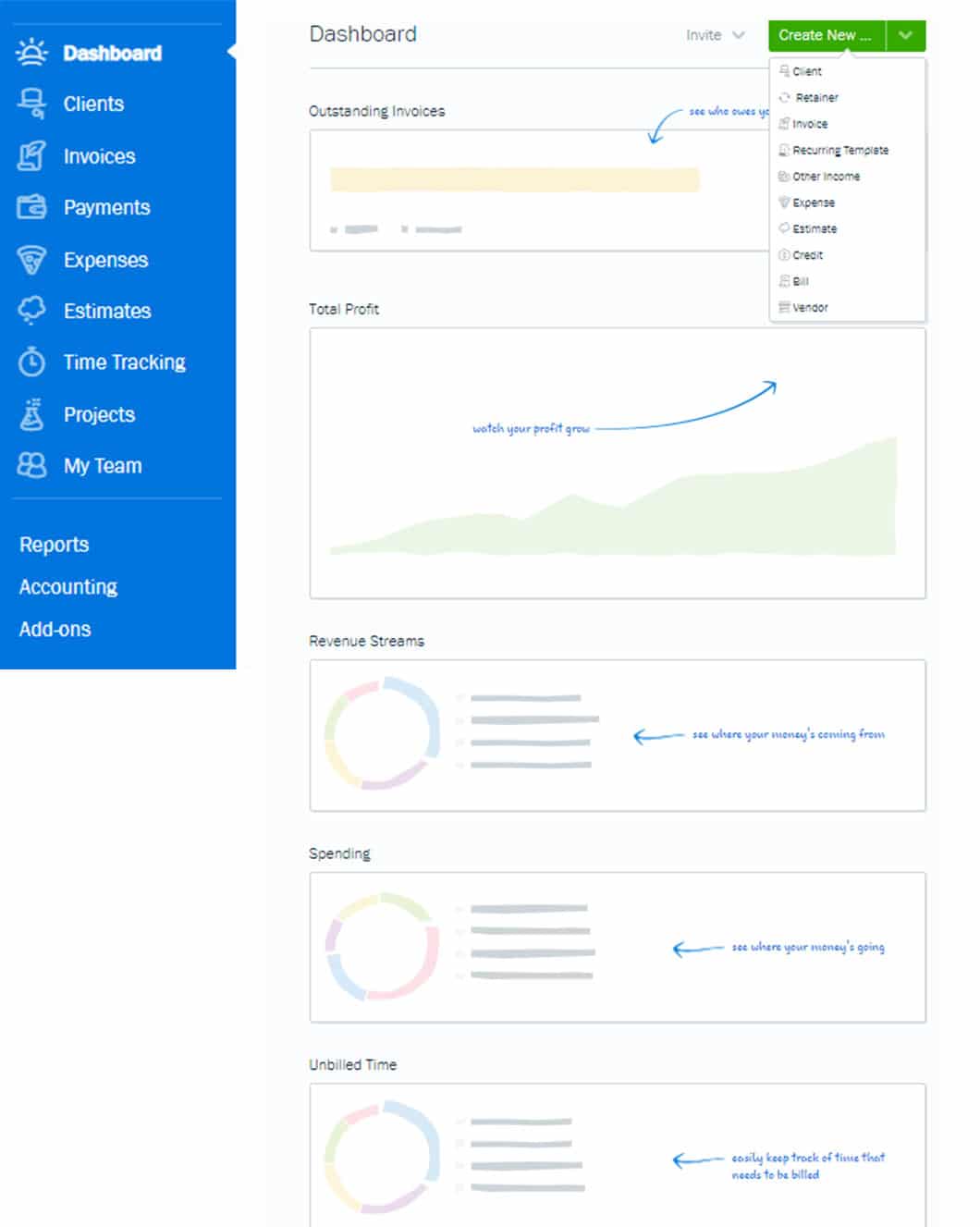

Here’s a view of FreshBooks’ online dashboard:

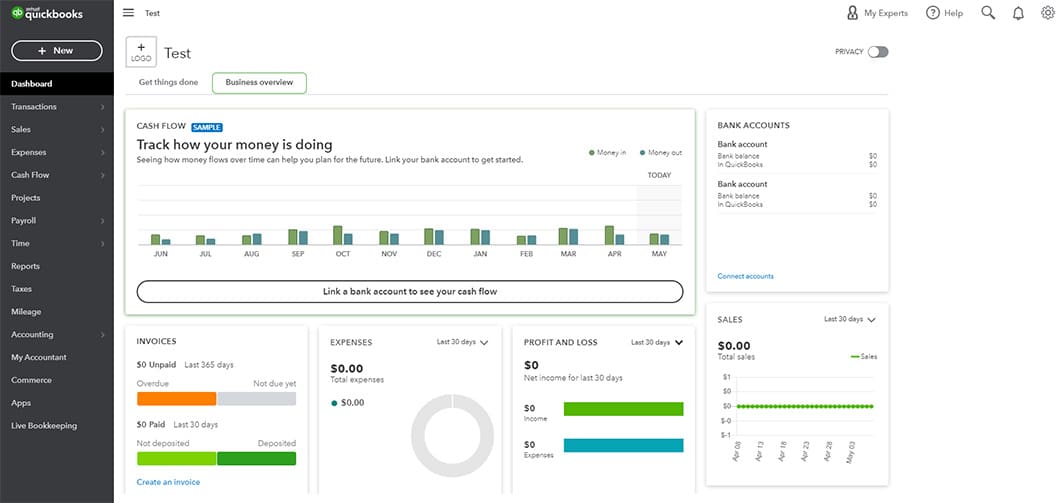

Here’s a view of QuickBook Online’s dashboard:

Integration with Other Software

| FreshBooks | QuickBooks |

Integration with more than 100 third-party apps (e.g., Stripe, HubSpot, Shopify) for the following:

|

More than 650 apps available (e.g., PayPal, Bill Pay for QuickBooks, Salesforce, QuickBooks Time):

|

| Can also connect to more than 1,500 apps using Zapier | Connect with apps within the QuickBooks platform |

-

Export FreshBooks Invoices to QuickBooks

It is possible to export invoices from FreshBooks to QuickBooks, thanks to the ability to convert invoices to comma separated value (CSV) files. Once you download the CSV file, you can upload that CSV file to QuickBooks.

Alternatively, third-party data integration apps, such as One SaaS or Skyvia, could sync data between FreshBooks and QuickBooks Online.

Customer Support

| FreshBooks | QuickBooks Online |

|

|

What’s the Difference Between FreshBooks vs. QuickBooks Self-Employed?

Here’s a comparison of some of the features of FreshBooks vs. QuickBooks Self-Employed:

| FreshBooks | QuickBooks Self-Employed | |

| Invoice clients | X | X |

| Organize expenses | X | X |

| Generate basic reporting | X | X |

| Accept payments | X | X |

| Facilitate double-entry accounting | X | |

| Track inventory | X | |

| Track time | X | X (in beta) |

| Photo capture receipts with automatic entry of data | X | |

| Estimate quarterly taxes | X | |

| Track miles | Only available for business owners | X |

| File Taxes with Tax Bundle Option | X |

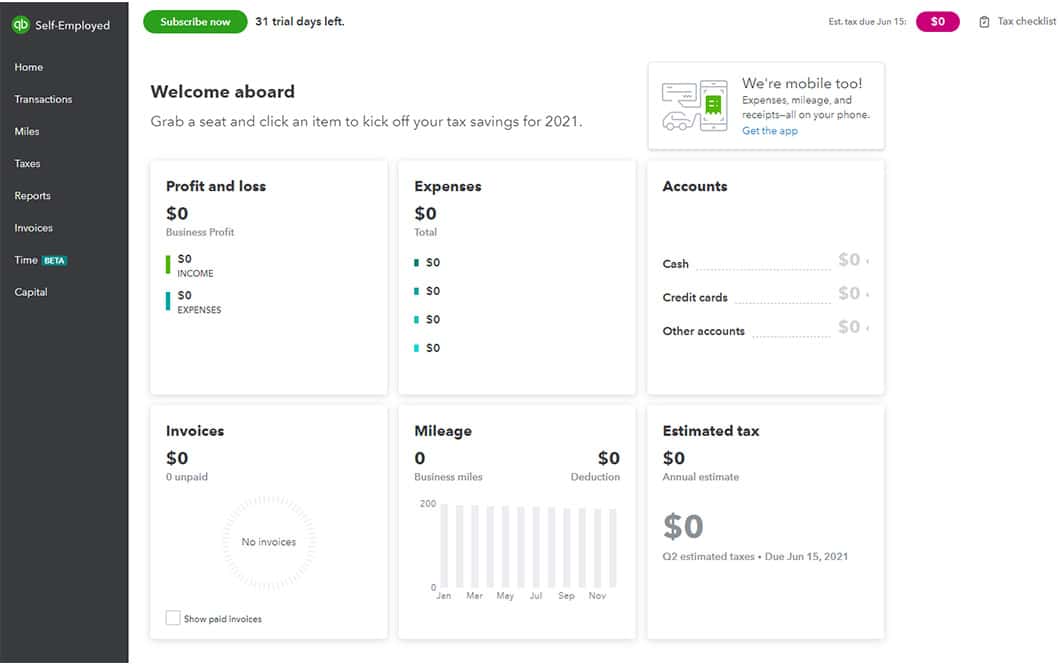

Here’s a snapshot of QuickBooks’ Self-Employed dashboard:

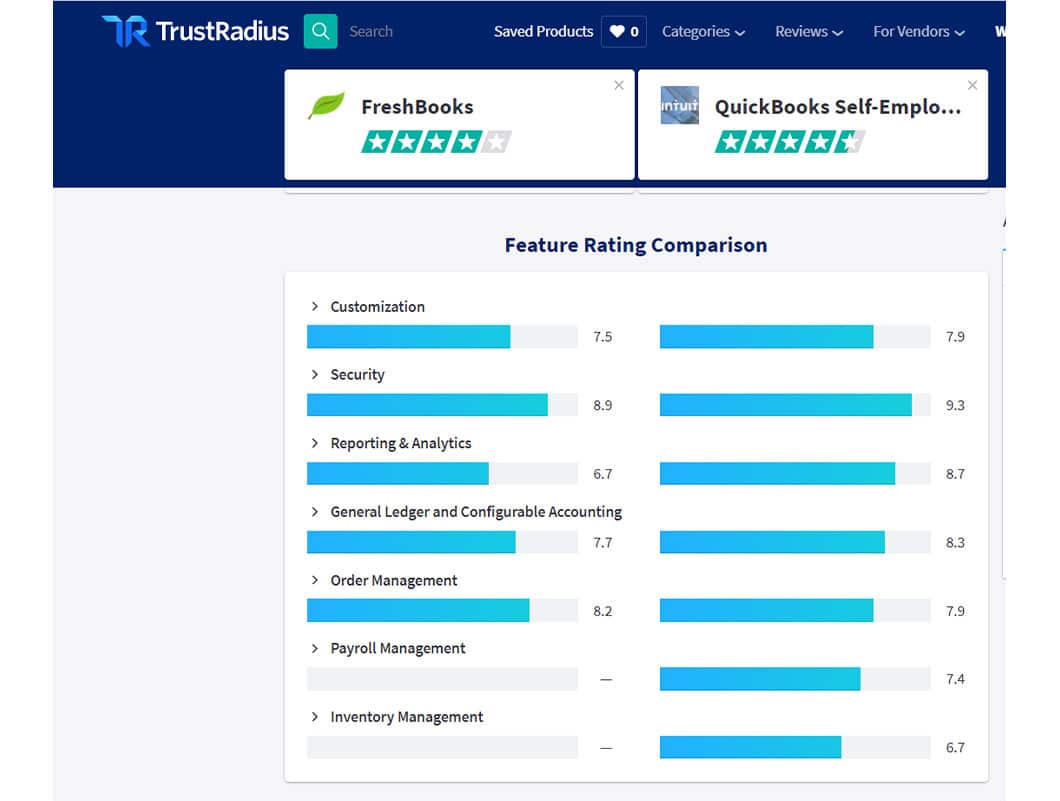

As far as ratings go, FreshBooks earned an 8 out of 10 score on software review site TrustRadius. This was based on 159 reviews. Not too far off, QuickBooks Self-Employed earned an 8.5 out of 10 score based on 40 reviews.

Here’s how reviewers compared the two accounting programs.

Comparing FreshBooks Costs and QuickBooks Costs

Below is a breakdown of pricing for each platform as well as QuickBooks Desktop version.*

| FreshBooks | QuickBooks Online | QuickBooks Desktop |

|

|

|

*Pricing as of April 2021. For the most up-to-date pricing, please visit each company’s website.

FreshBooks vs QuickBooks: Which Is Better in 2021?

There’s no clear-cut answer to this question. It really depends on your needs. If you’re a solopreneur, FreshBooks’ accounting software is easy to use and has a solid list of features for freelancers or the self-employed.

For small businesses with more in-depth needs, such as advanced reporting capabilities and tax assistance, QuickBooks may offer a better solution.

If you still have questions, test them out for yourself. Both plans offer free trial periods, so you can determine which one’s better for your needs.