If you’re an entrepreneur, you might have questions about how to file small business taxes for the first time. You might even ask yourself, “Do you have to file taxes your first year in business?” or “Can a small business get a tax refund?”

While the tax code is ever-evolving and complex, there’s no need to panic.

We’ve broken down everything you need to know so you can confidently file your first small business tax return. Learn which forms to use when filing, how to minimize your tax burden and how to properly estimate your tax payments.

1. Determine Your Accounting Method

One of the first steps to consider when you’re wondering how to file taxes for the first time is to decide whether you’ll be using the cash or accrual method of accounting.

With cash accounting, income and expenses are recorded only when money is exchanged. When a deposit comes into a business, it’s recorded as income. When a bill is paid, it’s recorded as an expense. For example, if only half of a bill has been paid, only half is recorded. With this method, you won’t pay taxes on the revenue from the invoice that hasn’t been collected yet.

In contrast, with the accrual method of accounting, income and expenses are recorded on the date a transaction occurs (not when cash has been exchanged). In other words, let’s say you have 2 invoices, but only 1 has been paid, you’d still note both as income. Though more complex, this method is often seen as a more effective way to track cash flow and profitability since expenses and revenues are matched in the same reporting period.

2. Be Clear on Your Tax Obligations

When submitting a tax return for your small business in its first year, knowing which IRS forms to file and what taxes you’re liable for can be confusing.

It all depends on what sort of business entity you have. For example, some hold the owner personally responsible for company taxes, whereas others separate the business’s tax liabilities from the owner’s. Also, each business structure requires a different IRS form.

We’ve broken down each entity below so you won’t face any surprises, whether you’re filing business taxes for an LLC for the first time, as a sole proprietorship or as another type of structure.

| Entity | Tax Liability | Required Forms |

| Sole Proprietor | A sole proprietorship is a single-owner business structure. The owner, called the sole proprietor, is considered the same legal entity as the business. | Income and self-employment taxes are filed with forms 1040, Schedule C and 1040, Schedule SE respectively. |

| Partnerships | A partnership has 2 or more owners. Like a sole proprietorship, a partnership is only taxed at the personal income level. | Form 1065 is used to report business income and expenses to the IRS. The company sends Form 1065 Schedule K-1 to each partner, showing each person’s share of income and losses. Partners then use Schedule K-1 to fill out their personal income tax returns. |

| Corporations | A corporation’s profit is taxed to the corporation when it’s earned, after which it’s taxed to the shareholders when distributed as dividends. | Use Form 1120 to calculate and return the business’s federal income taxes and to report the corporation’s income and expenses. |

| Limited Liability Company | A limited liability company (LLC) combines parts of corporations and partnerships. Like a corporation, an LLC and the owners are separate legal entities. And like a partnership, the owners have shared tax liabilities. Typically taxes pass through to the personal income level, so the business is not double-taxed. | Depending on how an LLC is set up, the company may file as a corporation, partnership or as part of an individual tax return. |

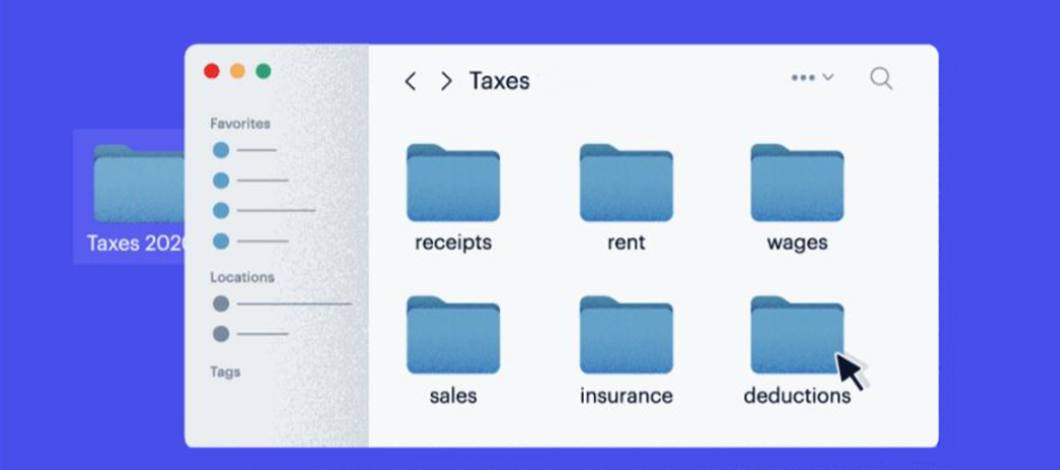

3. Organize Your Records

When filing small business taxes for the first time, it’s important to organize your accounting records.

If you’ve been tracking your daily business transactions from day one, great news: You won’t find yourself scrambling to calculate your income and expenses when tax season rolls around.

Not only will this save you time, but also tax preparation costs should you employ the services of an accountant.

Although fewer than 1% of taxpayers reporting income less than $500,000 are audited, an audit is a risk you face.

Should the IRS send you a notice that you will be audited, you can easily back up the figures reported on your tax return with complete and well-organized accounting records.

To get a better idea of what you’ll need when filing business taxes for the first time, gather the following:

- Gross receipts

- Checking and savings account interest

- Returns and allowances

- Sales records

- Unclassified income

- Employee wages

- Insurance premiums

- Professional fees

- Contractor payments

- Office rent

- Transportation and travel expenses

- Advertising costs

- Office supplies and equipment

- Telephones and other communication devices

4. Understand How and When to Pay Estimated Taxes

Once you begin earning money as a small business owner, you should start paying quarterly estimated taxes if you expect to owe the IRS $1,000 or more ($500 for corporations).

Sole proprietors, partners and S-corporation shareholders should use IRS Form 1040-ES to submit estimated taxes. Corporations use Form 1120-W.

As a first-year business owner, you might be wondering how much you should pay in quarterly estimated small business taxes. The IRS suggests estimating your income for the entire year and using that number to figure out your quarterly payments.

The agency also notes that if you estimate your earnings too high, you can complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. On the other hand, if you estimate your earnings too low, you can complete the worksheet again to recalculate your estimated taxes for the following quarter.

In addition to income, self-employment and estimated taxes, consider that you might be liable for employment and excise taxes. For more information on these taxes, check out the requirements the IRS outlines on its website.

Also, look into the requirements for your state and county to see if any additional payments are needed at the local level as well as their due dates.

-

How Much to Save for Business Taxes

A rule of thumb is to set aside 30%-40% of your income for business taxes. You might be thinking that’s a lot of money, and perhaps you’re wondering, “Do small businesses get tax refunds for overpayment?”

Well, while putting aside at least 30% of your income could lead to slight overpayment, the IRS will give you a small-business tax refund for your first year of filing if you’ve paid too much in estimated taxes.

5. Capture Every Deduction to Which You’re Legally Entitled

Another tip for filing taxes for a small business for the first time is to ensure you’re claiming all the tax deductions available to your small business. As a new business owner, you’ll absolutely want to take advantage of whatever tax deductions you can. After all, this is one of the simplest ways to reduce your income tax bill.

Here are a few business tax deductions to consider when filing your first-year business taxes.

Home-Office Deduction

As a new business owner, there’s a good chance you operate out of a home office. If you have a dedicated home office you regularly use only for your business, and your home office is your principal place of business, you’re eligible to deduct a portion of your home-related expenses. These could include mortgage interest, homeowner’s insurance, repairs, utilities and depreciation.

Alternatively, you could use the simplified method to calculate this deduction, and deduct $5 per square foot for business use of your home, up to $1,500.

Startup Costs

Starting a new business venture is costly, but certain tax advantages can help offset this financial burden.

If it’s your first time filing small business taxes and your startup costs are $50,000 or less, you can deduct up to $5,000 of those costs in your first year of operation. The deduction is reduced for every dollar of costs greater than $50,000 up to $55,000. For example, if your costs before launching were $54,500, you’d only be able to deduct $500 of that the first year ($5,000 less $4,500).

If your startup costs exceeded $55,000, you won’t be able to take any deductions in the first year, and you’ll need to amortize them instead, claiming the remaining costs as deductions of equal proportions over the course of 180 months, starting with the month your business opened.

Examples of startup costs include:

- Advertisements

- Salary and wages for employees and instructors involved in training

- Costs associated with market analysis

- Travel expenses incurred while securing customers, suppliers or distributors

What’s more, you can claim up to $5,000 in organization costs, including legal fees, state fees and travel fees for organizational meetings.

While deductions may be helpful when you’re filing small business taxes for the first time, taking the maximum deduction in your first year may not be the most sensible move.

Consider taking bigger deductions in the years you have the most profits to minimize the taxes you owe. If you operate a business making little or no profit, you’ll probably want to skip the first-year deduction and spread it out over more profitable years instead.

Interest Payments

When you’re filing taxes for the first time as a small business owner, keep in mind a portion of your interest expenses can also be deducted. Your deduction, however, cannot exceed 30% of the taxpayer’s annual adjusted taxable income or the taxpayer’s annual business interest income.

For instance, if you have a small business loan or are making payments against a business line of credit, you might be able to claim the interest paid as a deductible business expense.

6. Don’t Let Tax Filing Deadlines Sneak Up on You

A lot goes into preparing to file small business taxes for the first time. Be sure to understand what you need to know about small business tax deadlines.

Start the process early to ensure you don’t miss due dates, which could lead to financial penalties. Specifically, if you fail to file, the IRS imposes a 5% penalty of the unpaid taxes for each month or part of a month that a tax return is late, not to exceed 25% of your unpaid taxes.

7. Consider Hiring an Accountant

You don’t have to file small business taxes for the first time yourself. A small business accountant can help you navigate the process and steer clear of suspect deductions that could draw the scrutiny of the IRS. They can also help you claim write-offs you might have otherwise missed. The best part is, your accounting fees are tax-deductible.

Get Set to File Your Small Business Taxes for the First Time

There’s no question: Filing small business taxes for the first time can be intimidating. But with the proper organization and preparation, you can submit your first filing unscathed.

That said, should you find yourself with a high tax bill that your available cash flow simply won’t cover, explore payment options, such as a business loan, to protect yourself against interest and penalties. Additionally, you may be eligible to defer tax payments for a period of time.

Whatever the case, don’t delay filing. Start your new business on the right foot in every respect, including its tax obligations.