An employee could file a lawsuit against your business for anything from sexual harassment to negligent reviews. Attorney and author Jonathan Hyman wrote that a company’s litigation costs could run anywhere from $75,000-$250,000, regardless of whether you win the case. Employment practices liability insurance (EPLI) exists to protect you from those crippling costs.

Learn more about what EPLI is, when you might need it and the potential costs to your business if you don’t have it.

What Is Employment Practices Liability Insurance?

EPLI is a type of liability insurance designed to protect your business if any employee sues the company for its employment policies or practices. Anything you do to an employee that could be construed as discriminatory, abusive or illegal could be cause for a case or lawsuit. The U.S. Equal Employment Opportunity Commission (EEOC) reported more than 72,000 employee charges against their employers in 2019 alone, and that doesn’t include state and local charges.

The EEOC reports the types of claims filed each year in 11 major categories, which include racial discrimination, sex-related issues (including sexual harassment), pregnancy, age and disabilities, among others. Federal law defines many of these issues in documents such as Title VII of the Civil Rights Act of 1964 or the Pregnancy Discrimination Act. There are also many state laws clarifying employee rights and responsibilities in these and other areas.

Despite the myriad possibilities of a lawsuit, many employers still remain uninsured. Jon C. Berns, a partner who represents plaintiffs in employment law with Dobson, Berns, & Rich LLP in St. Louis, sees roughly half of employers without employment practices liability insurance in his cases. In his 25 years of practicing, however, he’s seen the coverage number rise. He estimates only a quarter of employers were insured 10 years ago.

“I think companies started to recognize over time that they have a greater risk of incurring liability or at least getting sued in the employment realm, so they have chosen to insure against that risk,” says Berns. And it’s not just large employers. His firm will accept cases from employees working for companies with as few as 6 employees.

The fact is, it only takes 1 incident with 1 employee to trigger a lawsuit. If you have a staff of more than just yourself, you need to look at EPLI.

What Does an Employment Practices Liability Insurance Policy Cover?

A good EPLI policy will cover your business and its employees for the costs of litigating on a range of issues. Some of the most common claims include:

Wrongful Termination

Even though employment in the U.S. is “at will,” that doesn’t give employers the freedom to fire employees for any reason. If a worker feels their termination occurred for any discriminatory reason — whether for race, religion, gender, national origin or any other protected category — they may have grounds for a lawsuit.

Negligent or Discriminatory HR Practices

Say you don’t hire someone because they might get pregnant. Or you hire a less qualified candidate because he’s your nephew. Or you promise an employee a promotion but fail to follow through. Any of these could have you facing a lawsuit. You could even be in trouble if you give an employee an unnecessarily critical review.

Defamation

If you or one of your employees say or write something negative about an employee in public without adequate evidence, you could be sued for libel or slander.

Harassment

“You certainly see a lot of sexual harassment type of cases,” says Berns. “You know, we’re in the ‘Me, Too’ age if you will.” Sex-related cases, in general, represented 32.4% of EEOC cases in 2019 compared to 29.1% in 2010. Harassment, whether sexual or in some other form of bullying or violence, need not come from the top down. If a staff member or even a contractor harasses your employee, and you know but do nothing, your company could be liable.

Retaliation

According to Berns, a retaliation lawsuit is among the most common cases he encounters. For example, if an employee speaks up about harassment issues at work and is then fired by their employer, that employee might sue the company for retaliation.

Employment practices liability insurance covers the legal fees — up to your policy limit — for these issues and more. In addition to you, your company and your employees, you can purchase third-party coverage. If your employees regularly interact with vendors, customers or the public, third-party coverage would protect your business from outside litigation.

Sometimes, an EPLI policy might grant the insurance company “duty to defend.” In that case the insurance company might choose a lawyer for you. If you want the freedom to choose your own attorney, beware of these clauses. As is the case with any insurance policy, you should be sure you carefully read the fine print.

What Are the Limitations for Employment Practices Liability Insurance?

EPLI policies provide claims-made coverage. This means that both the purported action and the accompanying lawsuit must happen during your coverage period. If an incident occurs while your company is covered, but your employee files a claim after your policy has expired, you will not be protected.

There are several other limitations and exclusions to be aware of when it comes to EPLI policies. Some of the most common include areas that aren’t covered:

- Breach of Contract: If an employee or third party files a claim against your business for violating a written contract

- Criminal Acts or Other Legal Violations: If your company is guilty of a crime or if you violated legal protections of your workers under laws such as the Occupational Safety and Health Act (OSHA)

- Punitive Damages: Additional penalties for egregious harm

- Strikes: Claims arising from labor disputes

- Wage and Hour Claims: If an employee can demonstrate that you’ve withheld earned wages or tips

Employment Practices Liability Insurance Cost

Your premium for employment practices liability insurance will depend on the following factors:

- The number of employees you have

- The coverage limit you choose

- The amount of retention for which you are responsible (basically your deductible)

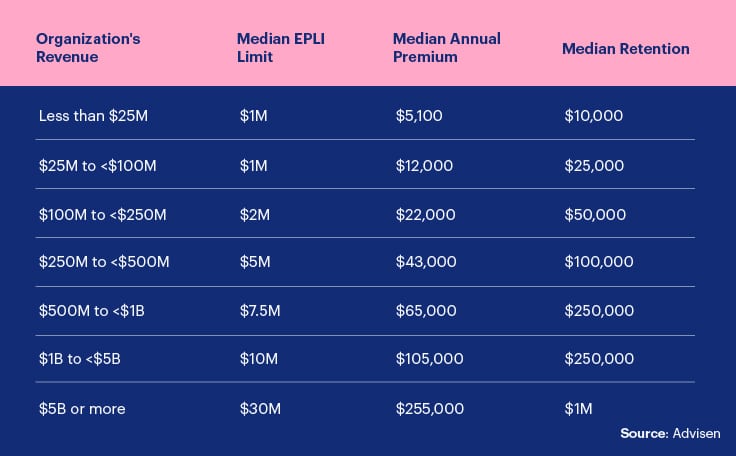

Data published by insurance data services provider Advisen reveals a large spread for annual premiums. These can serve as a guideline for your own coverage needs and costs.

According to Berns, even a lawsuit that doesn’t go all the way to court could end up costing a business around $100,000. A court battle would cost much more. A small company with revenues of less than $25 million would spend around $4,900 annually on an EPLI policy and — in the event of a lawsuit — $10,000 on retention fees. Those numbers are well under those 6-figure legal expenses.

Benefits of Employment Practices Liability Coverage

The peace of mind that comes with EPLI coverage is well worth the investment you have to make. According to Berns, a typical case could take 1-2 years to resolve, and those that go to court can take 3 years or more. The costs of this litigation can add up. Beyond legal proceedings, though, the cost of time and energy for your team can be immense, not to mention distracting from your business. EPLI reduces a significant portion of these stresses and frees you to focus on what matters most.

What’s the risk if you go without employment practices liability insurance? The answer is simple: your business. For many companies, one lost lawsuit could be enough to sink the ship.