Business debt consolidation is the process of combining multiple company debts into one loan. A business debt consolidation loan is worth considering if you have numerous loans, varied due dates and high interest rates.

What Is Business Debt Consolidation?

Business debt consolidation is a method of securing a new loan to pay off several debts. In using a business consolidation loan, business owners can typically consolidate many smaller loans that are often unsecured and have higher interest.

These debts are combined into one larger loan with a single payment, so you don’t need to remember multiple loan payment due dates. Small business owners can use debt consolidation as a tool to better manage credit card debt, equipment loans and many other types of financing.

Though it isn’t a guaranteed benefit of debt consolidation, business owners can potentially reduce the interest rates on their debt.

While it would be terrific if your business debt consolidation loan saved you money in interest fees, the primary goal of debt consolidation is to make payments more manageable by eliminating several payments with one. Business debt consolidation loan rates are sometimes very similar to other loan terms.

If your business is struggling to manage the different repayment schedules in your organization, a business debt consolidation loan can bring a great deal of simplicity to your debt management.

Secured Debt Consolidation Loan

If you’re considering a secured debt consolidation loan, you’ll need to offer collateral to be approved. This could include vehicles, real estate, inventory and accounts receivable.

Unsecured Debt Consolidation Loan

In contrast, you aren’t required to offer collateral with unsecured debt consolidation loans. Instead, you’re personally guaranteeing you’ll repay the loan. Unsecured loans are typical among online lenders.

Business Debt Consolidation vs. Refinancing

Business debt consolidation and refinancing are sometimes used interchangeably, but they describe two distinct processes.

While debt consolidation is the practice of combining multiple loans into one new loan with a single payment, refinancing is the practice of obtaining a new loan at a lower interest rate as a means of paying off other higher-interest loans.

How to Know It’s Time for a Small Business Debt Consolidation Loan

Regardless of what your financial picture may have looked like when you first took on business debt, it’s possible you could now be eligible to qualify for one large loan, possibly with better rates or terms. If your business finances have improved, a debt consolidation plan is worth considering.

Here are some signals it may be time to consolidate your small business debt:

You Have More Than a Few High-Interest Loans or Credit Balances

The higher your current interest rates, the more beneficial it could be for you to pursue small business debt consolidation and bundle all of your debt into a single, more manageable loan payment.

If you’ve taken out credit cards for your business, for example, those products can charge relatively high interest rates and those rates compound. However, business debt consolidation could save money over the long run.

As you apply for a new small business loan to pay off debt, a lender will evaluate several factors, including your time in business, credit score, company cash flow and annual business revenue.

You could qualify for a business debt consolidation loan at a competing rate (or a lower rate) than your current loans.

Your Personal Credit Is Above 620

For lenders to assist you with business debt consolidation, they check your personal credit. Any interest rates and terms that a lender is ultimately willing to offer are significantly affected by your score.

According to Equifax, these are the credit score ranges:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

Lenders love to see applicants with credit scores of 700 and higher. With a score this high, banks and lenders will be competing to offer your business the lowest interest rate.

Depending on the lender, owners with scores between 650 and 700 who’ve been in business for more than a year will also have attractive options to lower their interest rates through business debt consolidation. However, it’s likely there won’t be as many lenders willing to offer financing.

Some debt consolidation lenders may accept credit scores in the low 600s to high 500s, but these are considered “bad credit” options. Because these lenders accept lower credit scores, interest rates will be higher. Keep in mind, though, while securing a business debt consolidation loan with bad credit might be possible, it may not be practical because of the extremely high interest.

Your Business Finances Have Improved

If your business’s revenue or profitability has improved month-over-month for several recent months, your chances of qualifying for a business consolidation loan may increase.

The commercial debt consolidation loan amount you qualify for depends on the lender, your credit score, your annual revenue and other factors.

Your Personal Finances Have Improved

Another key financial debt consolidation factor is personal finances. As with credit scores, personal finances matter a great deal for a small business owner, especially when it comes to small business debt consolidation.

Qualifying for a business debt consolidation loan means having improved any of the following aspects of your personal finances:

- Increased personal income

- Reduced personal debt

- Lowered household spending

- Increased real estate equity

- Reduced number of dependents

Note that if your credit hasn’t improved lately, a consolidation loan may not save you money on interest payments.

You’ve Been in Business More Than a Year

Whenever you apply for a business loan, the longer you’ve been in business, the more it will help you secure a business debt consolidation loan with a lower interest rate.

Organizations with longer financial histories have more ways to demonstrate their ability to sustain success and profitability to lenders. Before applying for a business debt consolidation loan, your organization should be in operation for at least 1 year.

How to Consolidate Debt for Your Business in 5 Steps

Once you’ve determined you’re a good candidate for business debt consolidation, it’s time to move forward. Here’s how debt consolidation works:

1. Understand the Current Terms of Your Debt

The first step involves understanding the types of debt you’re consolidating and the terms they carry. This will help you know when it’s the right time to consolidate your debt.

For example, it’s common to want to consolidate the highest interest rate loans first. While this is understandable, your current loans may have restrictions keeping you from consolidating them. Debt holders often forget to include the cost of prepayment penalties into their total calculations.

Although consolidating may seem great in theory, in practice, it can be a costly mistake if the unification triggers additional fees or penalties. This makes being aware of the fine print extremely important when consolidating.

2. Outline Which Debts to Consolidate

You may be in a position to consolidate some, but not all, of your debt. The rates you have on one loan may be far better than those on another. Regardless, you need to have come up with an approach of how you’re planning to reduce the number of payments and interest rates you currently have.

Even if you’re unable to consolidate all of your debts, reducing what you can (as long as it’s a net positive for your business) may still be worthwhile.

3. Determine Your Qualifications

As with any other loan, each lender will have different requirements for a business debt consolidation loan.

These may include having:

- At least 1 year in business

- Annual revenue of $100,000+

- A minimum personal credit score of 600-650

- A debt service coverage ratio of 1.25 or better

4. Organize Your Documents

Having the right documentation prepared before applying helps keep the approval process from stalling.

For example, SBA loans (including SBA Express loans) can take weeks, even months, to be approved. The best way to expedite this process and keep everything on track is to be prepared with the right documentation before applying.

Gather the following:

- Financial statements

- Sales projections

- List of all debt

- List of equipment

- Profit-and-loss statements

- Personal and business tax returns

5. Apply and Wait for Lender Review

Once you’ve gathered your required debt consolidation loan information and submitted your application to a lender, the lender will review your documents. If you’re prequalified, the lender will conduct due diligence in reviewing your business for approval.

The lender may look into your recent payment history, see if your business has had any lawsuits and review titles of assets. If all goes well, your business debt consolidation loan is approved.

Pros and Cons of Business Debt Consolidation

Here are a few reasons to consider consolidation for your business loans (or not):

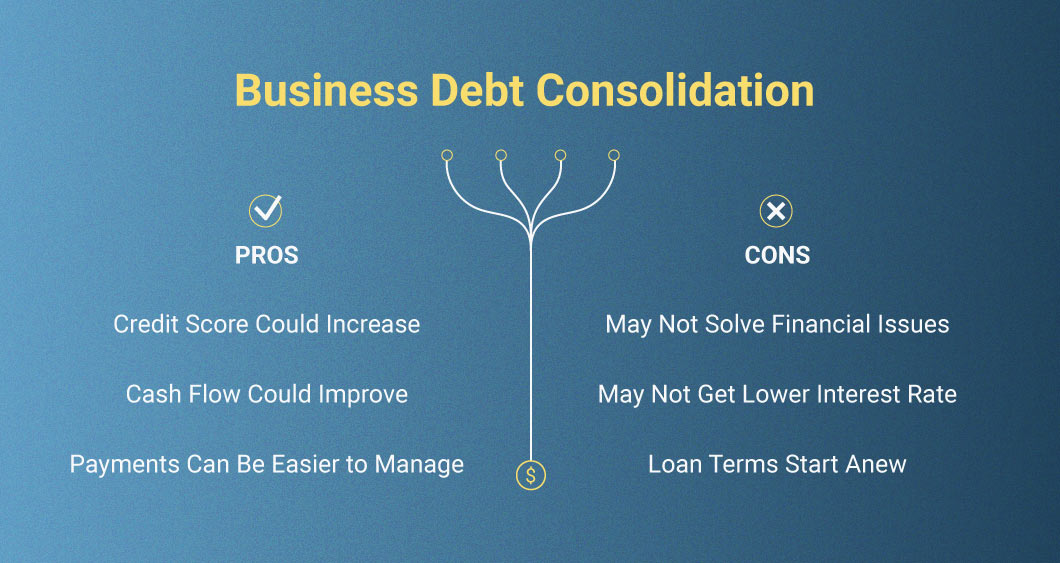

Pros

Credit Score Could Increase: While your credit score might take a hit initially because you’re taking out more credit (and closing existing loans), over time, your score could improve if your consolidation loan is more manageable. After all, on-time payments are a key factor in determining credit score.

Cash Flow Could Improve: If you’re able to garner a better interest rate, your payments could go down, which could improve your business cash flow. Such a financial boost could help you dedicate resources to other areas of your business you may have been previously neglecting when you were overrun with multiple loan payments.

Payments Can Be Easier to Manage: If you’re able to consolidate all your business debts into a single loan, you only have 1 loan, interest rate and repayment term to worry about. That’s less opportunity to miss a payment and more opportunity to stay current and focus on what really matters – running your business.

Cons

May Not Solve Financial Issues: While there are great benefits of debt consolidation, there are also drawbacks, including the fact that if you didn’t have a great handle on your finances before consolidation, things won’t suddenly change once you consolidate.

If you could benefit from help managing your finances, consider seeking assistance through a nonprofit business organization, such as SCORE, which offers educational resources and support in this regard.

May Not Get Lower Interest Rate: Keep in mind, consolidation is not the same as refinancing. While you could get a lower interest rate when you consolidate, the primary goal is to go from having multiple loans to having just 1 loan. If debt consolidation is going to mean you’re paying a higher interest rate, it may not make sense for your business.

Loan Terms Start Anew: Because consolidating debt means you’re taking out an entirely new loan, your loan terms start over. That means you could be paying more in interest over the term of the loan in spite of garnering a lower interest rate. So be sure to review your offer in detail before proceeding and consider using a debt consolidation loan calculator to weigh your options.

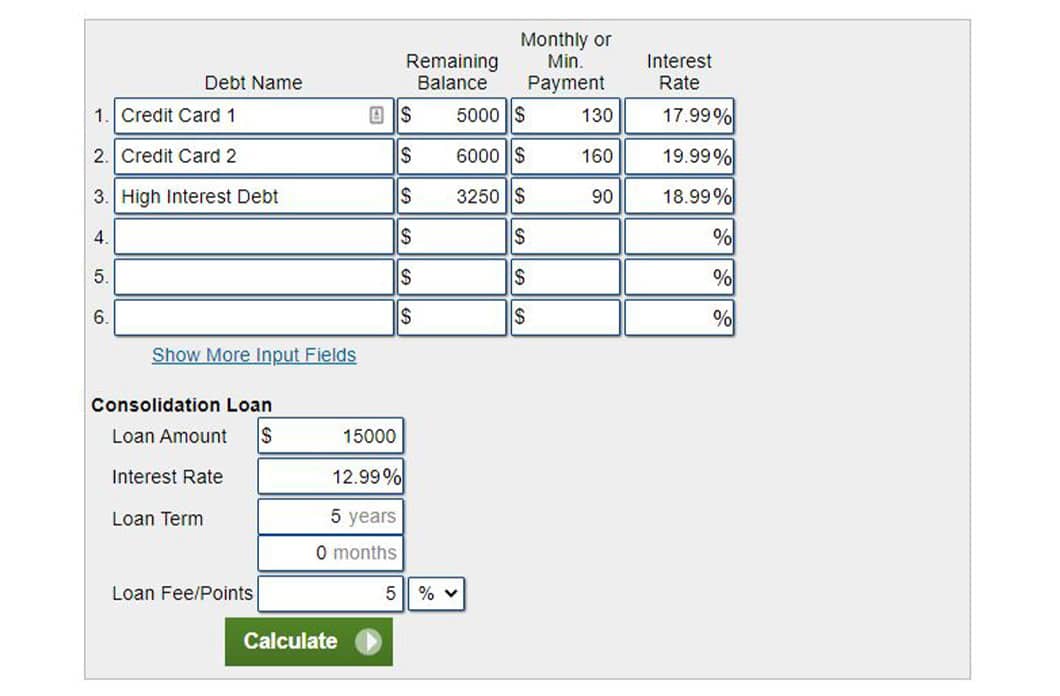

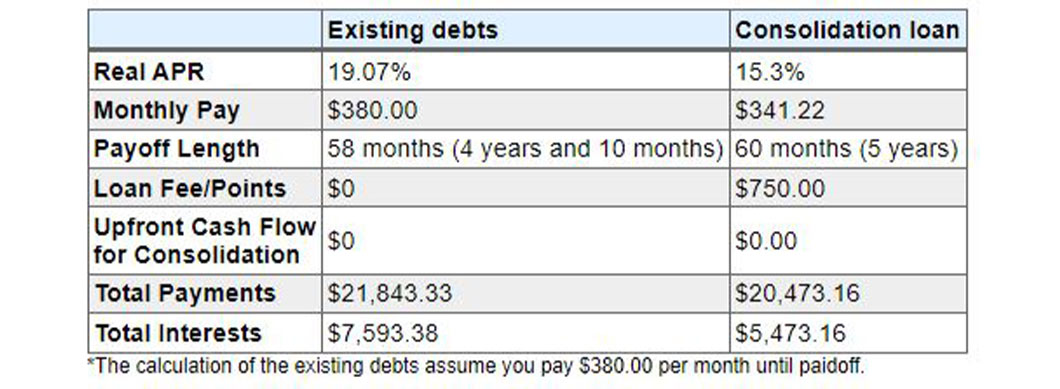

Below is an example comparison between the terms and payments of 3 existing loans and a debt consolidation loan using a debt consolidation calculator. The first image shows the inputs of the existing loans and the consolidation inputs, including balances, minimum payments, interest rates and term. The second image shows the comparisons of the existing debt vs. consolidated loan after calculations.

Best Loan Types for Business Debt Consolidation

When you’re looking to reduce your business debt, only a few loan types allow you to consolidate properly. For example, short-term business loans, typically meant to be paid in 18 months or less, are excellent for small projects and infusions of working capital but aren’t necessarily the best approach for unifying all of your debts into one loan.

Instead, entrepreneurs looking to consolidate their business should consider term loans or SBA loans.

Conventional Term Loans

Typically, a term loan is the best option for businesses looking to consolidate. Term loans can offer competitive interest rates with longer repayment terms, typically less than 10% interest for around 10 years. Chase, for example, offers small business loans to consolidate debt with terms up to 7 years and fixed monthly payments.

SBA Loans

If a business owner is unable to secure a term loan, the next option is typically pursuing an SBA loan, which is intended for owners who may not meet the requirements for a conventional bank loan but still have relatively good credit (i.e., minimum of 620-650).

One of the most popular programs, an SBA 7(a) loan, offers terms up to 25 years with amounts as high as $5,000,000 and interest rate maximums ranging from 8.25%-11.25% for fixed-rate loans.

Manage Business Debt Consolidation Loans With Care

Managing debt is a key element of running a successful operation. While taking on debt can, at times, be the best way for your business to grow, it can also hinder your ability to hit the next stage of growth.

Ensure the most successful outcome for consolidating debt by paying off your existing loans immediately after receiving your consolidation loan funds. Also, set up automatic payments if you can and be sure to create (and stick to) a budget to keep your business finances on track. Keep an eye on your debt-to-income ratio and continue to find ways to reduce your debt too.

Ultimately, if your business manages multiple debts, it could make sense to consolidate if you’ll pay the same or less money overall. However, depending on your circumstances, if you need to centralize your debts to improve your operational cash flow, spending a bit more over the long term might be worth it. Consider speaking with an accountant to determine if commercial debt consolidation makes sense for your business.