Having a business credit card with stellar rewards can help push your small business to the next level. You can pour the points or cash-back rewards you earn right back into your company.

But which are the best business credit cards for small businesses? Four come to mind:

- Chase Ink Business Unlimited

- Chase Ink Business Cash

- Capital One Spark Cash for Business

- American Express Blue Business Plus Credit Card

Each card made our list for a specific reason. Here are the best credit cards for small business owners.

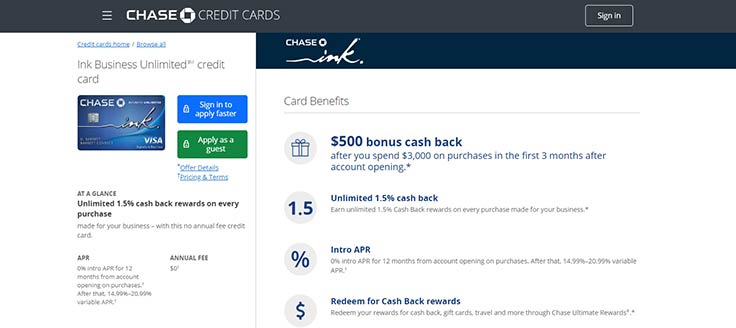

Best Rewards: Chase Ink Business Unlimited

What makes Chase’s rewards program special? It offers one of the best small business credit card rewards programs.

For starters, you’re able to earn 1.5% cash-back for every business-related purchase you make. If you spend $3,000 in the first 3 months of opening your account, you get a $500 bonus cash-back.

You’ll earn points when employees use their cards (which you can avail at no additional cost). Also, your reward points won’t expire as long as you don’t close your account and are in good standing with Chase.

What makes Chase Ink Business Unlimited even better are the flexible options you have at redeeming your rewards.

There are 4 ways to redeem rewards:

- Cash Back — You can have your cash applied to your balance or have it deposited into a checking or savings account.

- Travel — You can book flights with Chase Ultimate Rewards or redeem points on car rental or hotel accommodations.

- Apple Ultimate Rewards Store — Use your rewards to pay off your Apple purchases.

- Gift Cards — You can convert your rewards into gift cards. Use them for yourself or give them away to employees or customers.

If you refer other businesses to sign up for an Ink Business Unlimited Card, you can earn $150 cash-back for each (up to $750 per year).

On top of that, you get the following travel and purchase perks:

- Auto Rental Collision Damage Waiver — You can charge car rental costs to your card and forego the rental company’s collision insurance. If you fall victim to car theft or collision damage, you’re covered up to the cash value of the car in the U.S. or abroad.

- Travel and Emergency Assistance Services — If you’re in a bind while on the road, you can call the benefit administrator for legal and medical referrals. You also can contact the administrator for other travel emergencies. This doesn’t cover the cost of the services provided, though.

- Roadside Dispatch — Do you need your car towed? Having mechanical issues? You can call 1-800-847-2869 anytime for assistance. You will shoulder the cost.

- Purchase Protection — If you use your card to buy items, you’re given 120 days of protection against theft (up to $10,000 per claim and $50,000 per account).

- Extended Warranty Protection — You’re able to extend the warranty of your purchases by 1 year on eligible warranties of 3 years or less.

There is no annual fee.

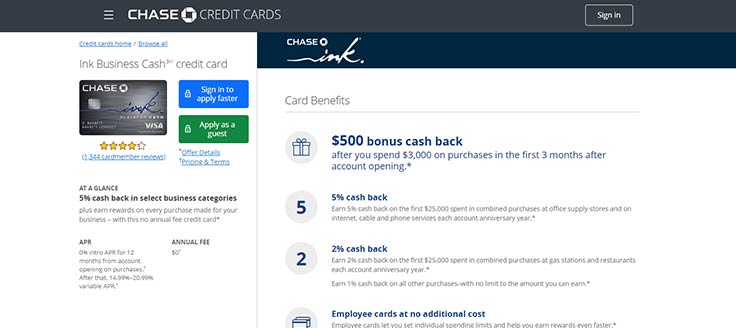

No Annual Fee: Chase Ink Business Cash

The Chase Ink Business Cash credit card features many similarities with Chase Ink Business Unlimited.

It has the same $500 bonus cash-back program after you spend $3,000 in the first 3 months. It also allows you to claim the same rewards. You get the same travel and purchase coverage provided by Chase Ink Business Unlimited.

More importantly, Chase Ink Business Cash has the same 0% intro annual percentage rate (APR) for the first year (14.99%–20.99% variable APR afterward) and a 0% annual fee.

What makes this card great for small businesses is its cash-back program.

- If you use it to buy office equipment, you get 5% cash back once you hit $25,000 the first time.

- This also applies to your internet, cable and phone service expenses.

- If you use the card at gas stations and restaurants, you get 2% cash-back on the first $25,000 in combined purchases.

- For other types of purchases, you get a 1% cash-back with no limit on the amount you earn.

This makes Chase Ink Business Cash an ideal card for those who are looking to purchase supplies for the office. It’s also great for those who frequently are using their cards to treat clients to lunch or dinner.

Chase customers give the Chase Ink Business Cash an average rating of slightly more than 4 stars out of 5.

There is no annual fee.

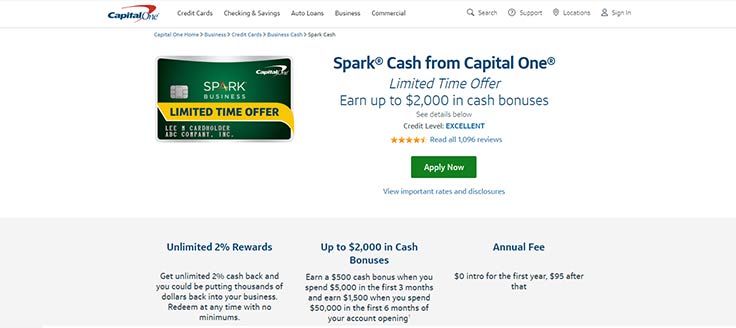

Best Cash-Back Rewards: Capital One Spark Cash for Business

The Capital One Spark Cash for Business card has an annual fee of $95 after your first year (the fee is waived for the first year).

Certainly, this is one of the best cash-back credit cards for small businesses. Here’s what you get with Spark Cash for Business:

- Unlimited 2% Rewards — You get 2% cash-back with no minimums required. You can redeem your rewards at any time. You’re able to put money back into the business whenever you need more working capital.

- $500 Cash Bonus — Get $500 if you spend $5,000 in your first 3 months after opening an account.

- $1,500 Cash Bonus — If you spend $50,000 in your first 6 months, Capital One will give you $1,500.

Spark Cash has other features, including:

- Year-End Summaries — Capital One will provide you an itemized spending report so you can budget and plan expenses more efficiently. This also can help when preparing your taxes.

- No International Transaction Fees — Unlike some small business credit cards, purchases you make outside of the U.S. using this credit card will have zero international transaction fees.

- Purchase Reporting — You can download your purchase records in different formats, including Quicken, QuickBooks and Microsoft Excel.

- Automatic Payments — You can set your account to deduct payments automatically.

Need employee credit cards? Capital One provides them for free when you sign up. You’re able to track employee spending and set spending limits. You also earn rewards from their purchases.

You can even assign an account manager who will make purchases and review the transactions.

Users have continuous access to their accounts. You can log in through their website or install a mobile app. Should you run into any issues, you can contact Spark representatives for help.

Spark has security features that can ease your worries. If Capital One detects an unauthorized charge, they will send you an email or text. You also won’t be responsible for charges made if your card gets lost or stolen. You also have the option to lock credit cards right from the app if they’re misplaced, lost or stolen.

If you don’t travel often and would prefer a cash-back reward system, the Spark Cash for Business might be the ideal credit card for your business.

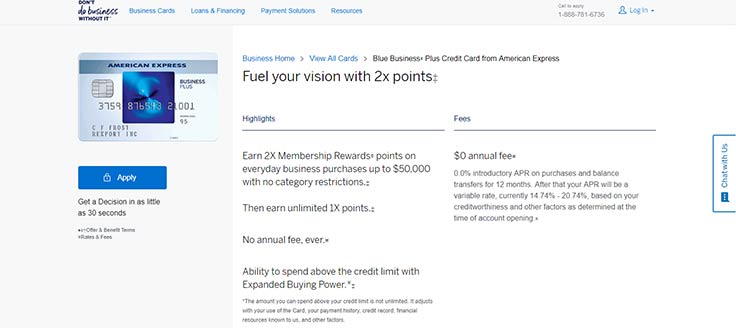

No Credit History: American Express Blue Business Plus

Seeking the best credit card for small businesses with no credit history? The American Express Blue Business Plus credit card offers businesses with 12 months of balances without interest even if they don’t have any credit history. It also features one of the lengthiest 0% introductory APR periods in the market.

There’s more to this credit card than that. Other features include:

- 2-Times Reward Points — You get 2-times membership reward points for purchases up to $50,000. There are no category restrictions, meaning you can use the card to purchase any item and still earn points. Once you reach the $50,000 mark, you can earn unlimited 1x points.

- Expanded Buying Power — With American Express Extended Buying Power, you’re able to make purchases beyond your credit limit. And you can do so without having to worry about penalties. However, you don’t have unlimited buying power. How much you can spend will depend on many factors, including your payment history and credit record.

- 0% APR for 12 Months — The APR period covers both purchases and balance transfers.

- Connect to QuickBooks — Easily manage your transactions by enrolling your account in QuickBooks.

- Account Manager — You can assign a manager to oversee your transactions on your behalf.

- Employee Credit Cards — You can supply your employees with credit cards and get the rewards.

- Vendor Pay by Bill.com — Use your credit card to pay bills with Vendor Pay.

- 24/7 Live Chat Support — Get someone on the phone if you need help. Have access to American Express Global Assist when you travel abroad and need emergency assistance (medical, legal, passport replacement and similar services).

The Blue Plus Business credit card has no annual fee.

Note that you’re charged 2.7% for transactions you make outside the U.S.

Looking for a step-by-step guide covering how to qualify and apply for a business credit card? We’ve got a blog post on the matter.