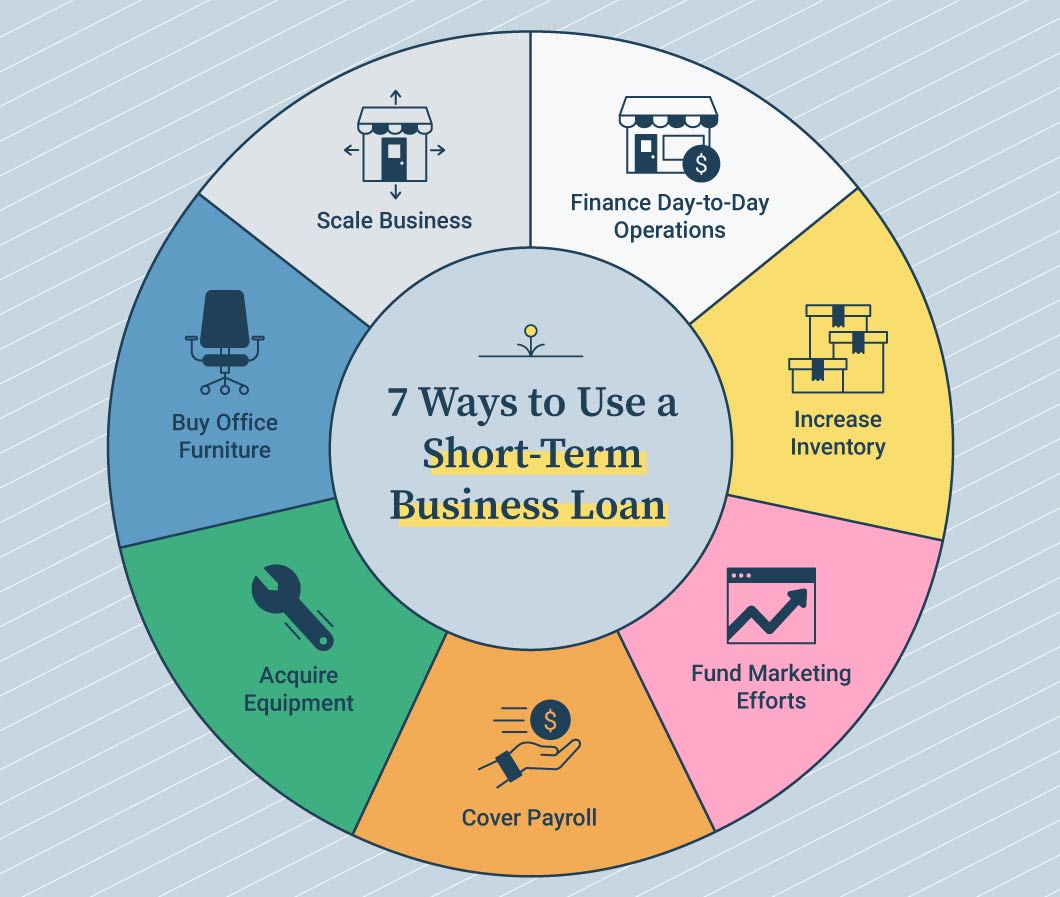

Short-term business loans are fast to fund and often have terms ranging from 3-18 months. As such, they’re best used for temporary needs and aren’t designed to finance long-term ventures.

Here are some of the top short-term loan uses as shared by actual small business owners, founders and executives.

1. Finance Day-to-Day Operations

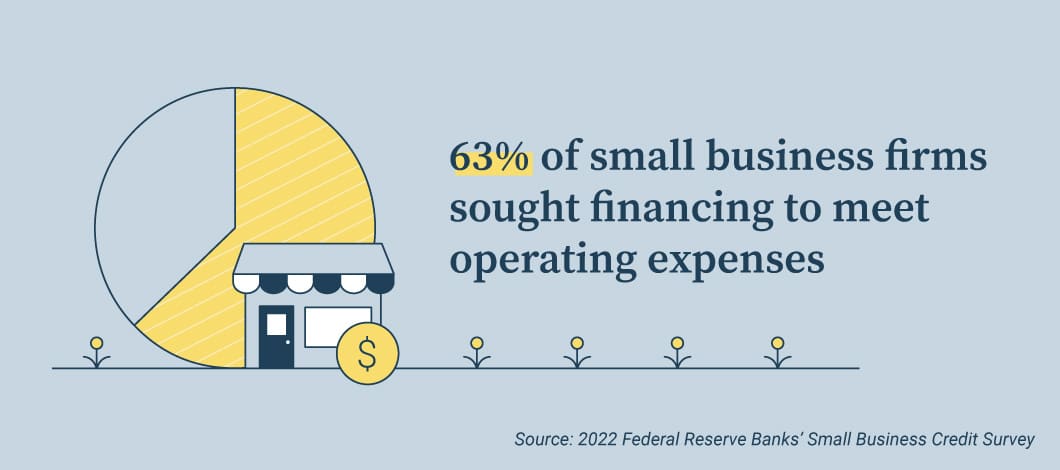

According to the 2022 Small Business Credit Survey, 63% of firms surveyed indicated they sought financing to meet operating expenses.

This is the reason Vlad Cristea, CEO of Branziba, took out a short-term loan, which Cristea mentions has had a positive impact on his marketing agency.

“We’ve used the money mostly to fund our day-to-day operations (such as paying for advertising, paying salaries and other invoices).”

Cristea notes his company always pays back the business loan the following month.

“We’ve been growing consistently since we started using business loans to fund our operations,” adds Cristea.

2. Increase Inventory

Founder of AtPerry’s, Perry Valentine, says, “As an entrepreneur, one of the best uses of short-term financing is to increase your inventory at peak seasons.”

Valentine shares he took out a short-term business loan from an online lender with a loan term length of 6 months. The purpose? To increase inventory before the Christmas season.

“During this time, our supplier offered us a large discount given that we can purchase a certain amount of products at short notice. Since our peak season was already coming, we decided to take this opportunity and take a loan to cover our financing needs.”

“By taking this loan and maximizing the discount given to us by our supplier, we were able to dramatically increase our sales last holiday season,” notes Valentine.

He says these efforts led to an ROI of 8%.

3. Fund Marketing Efforts

Like many businesses, RevenueGeeks was feeling the effects of the pandemic.

“Business was slow, and sales had taken a dip because we were losing a lot of customers,” notes co-founder Elise Bender.

“We came up with a robust marketing strategy in order to attract and retain our customer base,” says Bender. However, “The new campaign was put on hold because of a lack of capital since we weren’t generating any significant revenue.”

In late 2021, RevenueGeeks took out a short-term business loan with a repayment term of 8 months and used the money to fund its marketing campaign.

Of the campaign’s success, Bender shares the company was able to attract new customers and kickstart sales again.

4. Cover Payroll

Bishal Biswas, CEO of Word Finder, says during the pandemic, “There came a point where I had to decide between either paying my employees or laying them off. As a small business, I couldn’t afford to fire them.”

He says, “Instead, I borrowed short-term business loans to ensure that all my employees got their salaries on time.”

“This had a positive impact on my business in terms of employee retention. My workers trusted me to be there for them through thick and thin. As a result, it increased their satisfaction rates and boosted their morale.”

“Additionally, my employees were more engaged and determined to work because they saw how I didn’t fire them despite the pandemic,” shares Biswas. “This led to an increase in my company’s productivity and overall sales.”

Do you need a short-term loan?

5. Acquire Equipment

Aviad Faruz, CEO of Faruzo, shares, “As a result of the pandemic, my business suffered a lot. In order to cope with the loss and recover the expenses incurred, I opted for business lines of credit.”

“This loan suited my situation most, and one of the biggest advantages was that interest only accrued on the portion of [the] loan accessed,” notes Faruz.

“We took out this loan for a period of 12 months and it gave us remarkable outcomes.”

Faruz goes on to say, “Having access to capital helped us recover from the losses and provide proper equipment to employees so that they could adapt to work-from-home practices.”

“The return on investment was seen in the form of improved productivity, leading to profits and low employee turnover.”

6. Buy Office Furniture

Sonia Navarro, founder of Navarro Paving, shares, “The pandemic truly hit my business like a ton of bricks. I faced many financial issues and had trouble keeping my business afloat. Getting approved for a loan had been on the top of my to-do list for quite some time, and I recently found success in this regard.”

Navarro says, “I took out a short-term business loan to buy some extra furniture for my office. The loan runs for one year, and I pay it in equal monthly installments.”

“I invested the money buying office chairs, desks, file cabinets and lounge seating. I had multiple employees to onboard in the coming weeks, and I simply couldn’t afford not to have proper seating space for them.”

“The return on investment was excellent for me, primarily because I made the most of the furniture and purchased enough for my new employees,” notes Navarro.

7. Scale Business

CEO of Abrams Roofing, Kim Abrams, took out an 8-month business loan and used the funds to scale the business and enter different market niches.

“The access to capital allowed me the much-needed flexibility to streamline my business processes both internally and externally,” says Abrams.

Abrams was able to make investments that generated stable returns. Those funds were then used to integrate advanced technology into the company’s system processes.

According to the Small Business Credit Survey, expanding business or pursuing new opportunities was a reason 41% of firms sought financing.

Related: Best Short-Term Loans: Consider These 16 Top Providers of Financing