Is Bank of America (BofA) a good choice for your business? Use our Bank of America review to help you decide. This guide starts with a general overview of what types of services Bank of America provides and their general pros and cons. Then we detail the different small business services they offer, including checking, payment solutions, credit cards, loans and rewards programs. Use this information to help you decide whether they’re a good fit for your business needs.

Bank of America: An Overview

Bank of America is one of the oldest banks in the United States. Its roots lie in multiple predecessor organizations, dating as far back as 1784.

The present Bank of America has operated out of Charlotte since the 1999 merger of Bank of America with NationsBank. In 2021, Bank of America operated about 4,200 retail financial centers and 17,000 ATMs in the U.S. Its operations extend through the U.S. and U.S. territories and into about 35 countries.

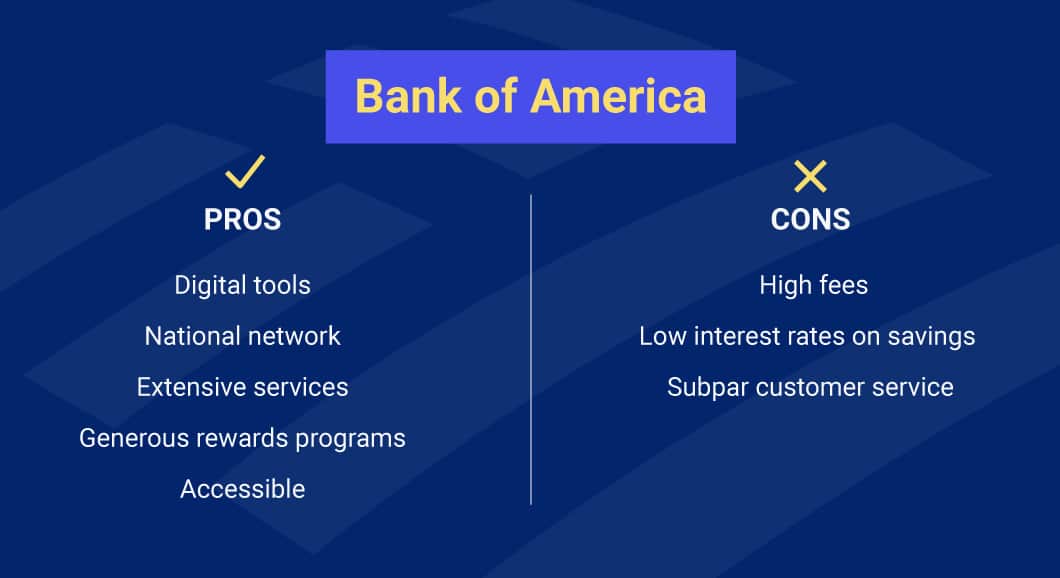

Bank of America Pros and Cons

Bank of America offers several major benefits for small businesses. They combine superior digital banking tools with an extensive national network of brick-and-mortar locations, making them accessible both online and off. They deliver a wide range of services for businesses, they have valuable rewards programs and they don’t have high requirements to open accounts.

On the con side, Bank of America’s fees can be high if you don’t meet requirements for waiving fees, and like many brick-and-mortar banks, their savings accounts don’t offer particularly high interest rates. Additionally, Bank of America reviews on sites such as the Better Business Bureau include a significant number of complaints about customer service issues. Many of these complaints revolve around online customer service problems such as long wait times. To avoid issues stemming from being limited to online support, we recommend that you develop a relationship with a contact at your local Bank of America branch if you choose to do business.

Bank of America Business Banking Services

Bank of America small business banking services include:

- Checking accounts

- Payment solutions

- Zelle digital payments

- Credit cards

- Loans

- Cash flow management tools

- Preferred rewards programs

Let’s look at what Bank of America offers in each of these areas.

Bank of America Business Checking

Bank of America offers a Business Advantage Banking checking account service designed for small businesses. This Bank of America small business account comes in a couple of varieties:

- Business Advantage Fundamentals Banking

- Business Advantage Relationship Banking

These business checking accounts can be opened online, by calling a phone number or by visiting a Bank of America location. Bank of America business account requirements to open either type of account online include:

- Having a business entity such as a sole proprietorship, limited liability company or corporation

- Name and title for person opening account

- Name and address of account entity

- Identifying information such as name, date of birth and Social Security number for each owner and controller of your company

- Certification of accuracy of information provided

Holders of Fundamentals Banking and Relationship Banking accounts can switch between these BofA business checking options at any time.

Business Advantage Fundamentals Banking

The Business Advantage Fundamentals Banking option includes:

- Bank of America’s Cash Flow Monitor mobile and online portal for viewing category balances, tracking transactions and making cash flow projections

- Support from the Erica voice assistant

- 200 teller transactions and checks written per month with no fee

- Mobile Check Deposit feature which lets you deposit checks from your smartphone by taking pictures

- Zelle digital payments service for transmitting and receiving business payments

- Incoming wire and stop payment options for varying fees

- Fraud safeguards

- Dedicated support from small business specialists

- Additional Business Advantage Fundamentals Banking accounts available for $16 a month

- Business Advantage Savings accounts for $10 a month

- Integration with QuickBooks for streamlined bookkeeping management for $15 a month

A Business Advantage Fundamentals Banking account costs $16 a month. However, Bank of America business account fees for Business Advantage Fundamentals Banking accounts can be waived by keeping an average balance per month of $5,000, calculated by combining amounts from a Business Advantage Fundamentals Banking account and other eligible accounts, or by spending $250 or more in new net qualified purchases using a linked Bank of America business debit card.

Business Advantage Relationship Banking

The Business Advantage Relationship Banking account includes all the basic features of the Business Advantage Fundamentals Banking account as well as some advanced benefits:

- 500 teller transactions and written checks per month without a fee

- No fees for electronic deposits, incoming wires, stop payments and certain other services

- Customized account access per employee

- QuickBooks integration for no fee

- A free additional Business Advantage Relationship Banking Account and a Business Advantage savings account

A Business Advantage Relationship Banking account costs $29.95 a month. However, this fee can be waived by retaining a combined average balance of $15,000 a month.

Bank of America Payment Solutions

Bank of America’s small business solutions offer merchant services to help companies accept payments.

Merchant service offerings include:

- Ability to accept payments online, over the phone or in-person

- Point-of-sale hardware and software for accepting credit cards

- U.S.-based 24/7 technical support

These merchant services are only available to merchants with domiciles in the U.S.

Bank of America Zelle Digital Payment Services

Bank of America small business online banking services include the ability to use Zelle to send, request or receive money transfers between eligible bank accounts in the U.S. Senders can select recipients from a contact list, select amounts, attach an optional note and click a button to authorize the transfer. Customers have the option of sending money using a Quick Response (QR) code you provide them. Transactions typically can be completed within minutes. Information is kept private to keep transactions secure.

Bank of America business customers can use Zelle free through a mobile app or online portal. For Bank of America customers to use Zelle, both sending and receiving parties must have a mobile phone number or email registered with Zelle through their respective financial providers. Small business customers can send up to $15,000 daily.

Bank of America Small Business Credit Cards

Bank of America offers a variety of credit cards for small businesses. Options include:

| Introductory APR | APR | Reimbursements | |

| Business Advantage Unlimited Cash Rewards Mastercard credit card | 0% for first 9 months | Prime plus 8.99% to 18.99% |

|

| Business Advantage Customized Cash Rewards Mastercard credit card | 0% for first 9 months | Prime plus 8.99% to 18.99% |

|

| Business Advantage Travel Rewards World Mastercard credit card | 0% for first 9 months | Prime plus 8.99% to 18.99% |

|

| Platinum Plus Mastercard Business card | 0% for first 7 months | Prime plus 6.99% to 17.99% | $300 credit statement offer |

To apply for Bank of America business credit cards, you’ll need to provide business information such as tax identification number and annual sales information, as well as personal identifying information for business owners and controllers and additional card holders.

Need fast financing?

Bank of America Loans

Bank of America offers a number of small business loan products, including:

| Amount | Interest | Terms | Eligibility | |

| Secured lines of credit | From $25,000 | Starting at 3.75% | Revolving with annual review | 2 years in business under existing ownership and $250,000 in annual revenue |

| Unsecured lines of credit | From $10,000 | Starting at 4.5% | Revolving with annual review | 2 years in business under existing ownership and $100,000 in annual revenue |

| Secured term loans | From $25,000 | Starting at 3.5% |

|

2 years in business and $250,000 in annual revenue |

| Unsecured term loans | $10,000 to $100,000 | Starting at 4.75% | 12 to 60 months |

|

| Commercial real estate loans | From $25,000 | Starting at 3% |

|

2 years in business and $250,000 in annual revenue |

| Equipment loans | From $25,000 | Starting at 3% | Up to 5 years when collateralized | 2 years in business and $250,000 in annual revenue |

In addition to these offerings, Bank of America offers financing for healthcare practices, SBA loans and auto loans.

To assist customers considering business loans, Bank of America provides free access to Dun & Bradstreet business credit scores for small business clients based in the U.S.

Bank of America Cash-Flow Management Tools

Bank of America supports customers with online and mobile tools to manage cash flow. The Cash Flow Monitor tool allows businesses to track credits and debits, set alert thresholds and make cash-flow projections. Bank of America’s digital dashboard syncs with apps such as QuickBooks Online, ADP Payroll and Google Analytics. You can track key performance indicators and project trends using these features.

Bank of America Preferred Rewards for Businesses

Bank of America lets small business clients participate in its Preferred Rewards for Businesses program. Benefits include:

- No fees for select banking services

- Monthly savings on select banking services with no maintenance fees on up to 4 checking accounts, plus no fees on wire transfers, stop payments and other services

- Interest rates of 5% to 20% higher on Business Advantage Savings Accounts

- Bonus rewards of 25% to 75% on eligible business credit cards

- Lower interest rates on new Business Advantage lines of credit, term loans and secured loans

- Rewards are tiered based on how much you maintain in your checking account. The lowest tier requires a balance of $20,000.

Is Bank of America Right for Your Business?

Bank of America offers businesses a wide range of services, including checking accounts, merchant payment solutions, credit cards, loans and rewards programs. It combines these services with strong digital support tools and a wide network of physical locations. On the downside, fees can be high if you don’t qualify for fee waivers, while savings account interest yields aren’t exceptional, and online support often falls short.

These factors make Bank of America most useful for businesses that desire local support, which would benefit from access to the bank’s rewards programs or which seek to open accounts without making large deposits. But if you’re looking for high-yield savings and investment accounts, you might look into other options.