Yes, working capital loans can be a good idea for your business if used wisely. However, keep in mind that working capital loans are designed to help businesses cover operating expenses over the short term. These expenses could include payroll, rent, utilities and inventory.

When determining if a working capital loan is a good idea for your business, it’s important to consider the specific type of working capital loan you’re being offered and the return on investment (ROI) you’ll see from the loan.

Ultimately, will your business be able to profit from and move forward as a result of the financing? If the answer is yes, taking out a loan to support your operating expenses could be a great move.

Related: Easily Calculate Business Loan ROI

What Can Working Capital Loans Be Used for?

In general, a working capital loan, which could be one of several different types of short-term financing options, can come in handy any time you find yourself running low on short-term cash or you’re anticipating an increased expense that would strain your cash flow.

These are just some scenarios where your company might require a quick cash-flow injection through a working capital loan:

Emergencies

One working capital loan use is if you need extra cash to cover an emergency cash-flow crunch resulting from unexpected expenses or slow sales. For example, business disruptions due to natural disasters or a personal health crisis can make it necessary to obtain extra funds to cover a temporary downturn in business.

Seasonal Fluctuations

Another way a working capital loan can be used is for seasonal ebbs and flows in business. For instance, if your company operates in an industry where your cash flow is subject to highs and lows throughout the year, such as retail or hospitality, this type of financing could make sense. Additionally, if you’re a manufacturer who supplies businesses with seasonal sales peaks, a working capital loan could help you too.

Business Expansion

Another way working capital loans work is by funding expansion opportunities. These might include upgrading a key piece of equipment, acquiring a larger storefront, investing in a new inventory line or financing a move into a new market.

Payroll

Working capital loans are also used for covering worker salaries. This could be if you just hired a new employee with a high salary and your payroll costs have increased or if you need to cover your existing payroll during a slow month.

Maintenance Costs

Running a business sometimes requires you to pay for maintenance and repairs of your office, storefront or vehicles. Whether the repairs were expected or not, a working capital loan can help you cover the costs.

-

Need a Working Capital Loan?

At Fast Capital 360, our network of lending providers is able to offer a rate of interest on working capital loans as low as 7%. Use our business loan calculator to estimate your costs.

We’re able to offer loans for working capital to borrowers who meet the following minimum criteria:

- 6 months in business

- $200,000+ in annual revenue

- 550+ credit score

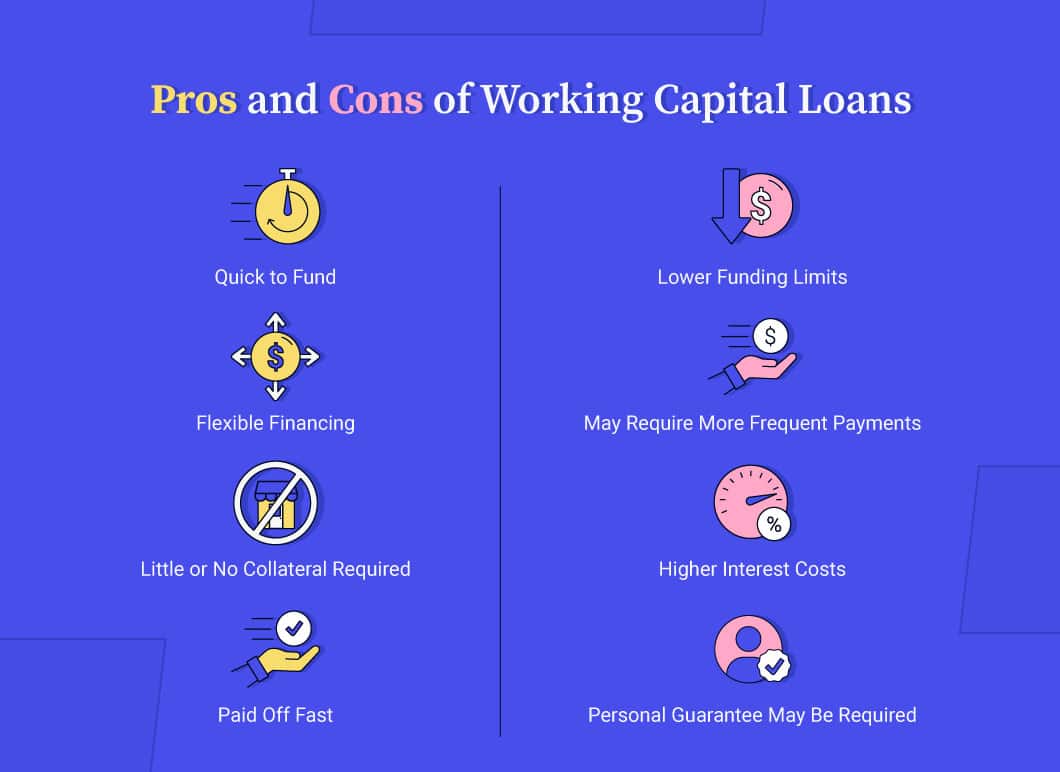

What Are the Pros of a Working Capital Loan?

With nearly one-quarter of U.S. small businesses stating they don’t have enough liquidity to get through the next 12 months, according to a recent working capital survey, it’s important to weigh the benefits of a working capital loan.

Some of the advantages include the following:

Quick to Fund

Funding for working capital loans can be available fast, in some cases as soon as the same day as approval. Compare this to other business loans, which could take more than a month to fund.

Flexible Financing

Though you should reserve working capital loans for temporary expenses, working capital loans typically have no limits on their uses. The choice is yours.

Little or No Collateral Required

Though you may need to provide collateral in some circumstances, working capital loans are often available without a collateral requirement.

Paid Off Fast

Working capital loans can be repaid faster than long-term loans, which means you’re not on the hook with loan payments for an extended period of time.

What Are the Cons of Working Capital Loans?

While working capital loans have advantages, they can also come with some trade-offs. Whether these will outweigh the benefits will depend on your needs and what type of specific working capital financing option you select.

Here are a few of the drawbacks to consider:

Lower Funding Limits

Working capital loans generally have lower limits than long-term financing options. As such, they’re less suitable for expenses that would benefit from an extended repayment period, such as commercial real estate investments or vehicle purchases.

May Require More Frequent Payments

Some types of working capital loans and financing options, such as accounts receivable financing and merchant cash advances, may require you to make frequent payments (e.g., daily or weekly), which can diminish your future cash flow while repaying your debt. That said, consider the lender’s method of lending working capital when making your decision.

Higher Interest Costs

Because working capital loans are typically short-term, the interest on working capital loans is often higher than that of long-term loans. Interest rates were indeed a concern for 46% business owners seeking financing, according to the previously noted working capital survey.

Personal Guarantee May Be Required

While many working capital loans do not require a borrower to pledge assets in the form of specific collateral, lenders may require a business owner to provide a personal guarantee. However, this is fairly common with many business loan types.

Is a Working Capital Loan Right for Your Business?

If you’re facing cash-flow concerns and need financing now, a working capital loan may be a good idea for your business. After all, loans for operating expenses are common in the U.S., so much so that 62% of small business firms surveyed sought funding to cover working capital needs, such as wages, rent and inventory costs.

When determining if a working capital loan is right for you, be sure to compare your options. Review the specifics of any working capital loans you’re seeking, including repayment lengths, interest rates and funding amounts, to determine the best fit for your small business.