Amazon’s business line of credit is a great fit for small to large businesses and organizations that rely on purchases from the online retailer to keep operations running smoothly.

We’ll go over the Amazon Corporate Credit Line program — what it is, what it’s for, how to apply and how much this financing will cost you. Plus, see the pros and cons. Also, discover other business lending options that are worth exploring.

Amazon Corporate Credit Line: How It Works

Amazon’s business lines of credit only work with Amazon Business or Amazon.com purchases.

Here are some details to keep in mind regarding Amazon’s credit line for businesses:

- Payments aren’t as flexible when compared with a revolving credit line because debt payments are due in full every billing cycle. As such, The Amazon.com Corporate Credit Line may be most appealing to large businesses, schools, government institutions and other organizations that can afford to pay in full.

- Users have 55 days to pay their invoices.

- Users receive a comprehensive monthly billing statement with a breakdown of every product purchased. This could simplify reconciliation.

- Accounts can be set up by department or location. For example, the human resource department can order supplies when it needs to. Or, if you have 2 branches, the satellite office can order items without relying on the main branch.

- Dedicated account management is available to customize billing or manage the Amazon business line of credit.

Additionally, keep in mind there are certain products that you can’t buy using the Amazon Corporate Credit Line. These include the following:

- Cell phones associated with a plan

- Textbook rentals

- Electronic documents

- Video games and software downloads

- Digital newspaper and magazine subscriptions

- Amazon Prime memberships

- “Subscribe & Save” and “Recurring Delivery” orders

- Print-at-home and emailed Amazon gift cards

Gaining Amazon Corporate Credit Line Approval

Be sure to understand the requirements and costs involved with an Amazon business line of credit. Below is a quick overview of what you can expect when you’re ready to apply for Amazon’s corporate credit line.

Qualifications

Businesses that have been in operation for at least 2 years have a better chance of qualifying for Amazon’s Corporate Credit Line.

Additionally, you may need to personally guarantee the account, meaning you’d be responsible if your company can’t pay its debt.

It also helps if you have an established credit history or a business credit rating. Remember: You can’t use your credit line for personal expenses. Amazon only allows business-related purchases on Amazon Business or Amazon.com.

Costs

The good news is that the Amazon business line of credit plan doesn’t charge an annual fee, and there’s no annual percentage rate because it’s a pay-in-full program.

In other words, you’re expected to pay the balance in full at the end of each billing cycle. A returned check fee will set you back $29, though. Additionally, it’s been reported there’s a 2% per month fee for late payments.

Payment Process

Synchrony Bank, Amazon’s credit line service partner, processes all the payments made.

You can manage your credit line by logging into your Amazon.com Corporate Credit Line account.

For queries about the pay-in-full credit line, call 1-866-634-8381 (Mon-Fri from 7 a.m. to 6 p.m. Central Standard Time).

Repayment Terms

With Amazon’s pay-in-full credit line, you have 55 days to pay once you get your invoice. Note this is a longer billing interval than most credit lines offer. However, you have to pay the full amount every time.

Pros and Cons of the Amazon Business Credit Account

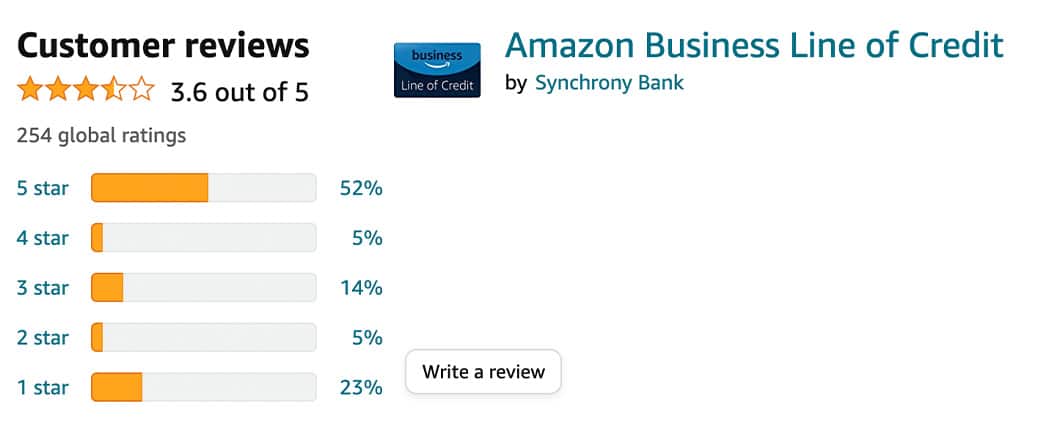

When deciding if you should apply for an Amazon corporate account credit line, keep in mind the online reviews have been mixed with a 3.6 out of 5 star Amazon rating as of Jan. 2022.

Also, consider the following benefits and drawbacks:

| Pros | Cons |

| No interest | Restricted to Amazon purchases |

| No annual fee | Not all Amazon items qualify |

| 55-day payment terms | No rewards |

| Can set up separate accounts for different departments under the same credit line | Bill statements can be confusing, according to reviews |

Amazon Corporate Credit Line Alternatives

Here are a few credit card alternatives to Amazon’s business credit line:

Amazon Business American Express Card

The Amazon Business Prime American Express Card offers 5% back or 90-day terms for the first $120,000 in purchases on Amazon Business, AWS, Amazon.com and Whole Foods Market with an eligible Prime membership, with 1% back thereafter.

There are other perks outside of Amazon. You get 2% back on purchases from U.S. restaurants, gas stations and wireless telephone services. For other purchases, you get 1% back. Eligible Prime members get a $125 Amazon Gift Card upon approval.

You can redeem rewards when you shop on Amazon.com or Amazon Business. Or you can apply them instead toward purchases on your balance statement. And when you’re using this Amazon business card, there are no foreign transaction fees.

The card comes with all the other features you expect from American Express, such as expense management tools and 24/7 support.

Additionally, there’s also the Amazon Business American Express Card, which has many of the same features as its Amazon Prime counterpart.

However, you only get 3% back or 60-day terms. Also, you can get a $100 Amazon.com gift card upon approval.

There is no annual fee for either card, and the APR is a variable rate of 14.24%-22.24%.

Blue Business Plus Credit Card from American Express

While the Blue Business Plus Credit Card doesn’t offer Amazon-specific perks, it boasts attractive features.

First, you get double the reward points on everyday purchases regardless of what category it falls under (up to $50,000 each year). Once you meet the maximum amount, the points go down to 1X. Also, there’s no annual fee. You get 15,000 extra reward points when you spend $3,000 on eligible purchases within your first 3 months of getting approved.

The Blue Business Plus Credit Card allows you to go over your credit limit. The amount you’re allowed to spend over the limit depends on factors such as payment history, credit record and other considerations. It also lets you buy from other retailers. You aren’t restricted to making Amazon purchases.

If you need to give other departments or personnel the ability to buy items on your behalf, you have the option to get employee cards. Or you can designate an account manager to help you manage your American Express credit card.

There is a 0% introductory APR on purchases for 12 months after the account is opened. Then the APR will shift to a variable rate, which could range from 13.24%-19.24%.

Non-Amazon Revolving Business Lines of Credit

Another option to having an Amazon business credit limit is to apply for a revolving business line of credit that isn’t specific to Amazon. These are available through conventional lenders, such as banks and credit unions, as well as alternative lenders.

With a revolving credit line, you’re approved for a certain dollar limit, but you don’t need to use those funds right away. The credit line is there when you need it to use for whatever your business needs. As you pay down the amount you’ve drawn against your limit, your credit line is restored respective to your payments, up to the original credit line.

Interest rates on business lines of credit may range from 5% to more than 20%, depending on the lender and a borrower’s creditworthiness.

-

Fast Capital 360 brings together business line of credit lenders through one straightforward application.

Applying is fast and, most important, won’t impact your credit score.