Many small business owners find that banks and creditors ask them for a personal guarantee. Becoming a personal guarantor for your company’s business loan can bolster the odds of approval, but what does it mean for you?

We’ll cover exactly what personal guarantees are and what effects they might have on your business. We’ll go over the details of personally guaranteed loans, what benefits they offer and what risks they might pose.

Personal Guarantee: A Definition

A personal guarantee is an individual’s promise to repay credit borrowed by a business for which they are a part, either as an executive or a partner. Therefore, if the business can’t pay the debt, the individual who signed the personal guarantee — the personal guarantor — is liable.

A personal guarantee improves your chances of getting approved for a loan. When you, rather than your business alone, assume liability for the debt, the lender has an extra degree of assurance regarding your intention and ability to repay the loan.

Note that in some cases, in addition to requesting a personal guarantee on a business loan in case of default, lenders may also file a UCC lien entitling them to business assets.

Why Do You Need a Personal Guarantee for a Loan?

In general, a personal guarantee reduces lenders’ risk when they fund a small business.

You’ll find a personal guarantee is often a standard requirement when you’re receiving small business financing. For instance, if you apply for financing from a Small Business Administration (SBA)- backed loan, the SBA will require individuals with a 20% or more stake in the company to take part in the personal guarantee loan agreement. Note that this depends on the loan type and amount; SBA Paycheck Protection Program loans and Economic Injury Disaster Loans up to $200,000 do not require any personal guarantee.

You also could need to enter a personal guarantee agreement in the following circumstances:

- Your financing isn’t secured with collateral

- Your business doesn’t have a high credit score or long credit history

How Does a Personal Guarantee Work?

For the most part, the application process is the same for borrowers. For example, you’ll still submit relevant financial documents and identifying information about your business. When you attach a personal guarantee to a loan or business line of credit, you’ll share your Social Security number with the lender so they can perform a full credit history and salary check to ensure they can recover the funding in case of a default.

It can be a secured or unsecured agreement, depending on if the personal guarantee specifies which personal assets (e.g., a vehicle, other property, bank account, etc.) could be remitted.

How long does a business guarantee last? In general, the personal guarantor should be released when the debt is paid in full. Review the agreements’ terms before signing to ensure you understand what happens if you default on the financing and what time frame the lender has to claim any assets for repayment.

Personal Guarantee Types

There are several personal guarantee loan types. The main options are unlimited and limited agreements. Let’s take a look.

Unlimited

An unlimited guarantee stipulates that the lender can recover the entirety of the loan amount in the event of default or business failure. Usually, this sum also includes legal fees, interest and other associated charges.

If you sign a personal guarantee and there is a business loan default, assets belonging to you or your business might be used to repay the loan to which you signed as a personal guarantor.

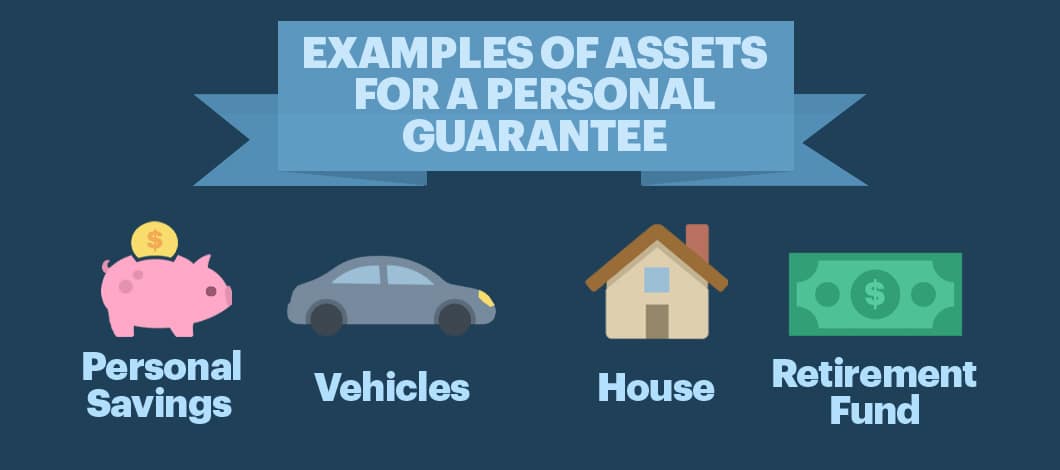

Lenders could pursue any of the following assets belonging to the personal guarantor:

- Personal savings

- House

- Vehicles

- Retirement fund

Imagine a scenario where your business borrows $100,000 from a loan for which you signed a personal guarantee. Your business pays down $20,000 but fails to make any installments after. The creditor spends $10,000 on lawyer fees to gain judgment in its favor. Therefore, you would personally be liable to repay $90,000 – the remaining $80,000 plus the $10,000 in legal costs.

Limited

A limited guarantee loan caps the amount of money collected from a personal guarantor. In many cases, limited guarantees are used for partnerships when you share the burden of loan repayment with other individuals in the company who have signed the guarantee.

The varieties of limited personal guarantee loans are described at length below. These loan types have unique benefits and drawbacks that vary according to the terms agreed upon.

Several

A several guarantee holds that each signatory on the agreement is held to a fixed share of the total liabilities incurred by the business, decided on before the loan is approved. This makes each personal guarantor aware of what amount he or she could be responsible for repaying.

A simple example, if 2 business partners agree to share an even split of the liability, then each would owe 50% of the loan if the business defaults or misses a payment.

Joint and Several

Under a joint and several personal guarantee loan agreement, each person on the guarantee can be liable for the total incurred debt. Although the lender can recover only up to the limited amount, they can collect debt repayments from any co-signers on the agreement.

Under this scenario, it’s plausible that you might be on the hook for the liabilities agreed upon by your business partner if they aren’t able to cover their portion of the debt owed.

Before agreeing on a joint guarantee loan, ensure that you understand what you’re signing and trust the word of everyone involved.

-

Be Sure to Read the Fine Print of a Personal Guarantee

Unfortunately, the distinction between unlimited and limited personal guarantee loans are not so clear-cut. Keep an eye out for inconspicuous provisions in the agreement that effectively convert a limited guarantee into an unlimited one.

Be on alert when negotiating terms for a personally guaranteed loan. To protect yourself, consider consulting with an attorney or legal professional before signing the agreement.

What Happens If You Default on a Personal Guarantee?

Once you’ve personally guaranteed a business loan, you’ve granted the lender permission to claim your assets and income to make up the cost of the loan if you can’t repay it.

Many borrowers assume that repayments on a defaulted business loan can be made on the borrower’s terms. However, the real experience often doesn’t reflect this assumption.

Instead, if you default on a personally guaranteed loan, you might be responsible for providing more than only cash or liquid assets. For example, suppose you own a trucking and logistics company with an inventory of 100 trucks, and you default on a personally guaranteed loan. The trucks and other vehicle assets could be sold as a form of repayment.

Remember that virtually all the personal guarantor’s individual property can be reclaimed and taken to satisfy the debt. Additionally, in some cases, depending on the state, debt incurred by one spouse can be owed by both spouses.

Legal Consequences

If the lender decides to pursue legal action against you or your company for a personal guarantee business loan default, then your credit history can be negatively impacted. After your business defaults on a guaranteed loan, it’s common for borrowers to be given a court order to repay the loan amount.

Consequently, credit ratings take a hit, which can hinder your chances of securing other forms of business credit or personal credit, among other things.

Mitigating Risk

Whenever possible, take precautions to ensure that the loan terms you’re evaluating are fair and equitable.

Be willing to negotiate the terms of the loan. Usually, when you meet with lenders, they’ll provide you with a standard loan agreement. This is not necessarily the final version of the agreement.

You can suggest adding new clauses or terms as you see fit. For instance, you can request that joint family or spousal assets be kept off the table.

Additionally, make sure that there are no hidden terms or questionable passages of text contained in the agreement. Be wary of overly complicated or vague language. Instead, everything should be clearly stated in terms that laypeople can understand.

Release of Personal Guarantee Obligation

In some cases, if you’re a personal guarantor and the loan goes into default, you could eliminate your obligation to repay the debt by filing individual bankruptcy (not bankruptcy on behalf of the business).

That said, if a lender has a lien on your property too, the lender could still be able to foreclose and seize collateral regardless if the personal guarantee is discharged in bankruptcy.

If you’re consulting an attorney before signing a business loan or personal guarantee agreement, request more information on this.

If a personal guarantee comes due and you’re unable to pay the outstanding debt, consider consulting with a bankruptcy attorney to determine what remedies could be available to you.

If you sell your share of the business, request a release of your personal guarantee. If the worst-case scenario arises, you don’t want to be held liable after you’re no longer part of the company. Of other note, if you’re selling your business, you may be required to pay off the outstanding debt at the time of sale.

Does Fast Capital 360 Require a Personal Guarantee?

Fast Capital 360 can require a personal guarantee from some borrowers. Financing options that can require a guarantee include SBA loans and merchant cash advances. When you apply for funding with Fast Capital 360, you can speak with a loan expert to determine what you’ll need to obtain the best terms for your business’s financing.

[/content-card[]

Is a Personal Guarantee Worth the Risk?

Personal guarantees aren’t unusual when it comes to business loans. Signing a personal guarantee can help your company gain approval for much-needed funds.

However, once your business has gained assets, you may be able to provide collateral to get a secured loan instead, which can have more competitive rates and terms. Additionally, if you build a strong credit profile, some lenders may be willing to omit a personal guarantee from an unsecured loan contract.