Wondering how to get a small business loan with bad credit? It’s not as challenging as you might think.

We’ve been conditioned to believe a low credit score is a deal-breaker when applying for small business loans. In fact, roughly 90% of firms didn’t think they’d be approved for financing because of credit issues, according to the Federal Reserve Banks’ Small Business Credit Survey.

Reasons included the following:

- Too much debt: 36%

- Low credit score: 33%

- Too new or insufficient credit history: 23%

While no lender will provide bad credit business loans with guaranteed approvals, many lenders are willing to work with subprime applicants. We’ll help you find the best secured and unsecured business loans for bad credit.

Where Can You Get a Business Loan for Bad Credit?

You can obtain one of the best bad credit business loans or financing options through alternative lenders.

Alternative lenders aren’t as risk-averse as banks and offer several choices if you’re searching for online small business loans for bad credit. They also extend capital to a broader selection of business owners.

Interestingly, instead of banks and credit unions, nearly 20% of firms in 2021 used the services of an online lender, a fintech company or finance company, according to those surveyed in the Federal Reserve Banks’ report.

Because alternative lenders generally focus more on your business’s overall financial health, your credit score isn’t the end-all-be-all for their approval criteria.

5 Lenders for the Best Business Loans With Low Credit Score Requirements

Here are a few top lenders offering bad credit business loans and financing.

1. Forward Financing

Forward Financing offers revenue-based financing to small business owners with a minimum of a 500 credit score. To qualify, applicants need at least 1 year in business and at least $10,000 in monthly revenue. Funding amounts range from $5,000-$300,000 with estimated payment terms of 3-12 months.

Forward Financing has a 4.8-star Google rating. It’s also accredited with the BBB with an A+ designation and a 4.55-star rating from customer reviews.

2. Credibly

Credibly offers merchant cash advances to applicants with at least 6 months in business and a credit score of at least 500. The business must have at least $15,000 in average monthly bank deposits to qualify. Advance amounts go as high as $400,000.

Additionally, Credibly offers business lines of credit to applicants with at least a 560 credit score and $50,000 in annual revenue. Equipment and accounts receivable financing are also available.

Credibly is accredited with the BBB and is A+ rated. The company also has a 4.8-star rating on the consumer rating platform Trustpilot.

3. Headway Capital

Headway Capital offers business lines of credit up to $100,000 with repayment terms of 12, 18 or 24 months and weekly or monthly payment options. Applicants must have at least 1 year in operation and have annual revenue of $50,000 or more.

The company states that it takes a holistic view of an applicant for business financing, understanding that a credit score doesn’t necessarily represent the overall health of a business.

Headway Capital has a 4.6-star rating on ConsumerAffairs and an A+ rating with the BBB. The company has also earned a 4.7-star rating from more than 1,300 reviewers on Trustpilot.

4. The Business Backer

This lender offers small business financing to applicants with at least a 550 credit score who have at least 1 year in business and earn a minimum of $100,000 in annual revenue. Bad credit business funding options include loans, lines of credit and purchases of receivables.

The Business Backer has a 4.7-star rating on Trustpilot and a 4.8-star rating on Facebook as well as an A+ rating with the BBB.

5. OnDeck

While OnDeck’s website notes that the company doesn’t offer “bad credit loans” per se, it does state that “a bad credit score doesn’t always mean you can’t qualify for business financing.” It also mentions that its short-term loans are an alternative for borrowers who’ve had a hard time getting traditional installment loans and credit cards.

The website lists eligibility requirements for a loan or line of credit to be at least 1 year in business, a 600 FICO score and $100,000 or more in annual revenue.

OnDeck is A+ rated by the BBB, where it’s also been accredited since 2008. Additionally, the company has a 4.8-star rating from more than 3,500 Trustpilot reviewers.

-

Getting Business Funding with Bad Credit Through Fast Capital 360

If you’re on the hunt for easy business loans for bad credit, consider alternative lender financing. Here’s how to quickly apply for a business loan with bad credit or no-collateral financing through Fast Capital 360.

Get Funding in 3 Easy Steps

- Get Preapproved

- Have lenders compete for your business to get the lowest rate.

- Review Your Options

- Receive offers from multiple lenders with one application.

- Get Funded

- Knowledgeable advisors will help you choose the best loan option.

Bad credit? No problem. Find financing options.

- Get Preapproved

What’s Considered a ‘Bad’ Credit Score?

Lenders often consider a score below 580 a “bad” credit score for business loan applicants. How do they determine this?

Credit reporting agencies calculate and interpret your score based on your financial data and borrower behavior. Your credit score then falls under a tier ranging from poor to excellent.

Lenders will judge how much risk they assume if they extend a loan agreement. Based on that risk, lenders determine the maximum funding amount they’ll offer you as well as your interest rate and repayment terms.

Credit scoring company Fair Isaac Corporation, more commonly referred to as FICO, categorizes applicants into 5 tiers based on credit score:

| Credit Score | Rating | Impact |

| > 800 | Excellent | While lenders may deny an applicant for other reasons, those with “excellent” credit are rarely turned down. |

| 740 – 799 | Very Good | With a credit score falling in this range, you’re more likely to be approved for a loan and may even have multiple options to compare. |

| 670 – 739 | Good | “Good” credit gives you a solid chance of being approved, but you might not have the luxury of weighing different options. |

| 580 – 669 | Fair | Consumers with “fair” credit may experience difficulty getting approved and incur higher interest rates and other costs. |

| < 580 | Poor | Anyone applying for small business loans with a “poor” credit score is often rejected for various financing options. |

Has your credit score seen better days?

Best 'Bad Credit' Business Loan Types

If your score isn’t where you’d like it to be, that’s OK. Here are some of the most common bad credit business loans and financing options available to you.

Short-Term Loans

Bad credit small business loan applicants with lower credit scores might find this financing option suitable.

As the name suggests, short-term loans are a condensed version of term loans.

If approved, the lender will give you a sum of money. You’ll pay off the principal and interest according to a predetermined payment schedule over a set term.

You’ll pay off a short-term loan quicker than a conventional term loan. Generally, short-term loans reach maturity in 18 months or fewer.

The Case for Short-Term Loans

Short-term business loans for bad credit can be used for nearly any company-specific purpose, making them a flexible option without a long-term commitment.

Alternative lenders offer short-term loans for businesses with bad credit because they have a lower risk profile. Simply put, there is less time for something to go wrong that could cause you to default on the loan — and less money to lose even if you do.

Because of the higher risk, there are some caveats with short-term loans. For instance, rather than monthly payments, you might have to pay weekly or even daily.

Also, as with all business loans for poor credit borrowers, approval is not guaranteed. If you’re denied a short-term business loan because of your poor score, other business funding with bad credit options are available.

Accounts Receivable Financing

Accounts receivable financing is an alternative funding product that converts outstanding invoices into immediate cash for your small business. It’s a great option for receiving the working capital you need when waiting for customer payments (and it’s another one of the best ways to get a loan with bad credit).

Accounts receivable financing companies typically pay as follows:

- You receive a business cash advance, which may be up to 90% of the total invoices you’d like to finance.

- You’ll be responsible for fees that accrue each week a balance remains. However, the remaining amount withheld from you will be paid out when the invoices are fully paid off.

If you work with clients with excellent credit scores, accounts receivable financing lenders can look past your credit challenges and get the funding you’re seeking.

The invoices secure the advance, making this form of financing self-collateralizing. So, if you’re wondering how to get a business loan with bad credit and no collateral other than your invoices, this may be the right option for you.

Equipment Financing

If your business needs to replace or add new equipment or machinery, you might consider lenders offering equipment loans for bad credit. These loans are typically secured through the equipment you’re purchasing. If you default, lenders can recoup their losses by seizing and selling the equipment.

In some cases, you could secure up to 100% of the equipment’s value, though lenders often require up to a 20% down payment.

Even with bad credit, equipment leasing and buying opportunities may still be available because of the built-in collateral.

Merchant Cash Advance

If you’re looking to get approved for a loan with bad credit, a merchant cash advance (MCA) is another alternative financing option to consider. An MCA isn’t a loan but an advance on your future sales. Depending on the specifics of your MCA agreement, a lender will draw a percentage of your daily credit card sales as payment or withdraw funds directly from your business bank account.

With this short-term bad credit business finance option, the creditworthiness of your business, while considered, is less of an approval factor. Instead, lending providers are more interested in seeing solid sales.

A merchant cash advance is one of the best bad credit business finance options for borrowers turned down elsewhere.

Business Line of Credit

A business line of credit is the most flexible funding solution, and it’s a top option when you’re in search of the best small business loans for bad credit.

Borrowers are approved for a maximum amount from which they can draw funds as needed. Interest accrues only against the capital you’ve taken out.

You typically repay the money weekly or monthly until your line of credit reaches maturity. When you’ve repaid the initial amount, you’re often free to take out more. Although some options require collateral to secure them, it’s possible to obtain an unsecured business line of credit with a bad credit score. Fast Capital 360’s lending partners, for example, will accept as low as a 560 credit score.

Business lines of credit can be used for daily working capital needs and larger projects.

-

Small Business Tip:

While business lines of credit are a great way to secure small business funding with bad credit, they don’t always help you build your score.

The same goes for other alternative funding options, such as merchant cash advances and some short-term loans. That’s because some alternative lenders don’t report to credit bureaus.

On the flip side, when a new funding offer isn’t reported to the credit bureaus, that means it’s not showing on your credit profile as additional debt.

If you want to build your credit, consider applying for a business credit card instead.

Other Factors Lenders Consider

When alternative lenders review your application, they consider many factors to determine your fundability, particularly when it comes to the best business loans for bad credit. While credit scores are typically weighted heavily in the business loan application process, other parts of your business profile also show your company’s financial health.

Here are a few things that help lenders look past your credit score:

Annual Revenue

One of the most important parts of your loan application is your business’s annual revenue. High revenue proves to lenders that you generate enough money to repay their loans.

When a business owner applies for a loan with bad credit, high revenue can help offset the risks.

Annual revenue also factors into the amount of money a lender will offer. In general, the higher the revenue, the higher the loan amount.

Profitability

Even with high revenue, lenders want to know if your business is profitable.

When lenders see that you have liquid assets to repay a loan, this will help your chances — especially if you’re looking for business funding with bad credit.

Debt Obligations

If you have less than excellent credit and outstanding loans on the books, it might be more challenging to qualify for a second or third loan.

That’s because many lenders are hesitant to enter into a “second position” loan agreement. If you already have a business loan, your lender will likely put a Uniform Commercial Code lien on your business.

This means that the first-position lender has the right to seize assets in the event of default, leaving less collateral (if any) for other lenders to recoup losses.

Cash Flow

Demonstrating that you keep enough money on hand to afford regular expenses goes a long way in helping you qualify for business financing, bad credit or not.

At the end of the day, lenders want assurances that you have enough cash in the bank to cover your debt obligations.

This is why they will commonly ask to see 4-6 months of the most recent business bank statements, depending on the kind of financing you’re seeking.

Needless to say, it’s essential to focus on increasing the balance of your bank accounts if your goal is a lower-cost loan with favorable terms, especially if you’re looking for bad credit business funding.

How Your Business Credit Score Is Calculated (And How to Improve Yours)

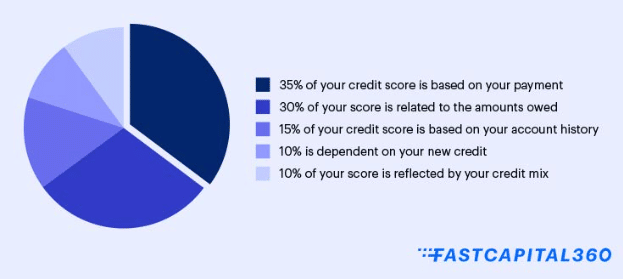

Your credit score is made up of factors such as payment history, amounts owed, new credit and credit mix.

Here’s a percentage breakdown of how FICO scores are calculated.

Payment History

Consistently meeting your minimum payments on time is the most significant factor in your credit score. Even one missed payment can be a red flag when you apply to get small business loans with a poor credit score.

Submit payments on time to improve your credit score.

Amounts Owed

Commonly called your “utilization ratio,” amounts owed reflect what percentage of the total credit available to you is used. Lenders want to see that you can take on debt without being underwater.

Use your credit report to review your payment history and see what you still owe on individual accounts.

Account History

This is determined using the average age of your accounts and the last time they were used. Creditors like to see a long, positive history of being able to maintain several active accounts.

New Credit and Credit Mix

Opening multiple new and similar types of accounts at once can hurt your credit score because it’s viewed as risky behavior. However, successfully managing different types of credit — e.g., mortgage, auto loan and credit card — is a sign of financial responsibility.

If you’re working to rebuild your credit, monitor your progress by periodically checking your credit score.