Whether you’re starting a business or expanding operations, you’ll need capital to reach your goals.

That can be hard to come by if you don’t know what types of small business funding options are available or where to look.

To get the cash your business requires, we’re letting you in on the top choices for small business financing and what you need to qualify.

Types of Small Business Funding

The main types of small business funding are debt and equity financing. They are umbrella terms, and each has its own set of financing options.

Debt financing involves borrowing capital with a promise to repay the principal amount — plus interest and fees — over a set period. In contrast, equity financing includes any source of small business funding that requires you to give up a portion of the company’s future profits. This means selling an interest in your company that can limit potential financial gains and even some control of your business.

Let’s take a deeper look at these small business financing options.

Debt Financing

When a business owner reaches a debt financing agreement with a lender, strict terms and conditions are agreed upon that must be upheld by both parties.

If the borrower violates the terms of the agreement or fails to repay the debt on time, the account defaults. This can hurt a borrower’s credit score and make it hard to acquire financing in the future. On the other hand, repaying on time can raise your credit score and show future lenders how well you handle debt.

Related: Bad Credit Business Loans? These Are Your 5 Best Options

How Much Will a Business Loan Cost?

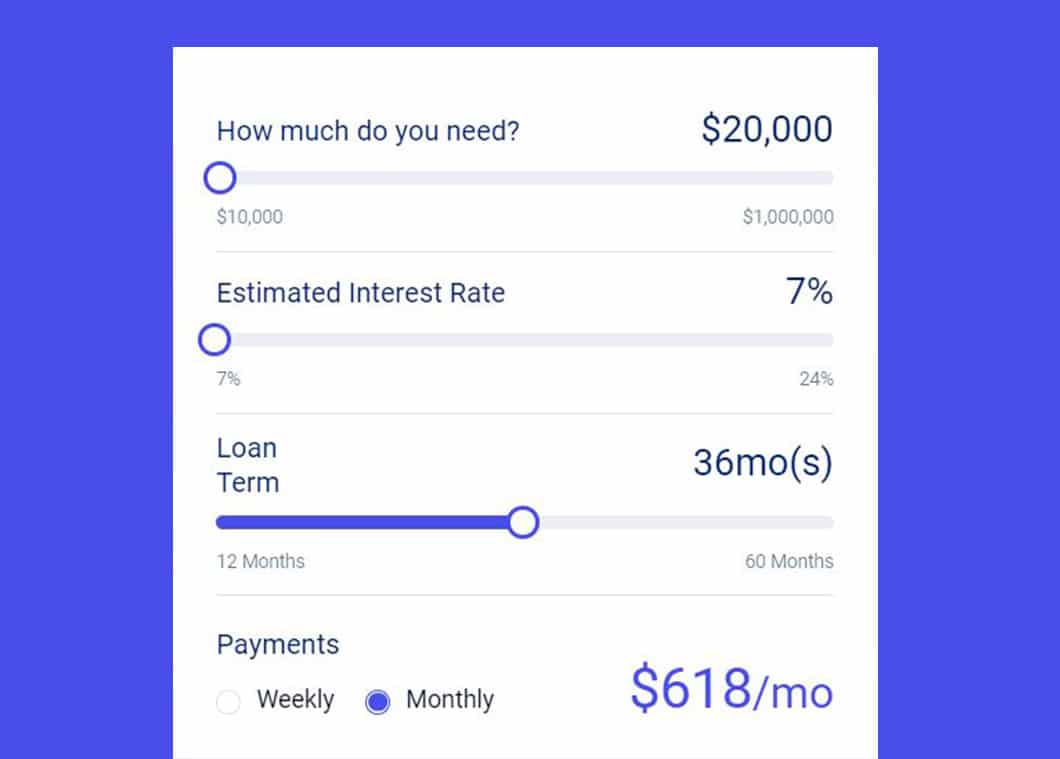

Use Fast Capital 360’s financing calculator to estimate your loan payments.

What rates and terms could you qualify for?

Equity Financing

Equity financing offers a way to receive money without incurring debt, which is critical to companies across industries and in multiple stages of growth.

It could be the best of your business financing options for those seeking small business funding with bad credit. Similarly, certain startups can benefit from equity financing due to the limited loan programs available to them.

Related: How to Get Startup Business Loans With Bad Credit or No Credit History

How to Get Funding For Your Small Business in 4 Steps

When you’re in search of how to get funding for a small business, there are a few key actions that can get you one step closer to approval.

1. Determine How Much Funding Your Business Needs

Figuring out how much capital your small business needs will help you avoid borrowing too much or too little. You want to avoid unnecessary debt and make sure you have the money you need to accomplish your goal. Go over all the numbers, including what you can contribute.

2. Gather Financial Documents

To obtain small business funding, gather your pertinent financial information, including bank statements, tax returns and financial performance reports.

It would help if you also put together a detailed business plan. This step is especially important for startups and other businesses seeking investors. Anyone who could supply business funding will want to see proof that you have an actionable plan in place to give them a good return on their investment.

3. Choose Your Funding Source

Your decision should be based on your goals, lender or investor requirements and the current position of your business.

For example, the best small business funding options for relatively new businesses might be friends and family, alternative lenders, investors or self-funding.

However, an older business looking to finance a considerable expense may be able to get the right amount through a bank loan or an online lender, depending on its creditworthiness.

4. Pitch Your Business and Apply

If you’re turning to investors and other equity financing sources, you must put together a great pitch. Highlight the positives, but don’t hide or mislead potential investors about any obstacles.

If you apply for a loan, fill out the application clearly and accurately. Paint a complete financial picture of your business and make sure your goals for the money are clear. Work with your lender if they ask for more information.

How Much Can My Business Qualify For?

Alternative Types of Small Business Funding

Besides debt and equity financing, there are other types of small business funding options available.

These business funding solutions are better suited for startups and businesses needing a small amount of capital. Here are a few sources of funds for your business:

Self-Funding

It’s not uncommon for entrepreneurs to self-fund their business ventures, especially in the early stages of growth.

This small business funding option involves the entrepreneur drawing on personal savings to fund the business without external capital.

If you don’t have enough money to self-fund your business, you can sell off personal assets to bring in cash for your venture. For example, selling a boat or an additional property can often generate enough capital to fund a startup.

Bootstrapping

A bootstrapped business funds itself through its sales, continually reinvesting profits to spur long-term growth. Whenever possible, it’s a good idea to bootstrap your company. The benefit of bootstrapping for funding your business is that it incurs zero debt, and you won’t hand over any ownership stake in the company.

Business-to-business (B2B) and service industry companies are often better-suited for bootstrapping than investor funding because, in most cases, sales alone can sustain operations and growth.

Friends and Family

Many entrepreneurs get funding for a business through family and friends. If you haven’t had luck securing a loan or finding an investor (and you don’t have the means to finance your business yourself), it might be worth asking loved ones. This way, funding your small business can often limit your debt costs and let you keep full control.

Small Business Grants

Many government and private groups aim to help small businesses through grants. Though grants can be a great way to fund a business, they can be hard to obtain. Competition is fierce because the money doesn’t come with additional debt or loss of control in the company.

The grant process is long, and there isn’t as much small business funding to go around as with other options. However, if you qualify and receive grants, they are one of the best financing options for a business.

Get Your Business Loan Faster

Small Business Funding Sources

There are several options for sources of funding for small business financing. Eligibility will depend on your business’s age, performance, industry and creditworthiness. Here’s an overview of the benefits and drawbacks of each available option.

| Funding Source | Pros | Cons |

| Banks |

|

|

| Online Lenders |

|

|

| Investors |

|

|

Banks

Banks are a great place to get small business funding if you qualify. Their small business financing products boast low interest rates, high loan amounts and long repayment terms that can help you keep your monthly costs in check.

However, bank loan approval criteria make it difficult for many small businesses to qualify. Personal credit scores and annual revenues must be high for your application to be considered. Your business’s age is also a factor. If you’re a startup or young company, you’ll likely have to seek other small business funding options.

Online Lenders

If you’re wondering how to finance a new venture or a small business with bad credit, online lenders can help. They’re a good source of funds for business loans, particularly for those denied conventional loans. That’s because they have lower minimum requirements for approval than banks do, opening up accessibility to funding for more business owners.

Another positive of online business funding options is the speed at which you can obtain cash. You can get business funding in as little as a day for certain financing products. This makes online lenders a good choice for businesses searching for funding for an immediate need.

However, because of the risk of working with less-qualified borrowers, these lenders will often charge higher interest rates and shorten the repayment terms on their offerings.

Investors

Small business investors commonly provide equity financing. In general, investors prefer to provide small business funding for startups and early-stage businesses they believe have high-growth potential. This way, they receive a more substantial financial stake in the company while the valuation is low.

Early investing increases the potential return on investment. The terms and conditions of investors’ small business funding options will vary.

Angel Investors

Angel investors are high-net-worth individuals who invest in small businesses in exchange for ownership stakes. Investment groups are usually composed of professional angel investors who pool their resources to hedge against risk and perform superior market research.

If you’re interested in seeking an angel investor to fund your business, you should speak with your local chamber of commerce or search online for an investment group.

Related: Private Business Loans: The Types, the Pros and Cons (Plus How to Qualify)

Venture Capital Firms

Venture capitalists are firms and organizations that provide funding for small businesses in the early stages of growth. They typically seek to own a large share of the company’s equity, so an entrepreneur should keep this in mind.

Crowdfunding Platforms

Crowdfunding is when an interested collective of parties contributes money (usually via an online platform such as Kickstarter or IndieGoGo) to fund a charitable cause or business venture.

In exchange for their contribution, crowd funders may receive rewards, such as a product prototype or a small amount of equity. There are also crowdfunding options that are debt- or royalty-based, where interest or a percentage of revenue is expected in exchange for the funds.

This is a popular funding source for startups, nonprofits and businesses with an outside-the-box product or concept. These businesses have trouble securing other small business funding options, leading them to turn to their supporters for the money they need.

Best Debt Financing Options for a Busines

Based on your business profile, you could qualify for bank loans, SBA financing or online business funding options.

| Funding Option | Best For |

| Term Loans | Businesses with good credit history and the need for a large amount of funding at once |

| Short-Term Loans | Businesses that need smaller amounts or don’t want long-term debt |

| SBA Loans | Those that were denied loans by banks but are still looking for similar benefits |

| Business Line of Credit | Seasonal businesses or those with revolving funding needs |

| Equipment Financing | Any business in need of replacing or upgrading equipment |

| Accounts Receivable Financing | Businesses that face cash-flow problems due to unpaid invoices |

| Merchant Cash Advance (MCA) | Businesses with immediate working capital needs and those looking for funding without optimal credit |

Term Loans

With a term loan, a borrower takes out a loan and repays the lender over a set period with interest.

You can receive term loans through banks or alternative lenders. The rates, repayment lengths and fees you’re approved for will be based on your creditworthiness, revenue and cash flow.

Repayment terms are years in length, reaching up to 10 or 20 years, depending on the use of funds. It’s not uncommon for larger commercial real estate mortgages to approach 30 years.

Generally, interest rates are lower for term loans than other small business financing options. Banks can offer rates between 4%-6%, while alternative lenders will start around 7% for term loans.

Short-Term Loans

A short-term loan is like a term loan with an abbreviated repayment window. If you’re an entrepreneur who hasn’t qualified for a term loan or doesn’t want to incur long-term debt, a short-term loan can be how to get funding for a business.

These loans are available from both banks and alternative lenders, and interest rates are higher than those seen with longer-term loans.

These loan repayment terms can range from 3 months to 2 years in some cases. The shortened term means higher payments, often at a greater frequency (weekly or daily vs. monthly). The benefit of paying off your loan sooner is that you’ll have added financial flexibility in the future.

SBA Loans

SBA loans are affordable business loans backed by the U.S. Small Business Administration (SBA).

The SBA guaranty helps banks and alternative online lenders provide small business funding with less risk. SBA loans offer interest rates comparable to bank term loans, and interest rates and fees are capped to ensure funding stays affordable.

However, you should have exhausted other small business financing options and be prepared to go through a lengthy application process to get SBA-backed business funding.

Business Lines of Credit

A popular company funding option is a business line of credit. This is an excellent choice for those with revolving funding needs.

You’re given a funding limit from which you can draw money. Like a loan, you then pay back the lender with interest over a set term.

Once the withdrawn balance is repaid, your credit line replenishes.

Equipment Financing

If you need fast small business funding to replace or buy new machinery, furniture or more for your business, equipment financing could be the answer.

Like other small business financing options, equipment financing involves a business owner borrowing from a lender — either a bank, an online lender or an equipment financing provider.

The difference is in how the loan is secured. Many conventional small business loans require collateral — money or assets owned by you or the business. However, the equipment you’re purchasing acts as collateral with equipment financing. In the case of default, the lender can repossess the equipment to recoup its losses.

Equipment loans are the No. 1 approved form of financing, with an 87% approval rate, according to the Federal Reserve Banks’ 2021 Small Business Credit Survey.

Accounts Receivable Financing

Businesses seeking fast business funding to fill gaps in cash flow due to unpaid invoices may consider accounts receivable financing. This small business funding option involves the lender advancing a portion of your unpaid invoices.

You could receive 80%-90% of the value of your invoices. When your customer pays their balance, the lender remits the remaining percentage to you. Until the balance is paid, fees accrue.

Merchant Cash Advance

A merchant cash advance (MCA) is a viable debt financing option for many small businesses, and it’s one of the most frequently approved forms of financing. In fact, with an approval rate of 84%, it comes in second only to equipment financing.

Business owners seeking fast small business funding online are drawn to MCAs for accessibility and speed. It’s possible to receive funding through a merchant cash advance as quickly as a day.

If you’re wondering how to finance a small business with bad credit, MCAs might be the best fit. Alternative lenders are more often willing to work with business owners banks won’t consider.

Merchant cash advances can cost more than other options, however.

Small Business Funding: In Review

Finding small business funding doesn’t have to be challenging. If you assess all of your options and determine what fits your business best, you can take a lot of the time and stress out of the process.

Once you’ve found the right fit, make sure to put your best foot forward. That means putting all of the information you can into a great pitch to investors and painting a complete picture of your business’s finances for lenders.

Now that you know about the different small business funding options and what funders look for, it’s time to apply that knowledge to get the money you need to reach your goals.